The Weekly Close

After a pivotal week, Bitcoin closed its weekly candle back above the old Range High at $109k and it’s 20-week moving average at $113.4k. This is why it is always so important to wait for weekly closes before assuming a level has been lost or reclaimed. I’m sure many sold last week expecting a large breakdown, just to end up being part of the wick that was left behind on the chart before Bitcoin closed higher. Now we just need Bitcoin to maintain this momentum and stay above its 20-week moving average so that our macro uptrend can continue.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment is back in the Neutral region. We saw a bunch of Fear over the past two weeks which is what you would expect during corrections, but it will be interesting to see if investors start to flip bullish again now that price is rising. It’s important to be aware of your emotions when investing. Especially when your emotions align with what the market is currently feeling. That’s when the best opportunities are presented.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to chop sideways. It’s nice to see Bitcoin following the path outlined by The GLI, but we likely won’t get more clarity as to what comes next until this week’s FOMC meeting. I know many people have written off using Global Liquidity because Bitcoin does not follow it perfectly, but I continue to believe it is a reliable and valuable indicator of general trend for Bitcoin.

Bitcoin and The Global Liquidity Index.

The US Dollar

The US Dollar is still chopping sideways as we wait to hear from the FED at this week’s FOMC. We know inflation came in cooler than anticipated last week. Which is good for FED rate cut expectations, but we aren’t getting any labor market data updates thanks to the US government shutdown. I will be watching the Dollar closely during this week’s FOMC to see if it breaks higher or breaks down after hearing Powell’s comments since FOMC meetings tend to have a large impact on The GLI and markets as a result.

The US Dollar Index.

The Bigger Picture

It’s nice to see Bitcoin bouncing as Gold consolidates after its most recent top. The relationship between these assets is pretty clear and it makes sense that Bitcoin, a risk asset, would struggle to rally when Gold, a risk-off asset, is rallying aggressively. I think both assets will do well over the next few years as currency debasement continues, but investors buy them for different reasons. Gold is what investors buy during uncertainty and Bitcoin is what investors buy when they want to speculate more aggressively. I think both have a place in a balanced portfolio.

Bitcoin and Gold Correlation.

What I’m doing with my portfolio

No changes were made to my portfolio this week. After buying the dip 2 weeks ago, it is nice to see this recent market recovery. We aren’t in the clear quite yet, but I remain optimistic that this cycle still hasn’t ended and that we still have higher to go. If we see higher prices, I’ll happily lock-in more gains. If we see lower prices, I will happily buy the dip. This is the advantage we get as long-term-oriented investors, we never have to be all-in or out of the market and we can instead take an approach that can navigate multiple possible outcomes.

Portfolio snapshot as of October 27th, 2025.

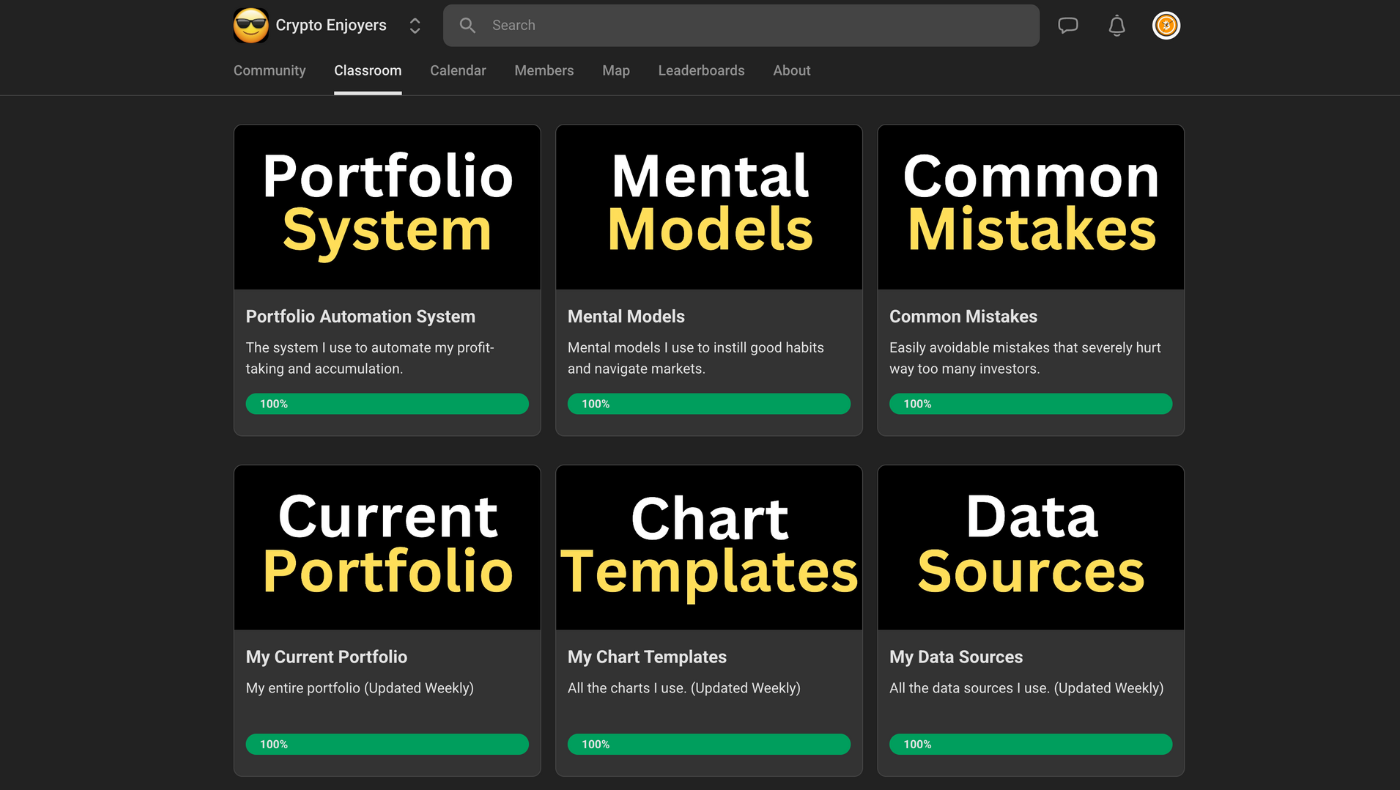

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. I completed the final module for the “Common Mistakes” course so the one-time fee offer will be ending in 6 days and will become a monthly subscription. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝