The Weekly Close

After a relatively choppy week, Bitcoin closed its weekly candle just above $115k. It is now retesting its 20-week moving average to confirm a higher low and the start of a new uptrend. If it holds the 20-week moving average it would be similar to the price action we saw in late-September of 2023 and late-September of 2024. It would be wild if we saw that same pattern repeat for the third year in a row.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment remains comfortably in the Neutral region. It is clear that many investors are getting fed up with the choppy price action and are now throwing in the towel. Bitcoin has had so many of these boring periods already this cycle. It usually chops around just long enough to make everyone give up before finally breaking out.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI made new highs last week and continues to grind higher. It’s amazing how useful this tool continues to be. As of right now it is saying we should be entering a brief correction here, but I am more concerned with what our macro trend is and according to The GLI, the macro trend for Bitcoin is still up.

Bitcoin and The Global Liquidity Index.

Inflation

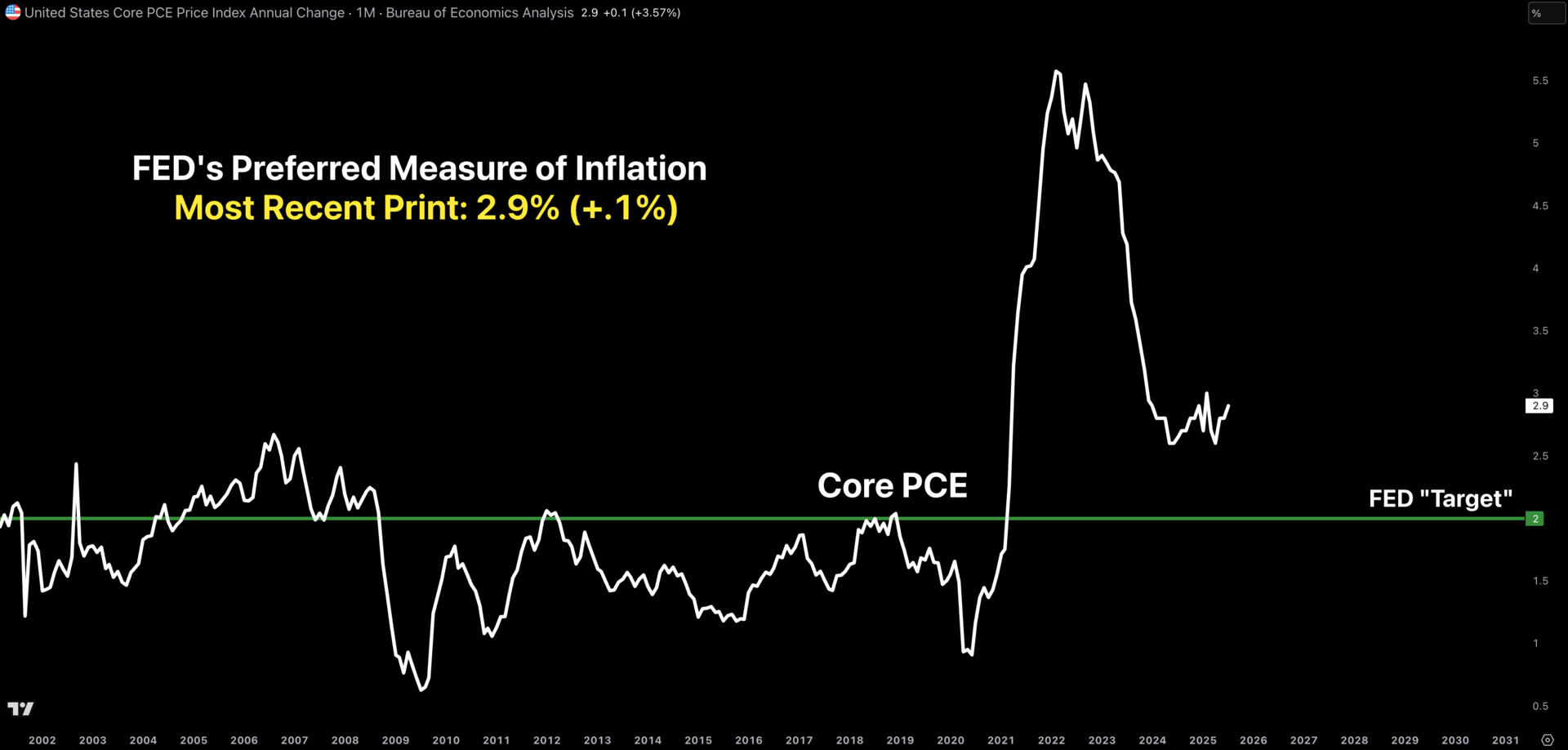

This week we will be receiving an update to the FED’s preferred measure of inflation, Core PCE. The market is expecting the year-over-year number to remain flat at 2.9%. Ideally we see this print come in at or below expectations so that it does not interfere with the 2 rate cuts the market is pricing in for the remainder of 2025.

Core PCE.

The Bigger Picture

Bitcoin’s macro uptrend remains fully intact, so my base case is that Bitcoin still has higher to go in 2025. There will be volatility to wash out the leverage traders, but the larger trend remains clear. I am also on the lookout for a surprise headline or announcement that would trigger the “Full Reset” scenario, but that will likely come down to whether Bitcoin is able to hold its 20-week moving average or not.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

No changes were made to my portfolio this week. I’m glad I ended up taking those Solana profits last week so that I can sit comfortably through this correction with no regrets. I feel well positioned for all possible scenarios and all my holdings are near their targets. All that’s left to do now is wait and see what Bitcoin has in store for the remainder of 2025.

Portfolio snapshot as of September 22nd, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝