The Weekly Close

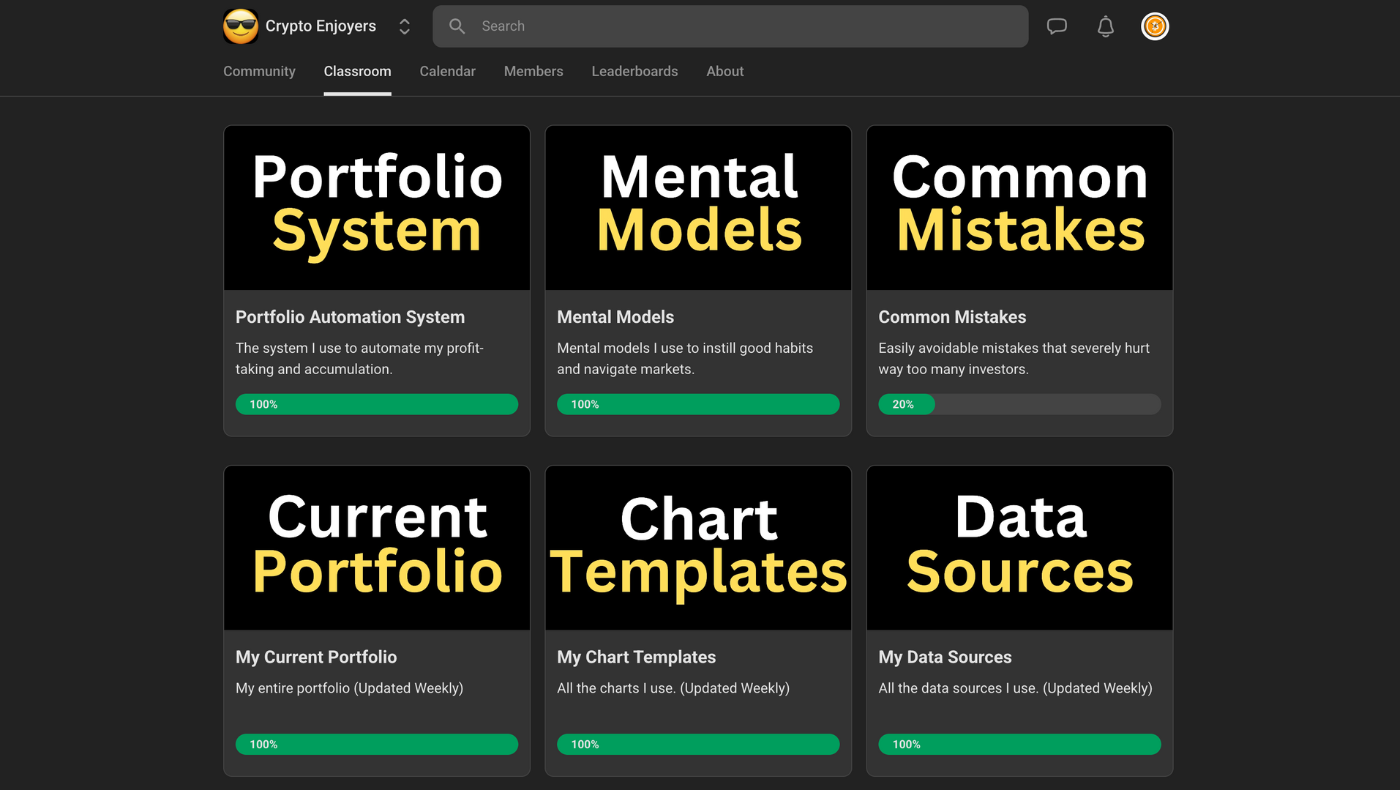

After a clear rejection above the $123k all time high, Bitcoin closed its weekly candle back below $118k. As it stands, this is a clear false breakout and is usually a bearish warning sign that chop and consolidation are around the corner. There are many people comparing this price action to the November 2021 cycle top, but I highly doubt those people will be correct. I have never seen Bitcoin repeat an obvious topping pattern from the previous cycle.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment is back in the Neutral region once again. We continue to see lower highs and higher lows on sentiment and it is only a matter of time before we get a big move that breaks the tightening range. My base case is that it will be a move to the upside, but I am open to alternative outcomes if price action starts to call for it.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI remains in a downtrend as it continues to put in lower highs and lower lows. This indicator has been a very valuable tool this cycle and I will adjust my base case scenario if we see it break out of its downtrend to the upside. However, if it breaks down and the downtrend continues, that will provide even more evidence that we are correct in expecting an early top.

Bitcoin and The Global Liquidity Index.

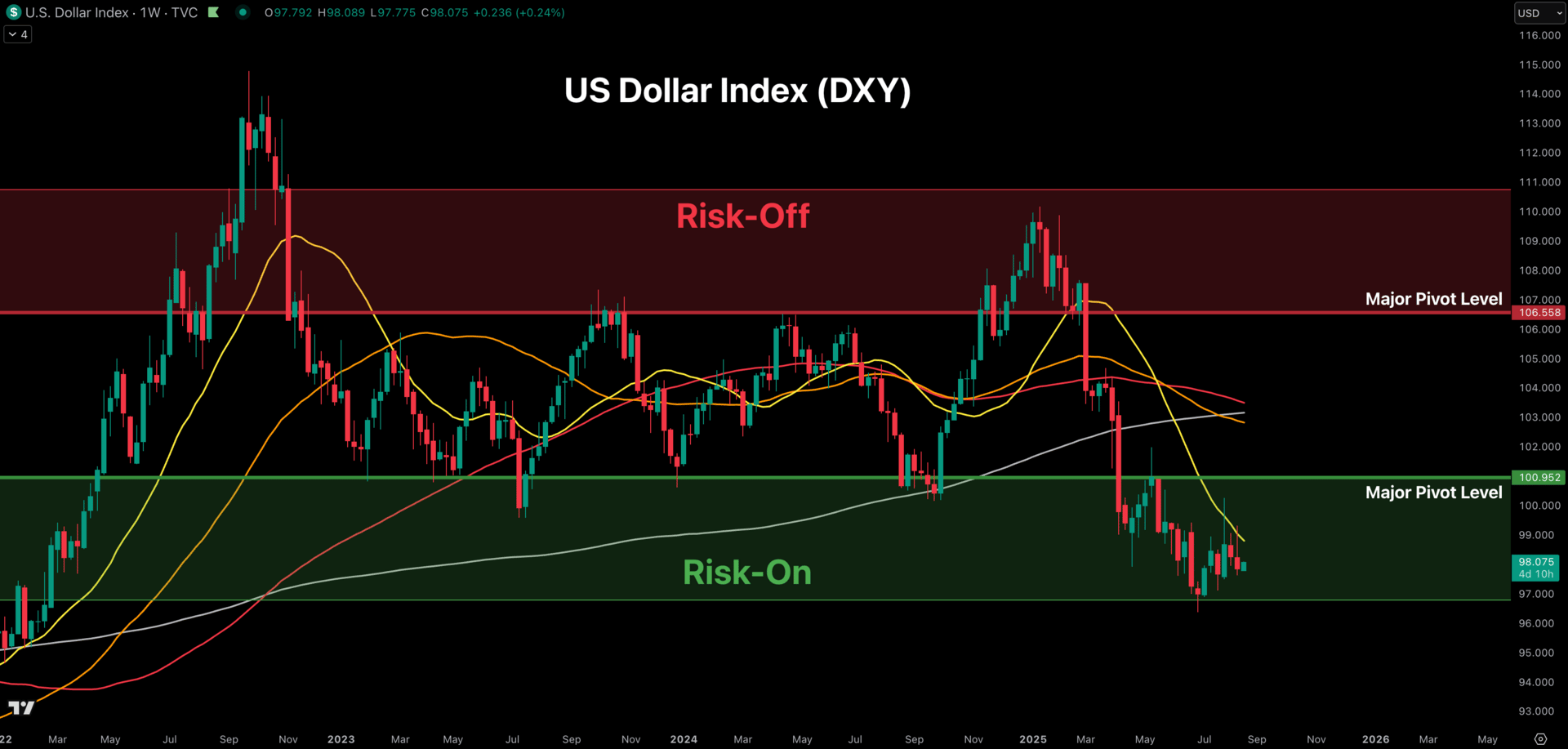

The US Dollar

The US Dollar Index continues to slowly trend higher and put downward pressure on The GLI. This is likely the result of the market pricing in less and less rate cuts as inflation data begins to worsen. The FED is now stuck between a weakening labor market calling for rate cuts and a stubborn inflation rate calling for rates to remain where they are. This push and pull over the next few months will be the main driver of The DXY, The GLI and risk assets as a result.

The US Dollar Index (DXY).

The Bigger Picture

Bitcoin is still comfortably near the center of our “Expensive” region. This is an area where it is important to implement some risk management incase this cycle doesn’t reach our “Very Expensive” region. However, the downside risk isn’t nearly as bad as previous cycles because the 200W moving average is only 50% below where we are currently trading. Not to mention the fact that it is still rising higher week after week.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

No changes were made to my portfolio this week. We take small profits on the way up so that we are not panicking when prices are going down. I still believe the market has not topped yet, but my 30% cash target keeps me calm in the low probability chance that it has. I’ll happily buy the dip if we go low enough for my system to call for it. For now, I’m happy to sit on my hands and let the market provide more clarity on its next move.

Portfolio snapshot as of August 18th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝