The Weekly Close

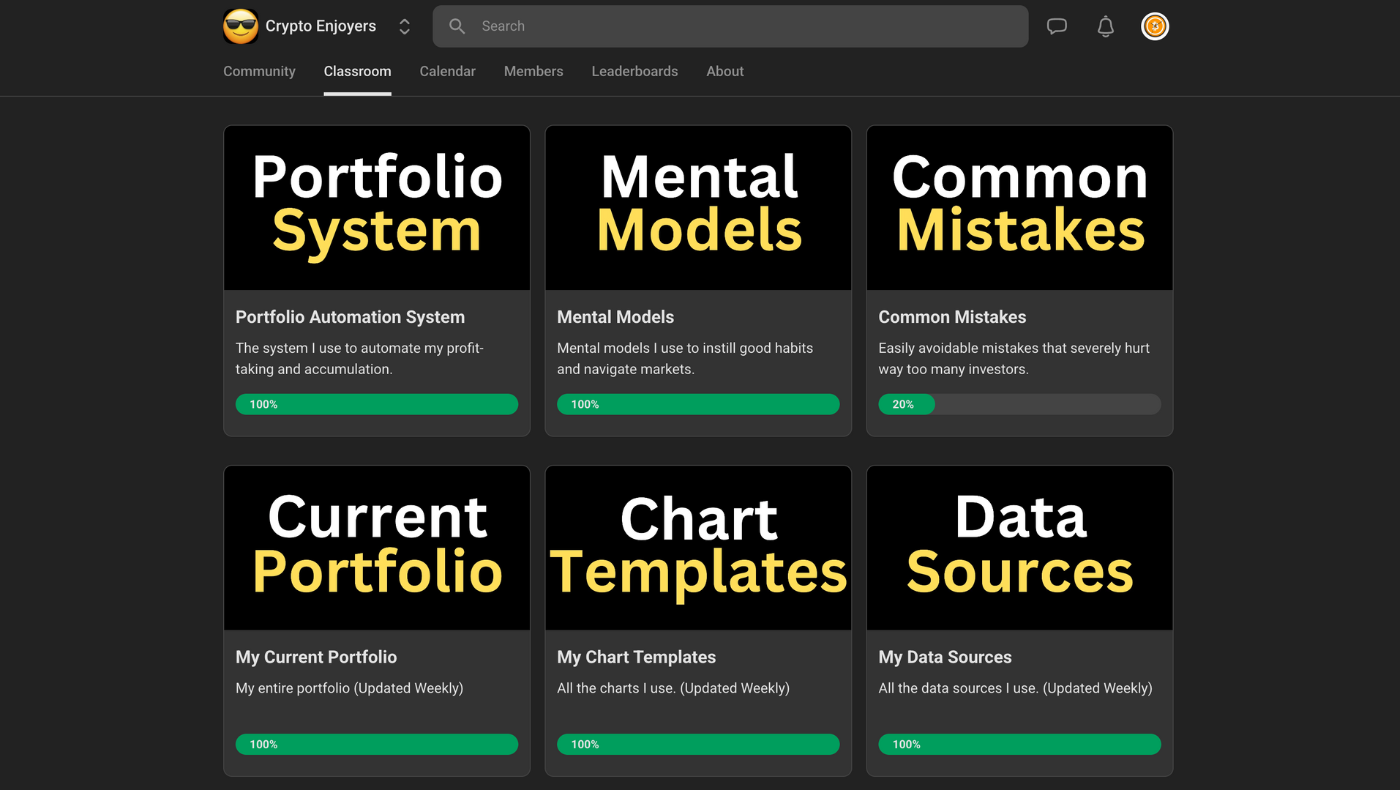

After a brief selloff below the 20-week moving average last week, Bitcoin was able to close its weekly candle back above it. This is why we always wait for weekly candle closes before assuming something is a breakout or breakdown. Otherwise we could end up buying or selling into a wick that ends up completely reversing. All we need now is for Bitcoin to hold that higher low and head higher to confirm that the local bottom is in.

The Bitcoin Weekly Chart.

Market Sentiment

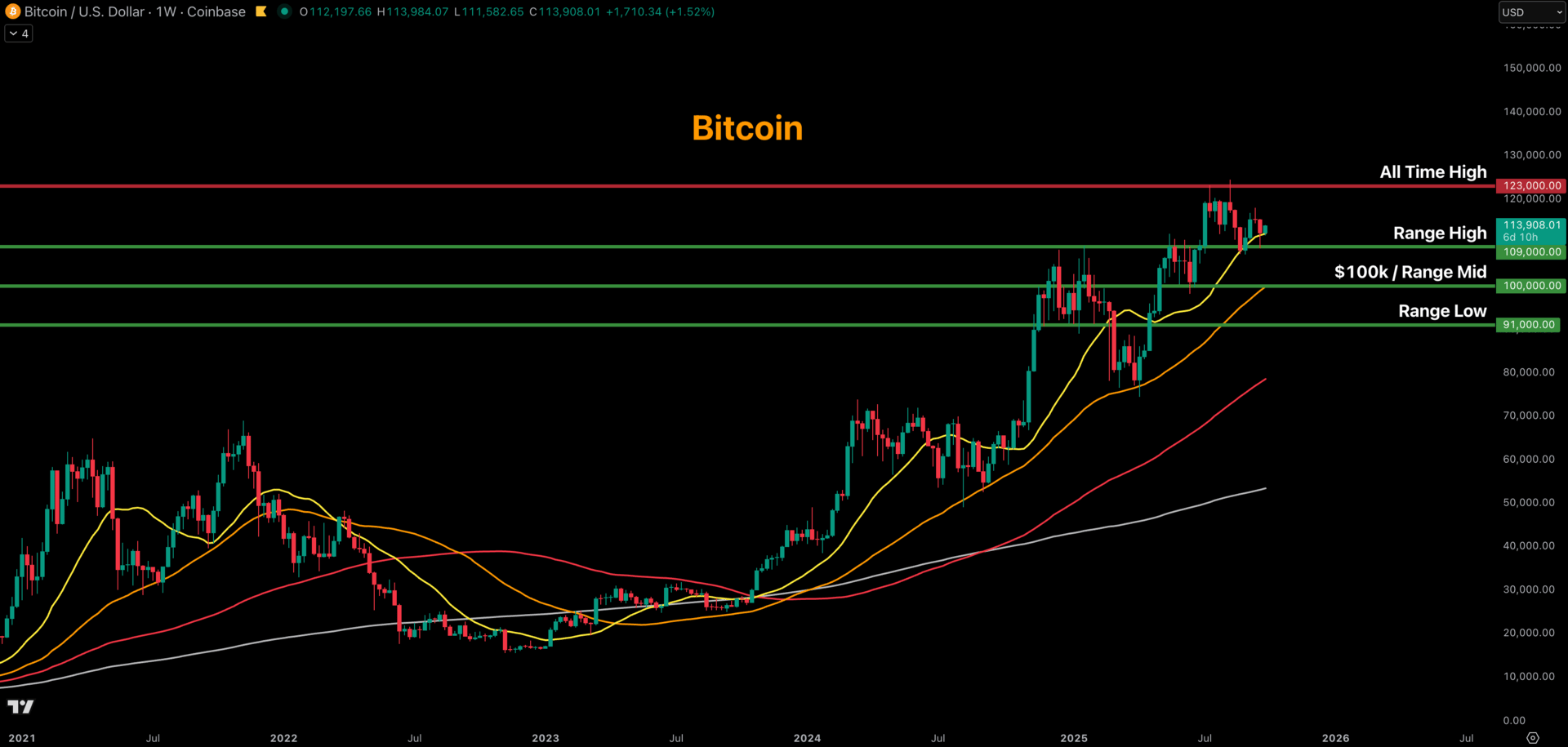

Market sentiment is still ever so slightly in the Fear region, but I expect that to change back to Neutral on the next print. The Fear we saw last week is exactly what you’d expect at a local bottom. Nothing changes sentiment like price and it won’t take much of a rally higher here to fully flip sentiment back into Greed and have everyone piling back into the market again.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

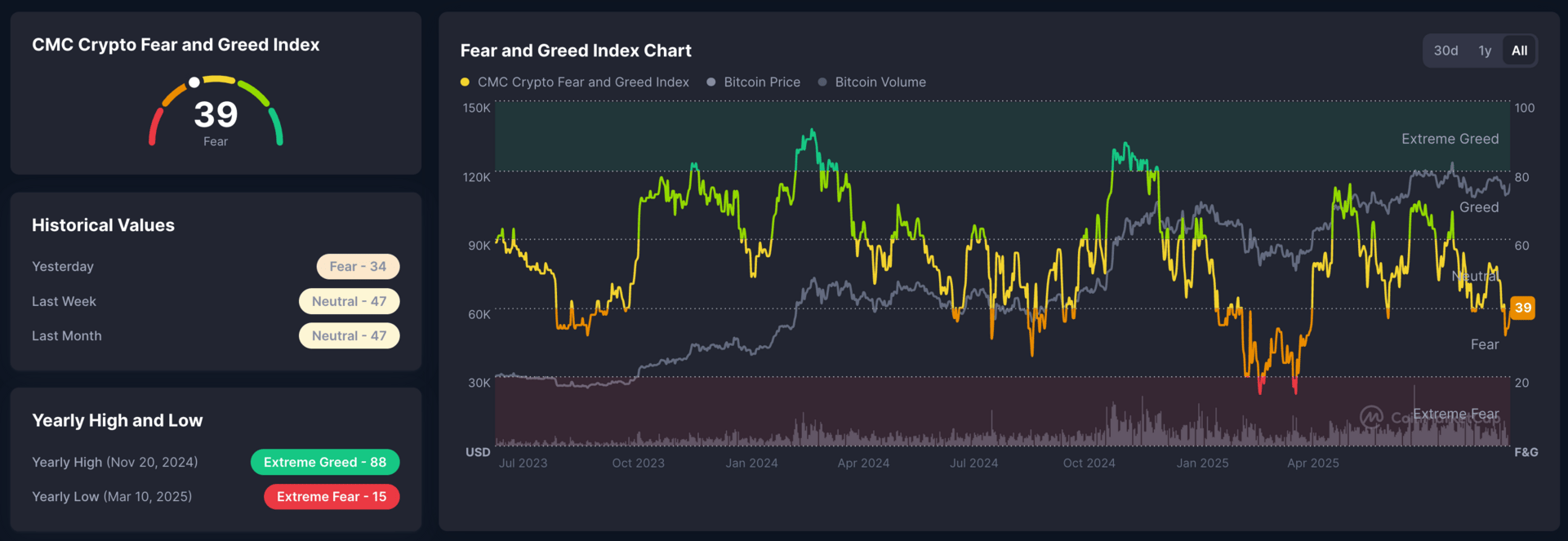

The GLI did drop a bit last week, but it is way too early to assume it is the start of a new downtrend. According to The GLI we should be in the clear from about mid-October to the end of November which should give Bitcoin plenty of room to rally. As we get close to those dates we should get more clarity as to what comes next. For now, it is saying we could face some chop over the next week or 2, but I’m not too concerned with that given the bigger picture and what comes next.

Bitcoin and The Global Liquidity Index.

The Labor Market

This week we will be receiving an update to the FED’s preferred measure of employment, the unemployment rate, on Friday, October 3rd. The market is expecting it to remain flat at 4.3%. If we see a miss to the upside the market will price in more rate cuts, but if it comes in at or below expectations the market will push back some of the rate cuts that are already priced in December onwards.

The Unemployment Rate.

The Bigger Picture

Bitcoin held support at our “Likely” level once again. We still have to remain open-minded to a retest of lower support at the “Possible” region where the 50-week moving average is, but as of right now I am not seeing any major warning signs that the cycle is over. Q4 tends to be a great time period for Bitcoin, so all we have to do is be patient enough to see it through.

Bitcoin support levels and their likelihood of being revisited.

What I’m doing with my portfolio

I bought the dip across my positions this morning. My cash position was getting a little too far from my target and it never hurts to be greedy when others are fearful. I know I didn’t buy the exact low by waiting until Monday to buy, but the benefits of only having to think about my portfolio once a week (Mondays) greatly outweighs the extra few percentage points of performance I miss out on by not buying the exact bottom. It’s also nice to make portfolio decisions right after the weekly close has happened so I can get a clearer picture of market structure and what to expect going forward.

Portfolio snapshot as of September 29th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝