The Weekly Close

After a relatively quiet week, Bitcoin closed its weekly candle just below $109k. This means that Bitcoin closed below our 20-week moving average. Every time that has happened this cycle, Bitcoin has went on to test the 50-week moving average. We saw that play out in September of 2023, August of 2024 and April of 2025. That doesn’t mean we have to test the 50-week again, but it does mean that we shouldn’t be surprised if we do dip a little lower before our next move up. I’ll be watching this week’s price action closely to see if we are able to maintain above the 50-week and hopefully reclaim the 20-week.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment is back in the Fear region. This fearful sentiment isn’t really surprising given the fact that it has been a rough few months for many. Especially leverage traders and altcoin holders. Many investors are starting to worry that the 4-year cycle is playing out again and that we are entering a bear market. They are constantly fighting with themselves trying to figure out if they should be all-in for a blow-off top of fully exit as we enter a downturn. This is why we are always prepared for multiple outcomes. It allows us to make rational decisions whether the average market participant is fearful or greedy. For that reason, it gives us the highest likelihood of success.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to chop sideways. The lack of economic data thanks to the US government shutdown has resulted in minimal action in rate cut expectations, The DXY and The GLI. The GLI is still pointing to a rally into the end of November. So that remains my base case until the market tells me otherwise. For now, all we can really do is keep an eye on the price action and wait for the US government shutdown to end so that we can start receiving economic data updates again.

Bitcoin and The Global Liquidity Index.

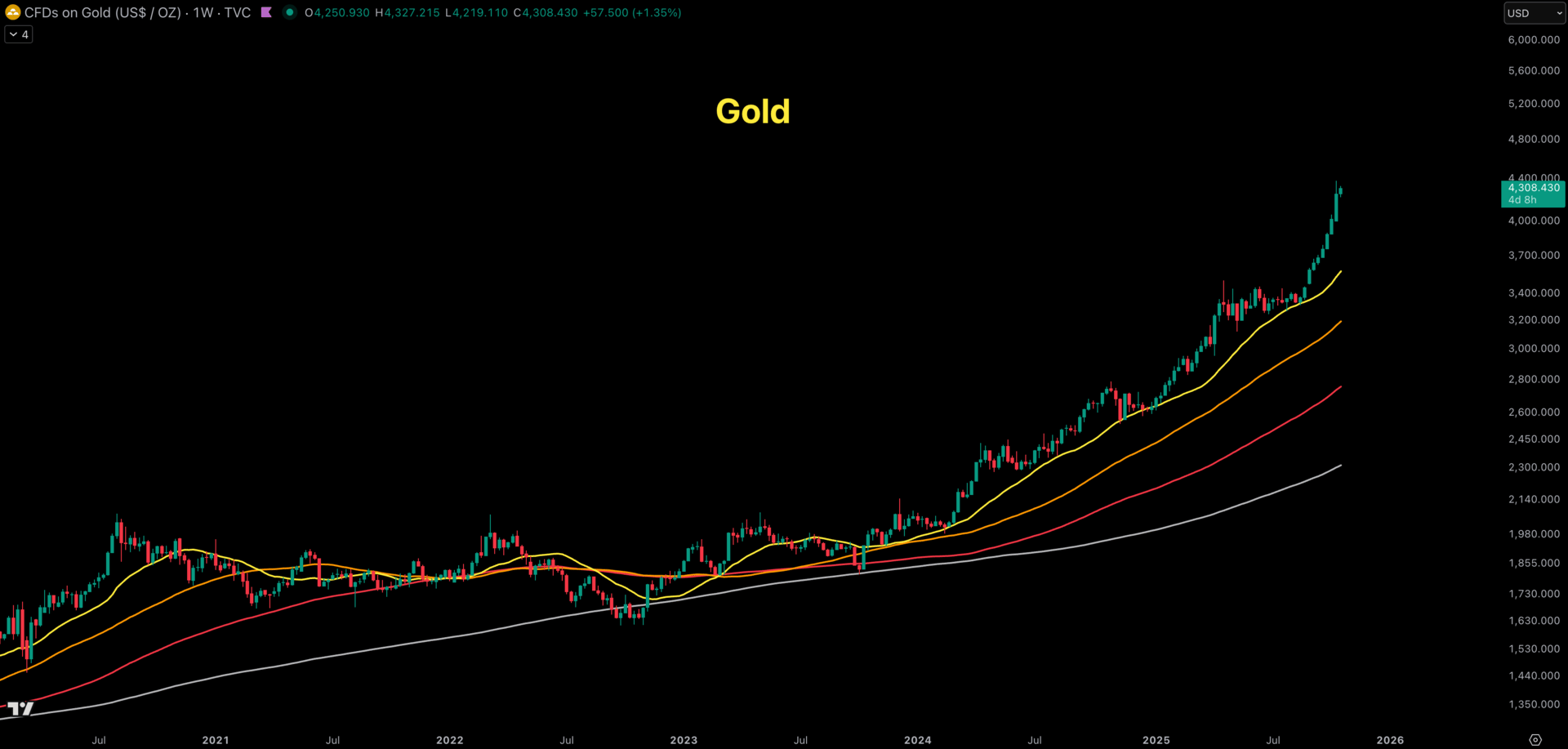

Gold

Gold has been on an absolute tear recently. The worsening US fiscal situation, regional bank struggles and US government shutdown have created a perfect uncertainty storm for Gold to shine. I have been monitoring the inverse relationship between Bitcoin rallies and Gold rallies and it is clear to me that we need Gold to find a local top and consolidate for Bitcoin to rally. The good news is the that Gold looks incredibly overbought in the short-term and just hit the $4200 milestone which puts it at exactly double the $2100 peak it achieved in 2020. It wouldn’t surprise me if Gold investors started taking profits here. That should result in a consolidation period for Gold and an opportunity for Bitcoin to rally.

Gold.

The Bigger Picture

The amount of Fear and uncertainty I am witnessing is making it very hard for me to believe the cycle is over. I still believe Bitcoin will make new highs this cycle whether that is later in Q4 or Q1 of 2026. My invalidation is the 50-week moving average being lost on a weekly closing basis, so ideally it doesn’t come to that. There are plenty of bullish catalysts on the horizon, but the difficult part will be surviving the volatility long enough to actually see them come to fruition. Some short-term bullish catalysts are FED Quantitative tightening ending, the crypto bills in congress passing and an end to the US government shutdown. Any one of these would bring investor optimism back and we will likely get all 3 by the end of the year. So it is easy for me to remain calm and collected while we wait to see what the market has in store.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

No changes were made to my portfolio this week. My allocations are at or very near their targets. I feel well positioned for all the possible scenarios I outlined in the chart above and I will update my portfolio as needed if that stops being the case. I still believe this cycle has higher to go and I am quite happy that I stuck with the majors like BTC, ETH and SOL and didn’t go out on the risk curve too early. It is so much easier to hold strong assets during volatility compared to the ones that have struggled all cycle long. I look forward to taking profits at higher prices later this year if we get them.

Portfolio snapshot as of October 20th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. I am working on the final module for the “Common Mistakes” course and once that is completed, the program and community will be moving from a one-time fee to a monthly subscription. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝