The Weekly Close

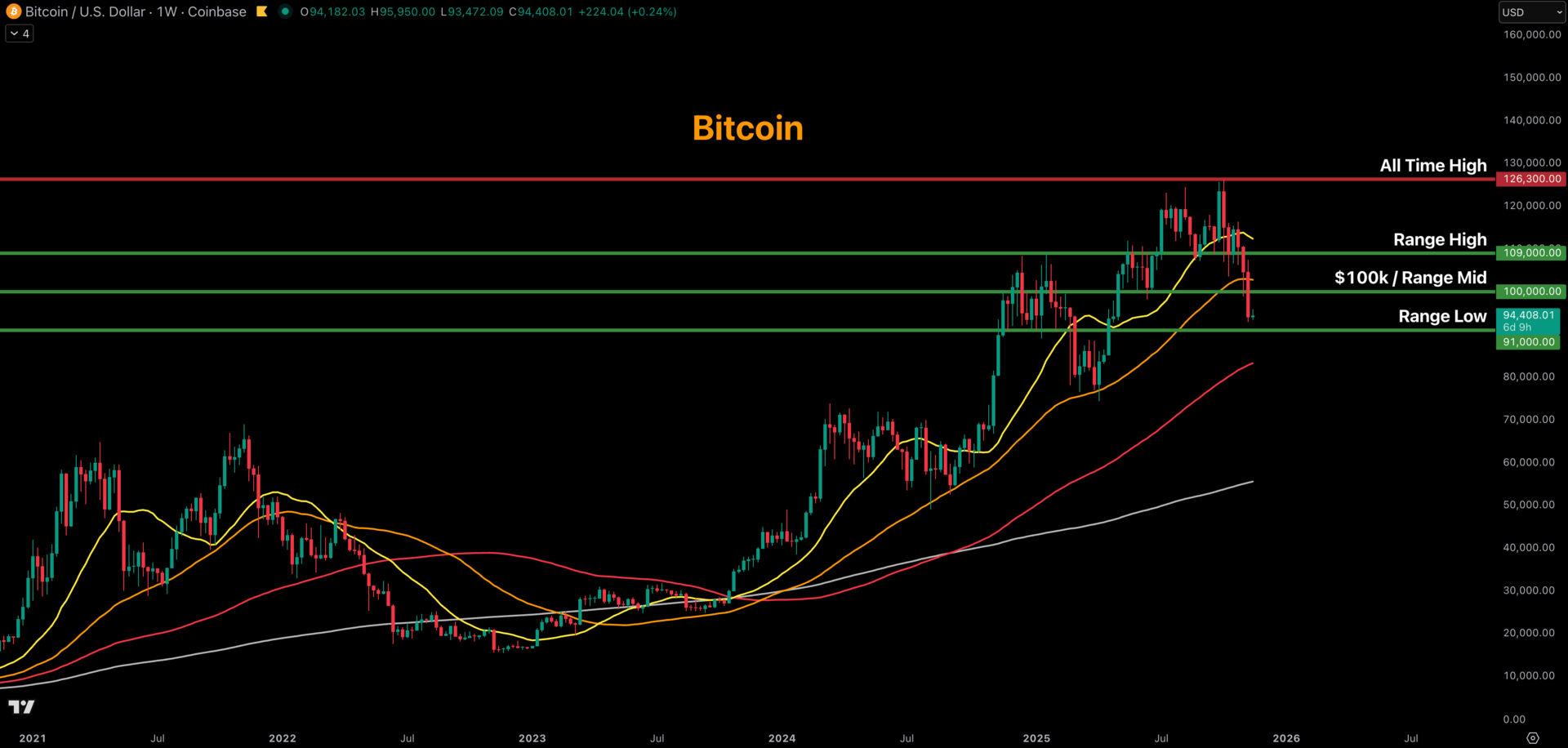

After breaking below the 50W MA, Bitcoin closed its weekly candle just above $94k. This is a major break of trend that cannot be ignored. It greatly increases the likelihood of downside over the next few months. We want to see the 50W MA reclaimed as soon as possible. Otherwise any bounces we see will likely just result in lower highs.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment is in Extreme Fear. In a bull market, this would be considered an incredible buying opportunity with expectations of new highs in the near future. In a bear market, this is the norm and usually results in a short-term bounce before lower prices. We need to watch this upcoming bounce very closely to see if Bitcoin can reclaim major levels or get rejected.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to chop sideways. Although we finally saw an end to the US government shutdown, the FED’s hawkish tone has pushed back rate cut expectations. I do believe that The GLI is the main macro driver for Bitcoin in the long-term, but as of right now The GLI isn’t providing much signal with its sideways chop.

Bitcoin and The Global Liquidity Index.

The FED Balance Sheet

The FED will be ending QT on December 1st. However, we still do not know how long it will take for QE to restart. The time period between the end of QT and start of QE is something investors will have to risk manage. We know the FED will have to go back to QE eventually, but the timeline remains unclear for now. The economic data releases this week should provide more clarity.

The FED balance sheet.

The Bigger Picture

The close below the 50W MA greatly increases the likelihood of us entering a bear market. There is a chance this could be one big bear trap, but until the market gives evidence of that, I believe it is a dangerous to assume that has to be the case. I know everyone wishes we could just go straight up from here and I hope that happens, but for now we have to listen to what the price action is telling us.

Bitcoin Cycle Scenarios.

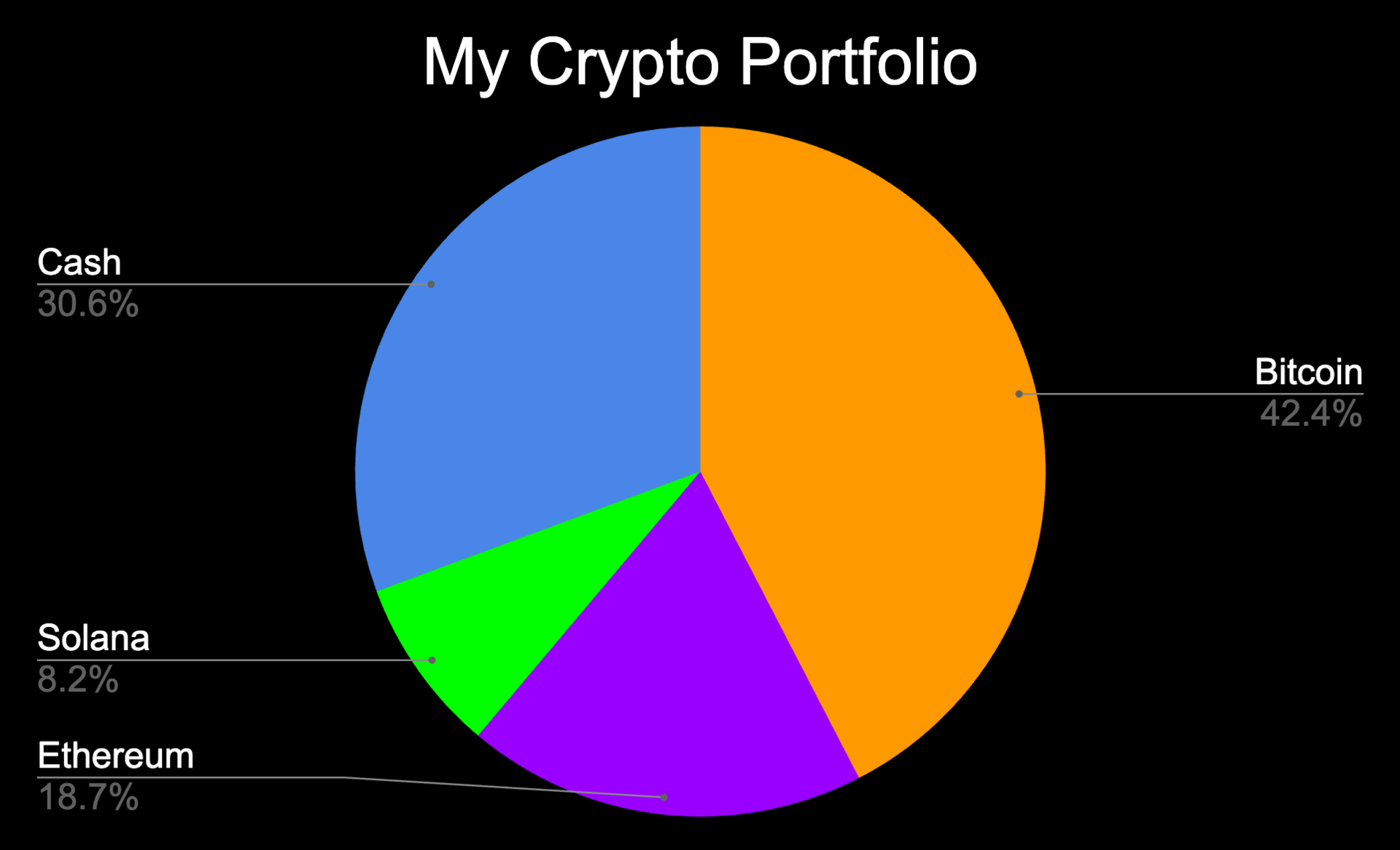

What I’m doing with my portfolio

I deployed some cash across my positions this morning. Whether we are still in a bull market or entering a bear market, I expect a local low here soon. Extremes in sentiment tend to be wrong and I don’t see why this time would be any different. I will be operating under the assumption that Bitcoin has likely topped and that we should be expecting a bounce into a lower high that gets rejected.

Portfolio snapshot as of November 17th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝