The Weekly Close

After a relatively quiet week of consolidation, Bitcoin closed its weekly candle just under $120k. It’s not surprising that the $120k round number is acting as a bit of psychological resistance as investors take some profit. Sideways consolidation after a breakout is usually a great sign that bulls are in control and usually leads to upward continuation. I don’t see any major warning signs on the weekly chart as of right now.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment is still comfortably in the Greed region. This isn’t surprising after a week of consolidation and is a great sign that we are not overheated yet. Even a brief dip into Neutral would be fine as long as price keep consolidating sideways. It feels like we are preparing for our next move higher into the Extreme Greed region.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI is showing signs of a downtrend for the first time in a very long time. It is very close to making a new lower low which would confirm this recent drop as a downtrend. The good news is that Bitcoin has followed the GLI with roughly a 75 day lag so as of right now it is pointing to a top around the mid-September timeframe. Now we can’t expect this to work perfectly every time, but it is nice to have an early warning sign of what could be around the corner.

Bitcoin and The Global Liquidity Index.

Inflation

We are getting an update to Core PCE, the FED’s preferred measure of inflation, on Thursday, July 31st. The market is expecting Core PCE to remain flat at 2.7%. As long as this data comes in-line with expectations, markets shouldn’t be too bothered by the print. We also have an FOMC meeting the day before on Wednesday, July 30th, and an unemployment rate print the day after, on Friday, August 1st. So this week will likely be full of data-driven volatility.

Core PCE.

The Bigger Picture

Everything seems to be lining up nicely for a strong rally over the next few weeks. It is very hard to have exact price targets or exact date targets for the cycle top, but we will use a combination of sentiment, global liquidity and price action to make the most educated guess that we can. I would love to see this cycle extend for longer, but that won’t be my base case until the data calls for it. For now we just have to remain patient and calm while being open to multiple outcomes.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

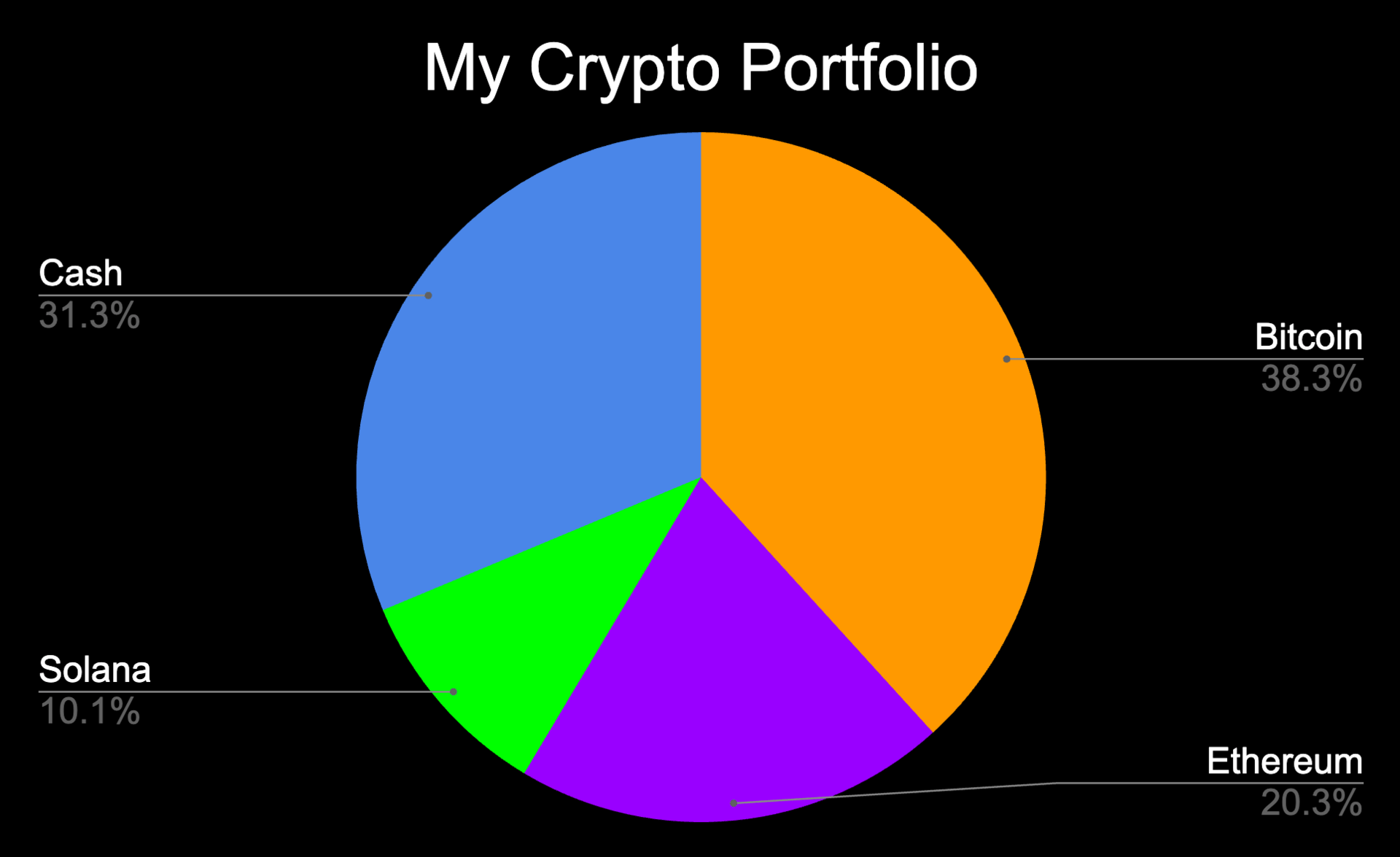

No changes were made to my portfolio this week. This isn’t surprising because the market has done nothing but go sideways since my last change. I still feel very well positioned for upside incase we do enter a mania phase over the next few weeks. While also being prepared for downside with the profits I have locked in on this price discovery breakout. There isn’t much left to do but sit on my existing positions and let the market do its thing.

Portfolio snapshot as of July 28th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝