The Weekly Close

After another rejection above our Range Low at $91k, Bitcoin closed its weekly candle just above $88k. Sellers remain in control for now as price has not been able to reclaim that pivotal $91k level. As long we keep closing weekly candles below $91k, my expectation is more chop and downward price action.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment remains in Fear. Extended time in the Fear region is to be expected during bear markets. The longer we spend in the Fear region, the higher the likelihood that we are in a bear market. I expect a relief rally that gets us back to Neutral soon, but based on price action, we may need to spend more time consolidating before that happens.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to show early signs of a new uptrend. This will likely act as a tailwind for Bitcoin’s relief rally. This recent rise in The GLI is driven by the FED’s recent announcement of starting QE. The current pace of QE isn’t enough to send The GLI skyrocketing higher, but it is enough to further confirm our long-term thesis and currency debasement trend.

Bitcoin and The Global Liquidity Index.

The Unemployment Rate

We will be receiving an update to the Unemployment Rate tomorrow. The market is expecting the Unemployment rate to rise to 4.5%. I expect quite a bit of volatility as a result of this print. If it comes in above expectations, we should expect rate cut odds to increase and The GLI to rise. If it comes in below expectations, we should expect rate cut odds to decrease and The GLI to drop.

The Unemployment Rate.

The Bigger Picture

The base case remains that Bitcoin has entered a bear market. Bear markets are long and grueling so patience and discipline are incredibly important. I’d love to be proven wrong and see Bitcoin surprise us with some bullish price action, but all we have seen so far is the opposite.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

No changes were made to my portfolio this week. Prices are pretty much chopping sideways so my allocations are still pretty close to where i want them to be. I look forward to selling at higher prices if given the opportunity and I look forward to buying at lower prices if given the opportunity. For now there isn’t much to do, but sit back and see what the market decides it wants to do.

Portfolio snapshot as of December 15th, 2025.

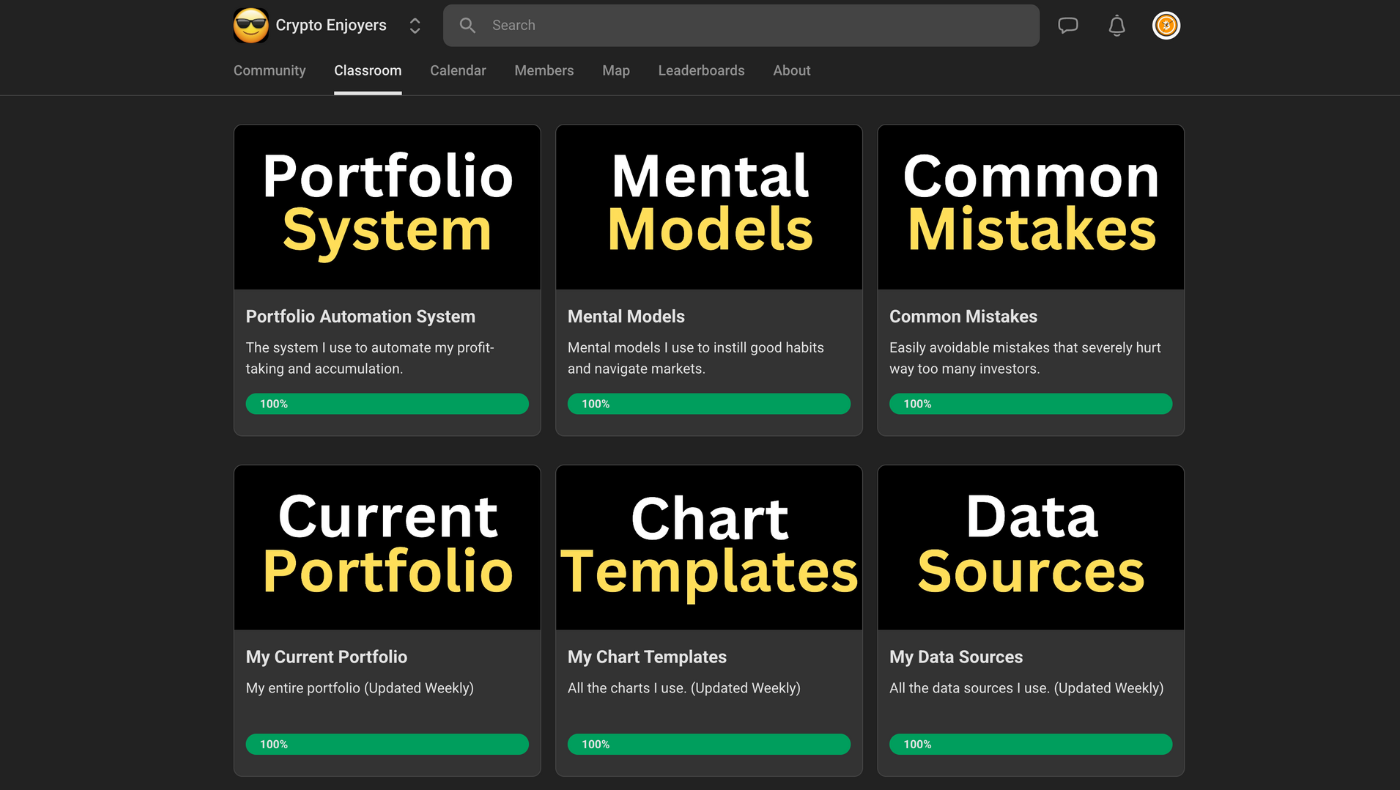

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝