The Weekly Close

After a market wide sell-off early in the week, Bitcoin recovered and closed it’s weekly candle just under $84k. This resulted in a reversal wick below the 50-week moving average and an almost perfect retest of our March 2024 swing high. I’m sure many investors panic sold the bottom during that drop as equities were selling off aggressively as well. Now those investors are sidelined and have to figure out if they want to FOMO back-in at higher prices or pray the market goes lower. The real test for Bitcoin will be whether we can reclaim our previous range low at $91k or if we will just continue chopping around in our current range.

The Bitcoin weekly chart.

Temperature Check

After another dip into the Extreme Fear region, the CMC Fear and Greed Index has recovered slightly. The market is still quite fearful and many investors aren’t convinced that the market has bottomed. By the time sentiment returns to Greed and the majority of investors are convinced we are going higher, the buying opportunity will have passed. Accumulating during Fear continues to be a great strategy this cycle and nothing flips sentiment quite like aggressive price action, so we’ll have to wait and see if Bitcoin follows through this week or gets rejected and chops around some more.

The CoinMarketCap Crypto Fear and Greed Index.

Global Liquidity

For the first time since February 2022, the Global Liquidity Index made a new all time high. I believe Global Liquidity is the main driver of Bitcoin’s macro trend, so it’s incredible that Bitcoin was able to make it all the way to $109k while Global Liquidity was going sideways over the past 3 years. We have watched Bitcoin follow Global Liquidity with a lag this entire cycle and I’m incredibly optimistic Bitcoin’s next move will be a rally higher now that we have seen a full breakout on Global Liquidity.

Bitcoin and The Global Liquidity Index.

Macro

The US Dollar Index just reached a level it hasn’t traded at since April 2022 during the early phases of Bitcoin’s past bear market. We know that the US Dollar is the global risk-off asset and has a huge impact on Global Liquidity as a result. Therefore, a drop like this should increase Global Liquidity significantly and be a strong tailwind for risk assets. If this is the beginning of a breakdown in the DXY, the next few months should be quite good for risk assets like Bitcoin.

The US Dollar Index (DXY).

Bigger Picture

The new all time high for Global Liquidity and the extremely fearful market sentiment further solidify my conviction that this bull market is not over. Bitcoin’s main use case is protection from currency debasement and it looks like central banks around the world are getting their printers warmed up for some serious money printing. It can be easy to get caught up in the short-term, but the devaluation of fiat currency is a trend I don’t see going away any time soon. Therefore, it’s hard not to be bullish on Bitcoin’s future.

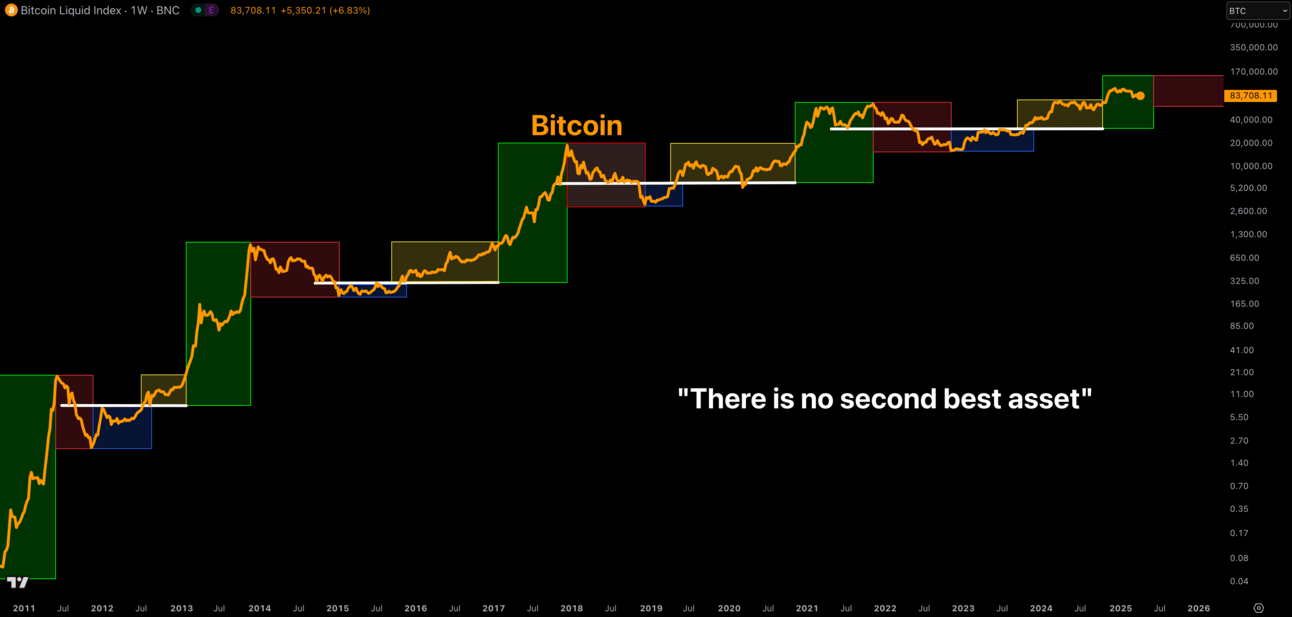

Bitcoin’s price history and market cycle phases.

What I’m doing with my portfolio

No changes were made to my portfolio this week. My cash position is right around my 30% target and the purchases made last week during Monday’s panic have performed quite nicely so far. Having target allocations and rebalancing as needed has made taking profits and buying dips 100x easier for me this cycle compared to previous ones. I can put my emotions aside and follow the system I laid out before all the uncertainty and fear overrides my decision making and psychology. I look forward to taking profits when market sentiment turns greedy once again.

Portfolio snapshot as of April 14th, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. Lifetime access with early bird pricing is still available on the Crypto and Macro Enjoyers program as I build out the final module this week. If you’d like to learn about my portfolio management system in a more structured way, you can learn more about it here:

Last week was another perfect example of how sentiment, narratives and price action force investors to make mistakes they later end up regretting. While disciplined investors with a system and plan can take advantage of the opportunities provided by the market. With the breakout we have seen in Global Liquidity, I believe the best is still ahead of us this cycle. The future looks bright. 🤝