The Weekly Close

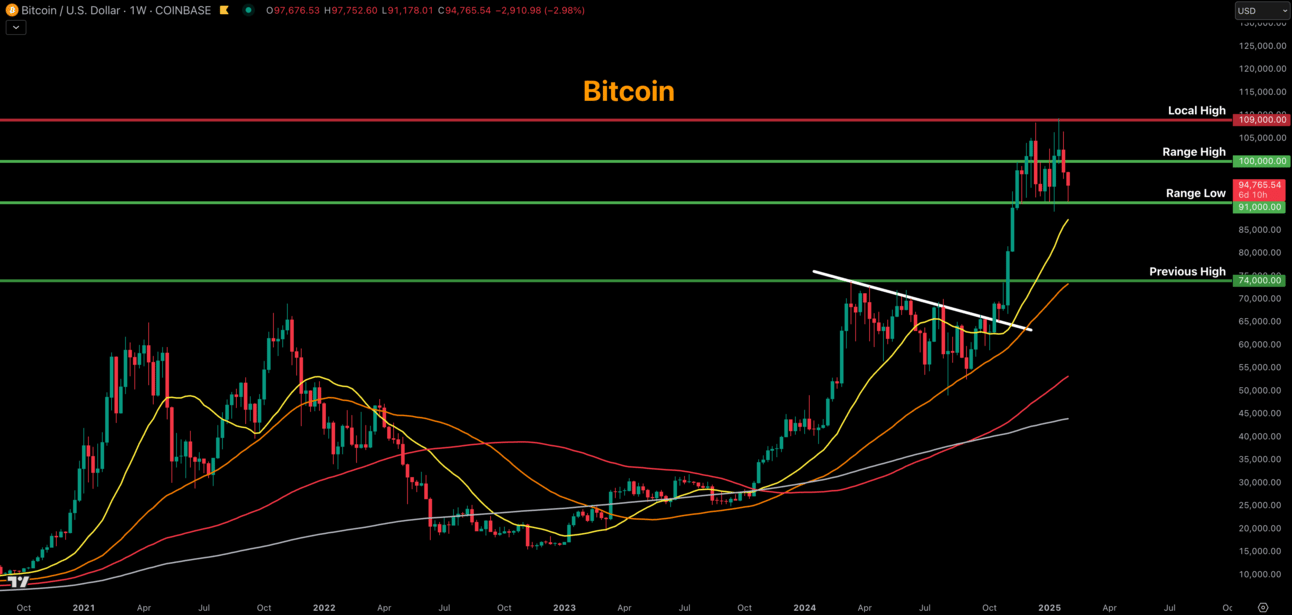

After a wild weekend, Bitcoin closed back below our $100k range high. This confirms our second false breakout above $100k and likely means we will spend more time consolidating within our range. This tells us the sellers are still in control above $100k, as you can see with all the upside wicks we have had over the past 3 weeks. For now, there are no major signs of concern unless we lose our $91k range low on a weekly closing basis.

The Bitcoin weekly candle closed at $97,676.52 (-4.76%) on February 2nd, 2025

Temperature Check

This has quickly become my favorite metric to monitor (alongside global liquidity) during this market cycle. It’s a great reminder that the market always cycles back and forth between fear and greed. In the last few weekly reports, I said I’d ideally like to see a full reset back to the “fear” region and we finally got it. These sentiment resets are healthy for the market and wash out all the froth so that we can build a base for our next move higher.

The CMC Fear and Greed Index is at 39 which represents “Fear”

Global Liquidity

After a nice bounce last week, the Global Liquidity Index has gone back to languishing sideways. The real question now is whether we will see the Global Liquidity Index put in a higher low and continue higher or breakdown to new lows. This will likely be the main driver for Bitcoin’s medium-term trend. The next major catalyst for Global Liquidity is this week’s Unemployment Rate print.

The Global Liquidity Index is consolidating after last week’s bounce

The Labor Market

The most important catalyst this week is the Unemployment Rate print this Friday February 7th. The market is expecting it to remain flat at 4.1%. An upside surprise would likely spook markets and spark recession fears, while a downside surprise would push back rate cut expectations and strengthen the dollar. This would reduce Global Liquidity and would not be great for risk assets like Bitcoin. Ideally the Unemployment Rate pint is in-line with expectations and remains flat.

The Unemployment Rate is 4.1%

Bigger Picture

My base case of an early 2025 cycle top remains intact. An extended correction would delay our next rally slightly, but the final destination remains unchanged. All we have to do is manage our emotions and stick to our plan in the meantime. It’s amazing how everyone forgets all the bullish narratives and catalysts during these corrections and immediately start calling for cycle tops. Then during the rallies everyone forgets about risks and concerns and start calling for a supercycle. In the long-term the calm and rational investors win.

Bitcoin Cycle Scenarios

What I’m doing with my portfolio

No changes were made to my portfolio this week. The best action during moments of extreme volatility is usually to do nothing. We have been taking profits at the highs so we could remain calm during these types of corrections. My portfolio is near the higher end of my 30-40% Q1 cash goal so I don’t feel the need to take any more profits here. However, prices are also not appealing enough for me to consider buying either. So for now I’ll just sit on my hands and let this consolidation play out.

Portfolio snapshot as of February 3rd, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. I’m sure many of you have heavy altcoin exposure and I know days like yesterday must have been tough. Just treat it as a learning opportunity for the future. We have all been there before and grew from it. We knew 2025 would be volatile and it is off to a crazy start. I remain optimistic that the best is still ahead. 🫡