The Weekly Close

After 2 weeks of holiday season chop (thank you Bitcoin for doing anything while I was away), Bitcoin closed right below our $100k psychological level and range high. This isn’t surprising because bounces are normal after aggressive sell-offs as investors have their emotions swayed back and forth between fear and FOMO. The real question is whether this is just a lower high at $102k or the early stages of a new rally. Bitcoin is trading above $100k as of right now, but this could easily end up being a wick by the time we get our weekly close on Sunday. Regardless, this week’s close likely sets our new trend.

The Bitcoin weekly candle closed at $98,345.33 (+5.11%) on January 5th, 2025.

Temperature Check

Market sentiment has spent the past 2 weeks in the “Neutral” region while Bitcoin was trading near our $91k range low. I would like to see us briefly visit the “Fear” region for a true reset to be complete, but spending 2 weeks in the “Neutral” region meets my minimum requirement for a sentiment reset during a bull market. It’s important to remember that markets will always fluctuate between Fear and Greed even after spending weeks or months in either region. If we do enter the “Fear” zone, the same market participants that were screaming for higher prices during “Extreme Greed” will start calling for lower prices and market crashes. This is why having a plan and not relying on emotions is so valuable in this volatile asset class.

The CMC Fear and Greed Index is at 60 which represents “Greed”.

Global Liquidity

The Global Liquidity Index continues to fall off a cliff and is dangerously close to setting a new lower low for this macro bull cycle. This is the main reason I have remained cautious with my targets although 4-year cycle seasonality and narratives are quite bullish. This drop in Global Liquidity points to quite a large correction for Bitcoin over the next few weeks. I really want to see this downtrend reverse soon because it will have major negative implications on the remainder of this cycle if it doesn’t.

The Global Liquidity Index remains low after it’s downtrend that began on October 1st.

The Labor Market

The FED has had trouble finding an excuse to cut rates aggressively while the Unemployment Rate remains low and inflation remains stubborn above their target. Unemployment rate prints tend to have a large impact on FED rate cut expectations and as a result, the DXY and Global Liquidity. The ideal backdrop for markets would be a slowly weakening labor market that forces the FED to ease more than the market has priced in, but not too big of a spike in the Unemployment Rate that causes the market to panic. I will never root for job loss or layoffs and would much rather see the FED ease due to falling inflation or the Federal Government’s ballooning interest expense. I expect a lot of volatility this week as we approach that Unemployment Rate print on Friday.

The Unemployment Rate is currently at 4.2%.

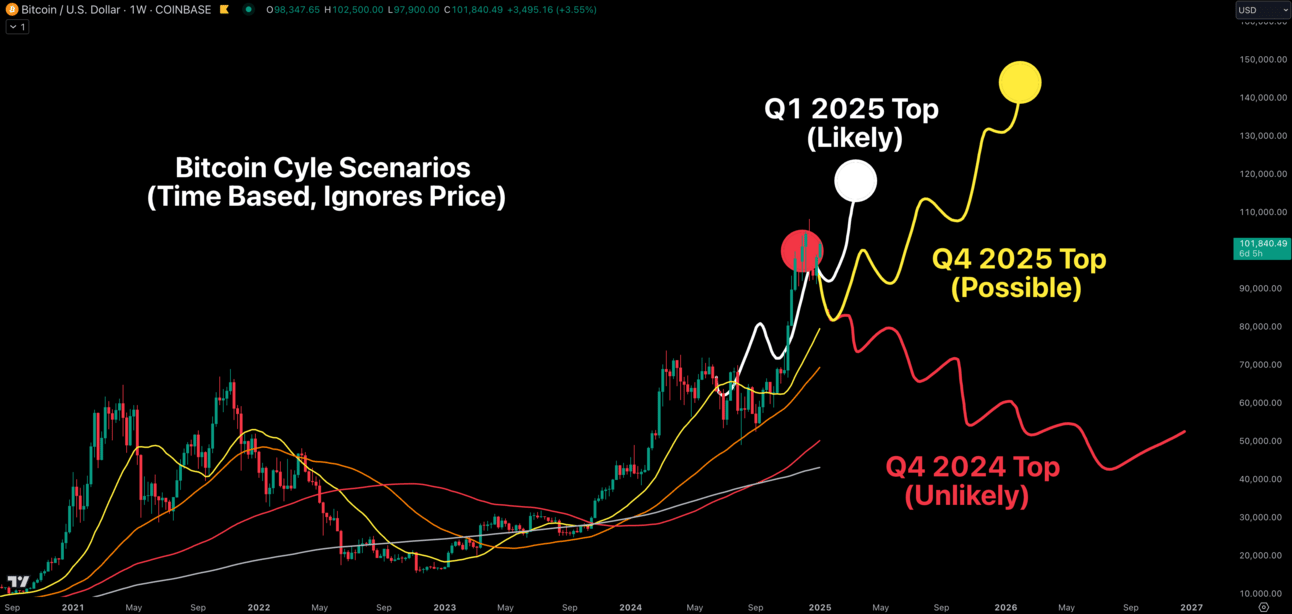

The Cycle Top

I’m still optimistic that we haven’t seen Bitcoin’s cycle top quite yet, but I do believe we will see some more downside before our final move higher into late Q1 or early Q2. I am open to the fact that the top may already be in at $108k. Especially if we were to see an immediate weakening in the labor market or economy that causes markets to panic, but this scenario is unlikely in my opinion. I’m also open to the possibility that this cycle could go on longer than my base case anticipates so I will make sure to leave enough spot holdings to take advantage of that outcome.

The most likely scenario for Bitcoin is a cycle top around late Q1 or early Q2 of this year.

My Current Portfolio

I took some profits across my holdings this morning because I can’t ignore the continuous drop we have seen in Global Liquidity. I will not try to perfectly time the cycle top because I have found that to be a losing strategy. Instead, I will take small profits whenever my cash position is near 30% because my cash allocation target for Q1 is 30-40%. If we see a large correction that puts my cash allocation above 40%, I might consider deploying some of it into opportunities I see at the time. If I am right about a larger correction driven by falling liquidity and bearish market structure, this lower high at $102k would be the area where it would begin. If I am wrong and Bitcoin puts in new highs, I’ll enjoy that rally with the roughly 68% spot holdings allocation I still have.

Portfolio snapshot as of January 6th, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. I can feel the anxiety and stress in the YouTube comments and Twitter DMs I have received over the past few weeks. Bulls get angry I have a cash position and take any profits and Bears get mad I talk about more upside this cycle 😂. I will continue to do what makes sense for me based on my goals and the data at hand and I will continue to share my experience and mistakes along the way. 2025 should be full of excitement and volatility and I can’t wait to navigate it with all of you. 🫡