The Weekly Close

After a choppy week of consolidation for Bitcoin and traditional markets, Bitcoin closed it’s weekly candle just under $83k. This is now a confirmed breakdown of our previous $91k-$109k trading range. Bitcoin is now in no man’s land between our March high at $74k and our old range low at $91k. As long as we are between those price regions, consolidation and chop is the most likely outcome as Bitcoin builds a base before deciding it’s next move. These time periods can be incredibly painful for investors because there are 2 types of capitulation, price capitulation and time capitulation. Price capitulation is when we see aggressive price drops that force investors to panic sell because they can no longer handle their portfolio value going down. Time capitulation is when investors get so bored and frustrated during prolonged periods of consolidation and chop that they sell and move on. I believe we are about to experience the latter.

The Bitcoin weekly chart.

Temperature Check

It’s safe to say that current sentiment is the worse we have seen in a very long time. Macro uncertainty is spooking Bitcoin investors and cycle top calls are getting louder and louder. During these time periods it is important to rely on a plan and data instead of the emotions everyone is feeling after these last few weeks of price action. Extremes do not last very long so mean reversion is the most likely outcome in these scenarios. We could spend a week or 2 at these sentiment levels, but I expect a mean reversion bounce sooner rather than later. Especially when metrics like Global Liquidity have been rising for weeks.

The CoinMarketCap Crypto Fear and Greed Index.

Global Liquidity

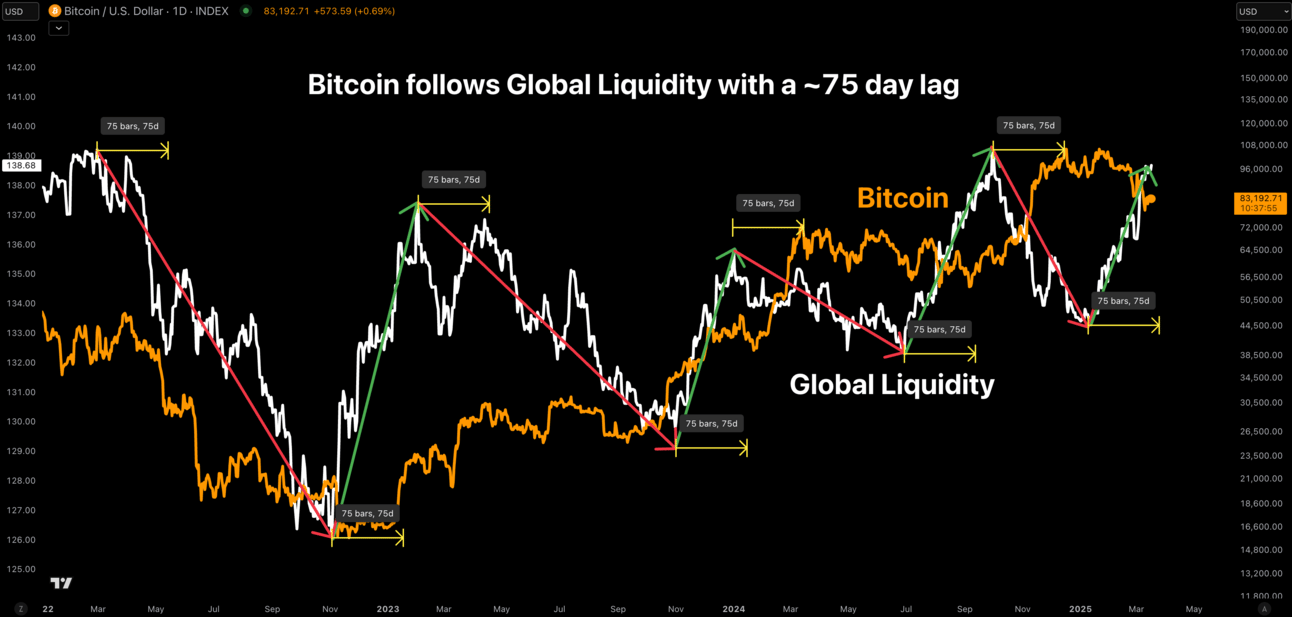

Our Global Liquidity uptrend continued last week. Bitcoin has followed this metric by roughly 75 days for the entirety of this bull market. Global Liquidity bottomed on January 10th so roughly 75 days after that date would put us in the last week of March. I know there are other investors saying that different lag amounts have better correlation with Bitcoin, but I think it’s important to focus on the trend and not the exact number of days. I remain optimistic that we will see this Global Liquidity Index uptrend impact Bitcoin within the next few weeks.

Bitcoin and The Global Liquidity Index.

Macro

The drop we have seen in the S&P 500 over the past few weeks has been truly incredible. It’s amazing that Bitcoin isn’t trading significantly lower with the amount of macro uncertainty we have seen over the past few weeks. The S&P 500 is well overdue for a bounce which should be a great tailwind for Bitcoin. We will monitor the S&P 500’s price action closely to see if we actually get a recovery or just a bounce into a lower high. The outcome of that bounce will likely spill over into Bitcoin’s next trend as well.

The S&P 500 weekly chart.

Bigger Picture

Even with all of the fear and uncertainty in the market right now, Bitcoin is still right in the middle of our “Fair Value” range. I wouldn’t call $83k Bitcoin a steal by any means, but it is a much more attractive price than the $100k Bitcoin investors were piling into a few weeks ago. I’d be more interested in accumulating inside the “Cheap” or “Very Cheap” regions, but going that low likely means the cycle is over and we have to enter a prolonged consolidation and re-accumulation phase before Bitcoin’s next bull market.

Bitcoin’s value based on it’s extension from the 200-week moving average.

What I’m doing with my portfolio

No changes were made to my portfolio this week. I’m happy with my current allocations and don’t feel the need to buy or sell any of my holdings. I have found that the best course of action during these periods of chop and consolidation is to do nothing. I have taken enough profits to be happy incase the cycle is over and I have enough altcoin exposure to take advantage of upside incase it isn’t. I still believe Bitcoin has higher to go, so for now I will sit on my hands until the market chooses Bitcoin’s next direction.

Portfolio snapshot as of March 17th, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. If you’d like to learn more, early bird pricing is still available on the Crypto and Macro Enjoyers program I am building. You can learn more about it here:

No matter what happens in the short-term, I believe the future looks bright for Bitcoin and other valuable risk assets. Currency debasement isn’t going anywhere any time soon. I hope you have an amazing week. 🤝