The Weekly Close

After an impressive rally last week, Bitcoin closed its weekly candle just under $94k. This was a crucial close for many reasons. For one, Bitcoin has reclaimed its previous trading range. Range reclaims tend to result in very bullish momentum shifts. Bitcoin was also able to get back above the 20 week moving average which tends to act as support in bull markets and resistance in bear markets. So getting back above it is a great sign of strength. All we need now is for Bitcoin to maintain this reclaim and we should be seeing new highs very soon.

The Bitcoin weekly chart.

Sentiment Check

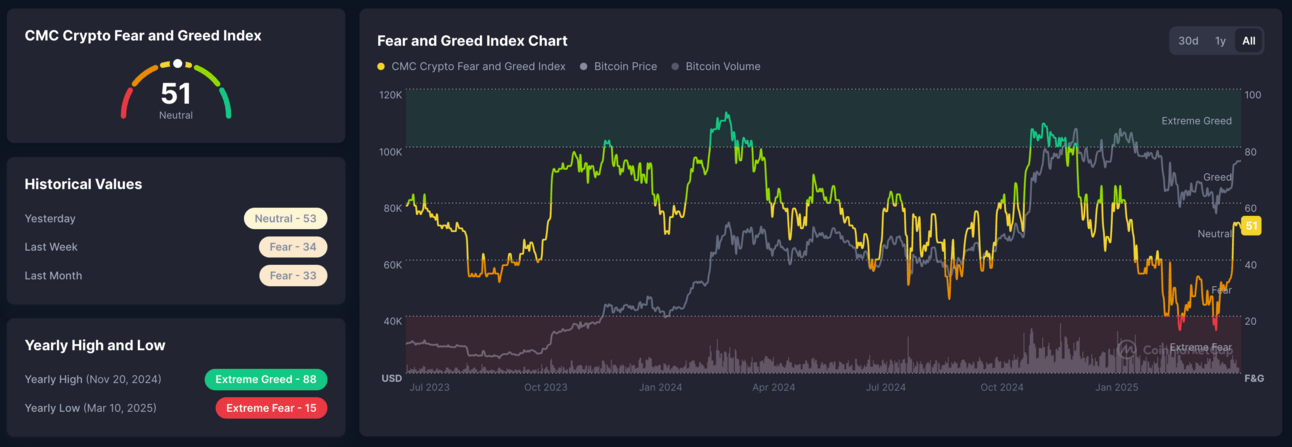

After months of Fear, the Fear and Greed Index has finally returned to Neutral. It’s amazing how quickly sentiment can flip after some positive price action. It makes sense that we are still in the Neutral region because investors are still pretty split between believing this is the start of a new rally or just a lower high before we enter a bear market. I’m glad we were able to take advantage of some buying opportunities while sentiment was in the Extreme Fear region and I look forward to taking some profits once the market enters Greed once again.

The CoinMarketCap Crypto Fear and Greed Index.

Global Liquidity

Global liquidity continues the insane uptrend we have seen over the past few months and it’s nice to see Bitcoin finally beginning to follow. I want to be very clear that this is not some magical indicator that will guide us forever, but more of a valuable variable that we can use for confluence as part of our analysis. It is hard to ignore how well it has worked this entire cycle even though investors start to doubt its validity every time it opposes their bias. I plan to continue using it until it stops working.

Bitcoin and The Global Liquidity Index.

Macro

We have many important data prints this week. We will get updated PCE data on Wednesday which will update the markets on how the FED’s battle with Inflation is going. We will also receive an updated Unemployment Rate print on Friday to update the market on how the labor market is holding up. Markets will pay especially close attention to these prints to see if we are already seeing lasting impacts as a result of all of the tariff drama. I will be watching both prints, as well as the market’s reaction, very closely this week.

The Unemployment Rate.

Bigger Picture

Bitcoin continues to follow our early cycle scenario quite closely. If we do end up seeing an aggressive rally over the next few weeks, I would imagine that to be the finale for this cycle. I am open to changing my views if the economic data holds up better than I expect, but the the Normal Cycle scenario is not my base case as of right now. I will continue to monitor the data and charts so that I can update these probabilities as time goes on.

Bitcoin Cycle Scenarios and their probabilities.

What I’m doing with my portfolio

No changes were made to my portfolio this week. It has been great sitting back and watching the market rise after the dip buying we did a few weeks ago and it can be tempting to overtrade during these volatile periods. I have found that most of the time, the best action in markets is no action. Until my system calls for some profit-taking or dip-buying, I will just sit on my hands and enjoy the ride.

Portfolio snapshot as of April 28th, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. If you’d like to learn more about my systems and approach to navigating this market, early bird pricing with lifetime access to join the Crypto and Macro Enjoyers program is available for 3 more days and will be ending on April 30th. You can learn more about it here:

It feels great to finally see some green in the market after the selloff and Extreme Fear we navigated over the past few weeks. Extreme price action and sentiment like that does not happen that often, but it does happen often enough to where it becomes easier to manage the more times you have been through it. As always, I hope you have an amazing week. The future looks bright. 🫡