The Weekly Close

After a wild leverage liquidation event on Friday, Bitcoin was able to close its weekly candle just above $115k. This means that Bitcoin was able to maintain above its 20W moving average and maintain its price structure. We want to see some continued strength this week to confirm that was the local low. It’s unfortunate that so many investors lost their positions last week due to that event and it’s why I always recommend that investors avoid leverage. If you did suffer big losses, just remember that every successful investor has experienced losses at some point along their investment journey and learning from them is what’s most important.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment is just barely back in the Neutral region. We saw a ton of Fear during last week’s liquidation event which is to be expected. There is a ton of uncertainty and anxiety regarding the 4-year cycle so it isn’t surprising that so many investors are on edge. This is when it is especially important to have a plan you can execute without being hindered by the emotions of the moment. It wouldn’t surprise me if we found ourselves back in Greed in a few weeks now that all the leverage has been flushed.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

I am blown away by how closely Bitcoin has followed the path laid out by The GLI. We saw the liquidation event on the exact day that The GLI said Bitcoin should bottom. If The GLI lag pattern continues, we should see a rally into late November from this point. I am keeping a close eye on the recent drop we have seen in The GLI and what that will mean for Bitcoin as we enter late November and early December. The good news is that we have plenty of time between now and then to monitor the data and price action as we approach that time window.

Bitcoin and The Global Liquidity Index.

The US Dollar

The US Dollar continues its rally higher. This is starting to put downward pressure on The GLI. My target for this Dollar rally is all the major moving averages coming in at about $102. Ideally we would see a rejection at those levels followed by a breakdown by the DXY. If the Dollar does not get rejected at those levels and instead breaks higher, that will likely be bad news for risk assets like Bitcoin. However, if we do get that rejection into new lows, it would create a compelling argument for an extended cycle.

The US Dollar Index.

The Bigger Picture

As longer-term investors, I believe these are the three main scenarios that we have to be on the lookout for. Bitcoin is currently sitting right between our “Final Push” scenario and “Full Reset” scenario. Neither one of those outcomes would really surprise me and, as a spot holder, I feel well positioned for both. I still believe this cycle has higher to go, but it’s important to consider the “It’s Over” scenario as well. For now, all we can do is monitor the data and price action to navigate the remainder of the cycle.

Bitcoin Cycle Scenarios.

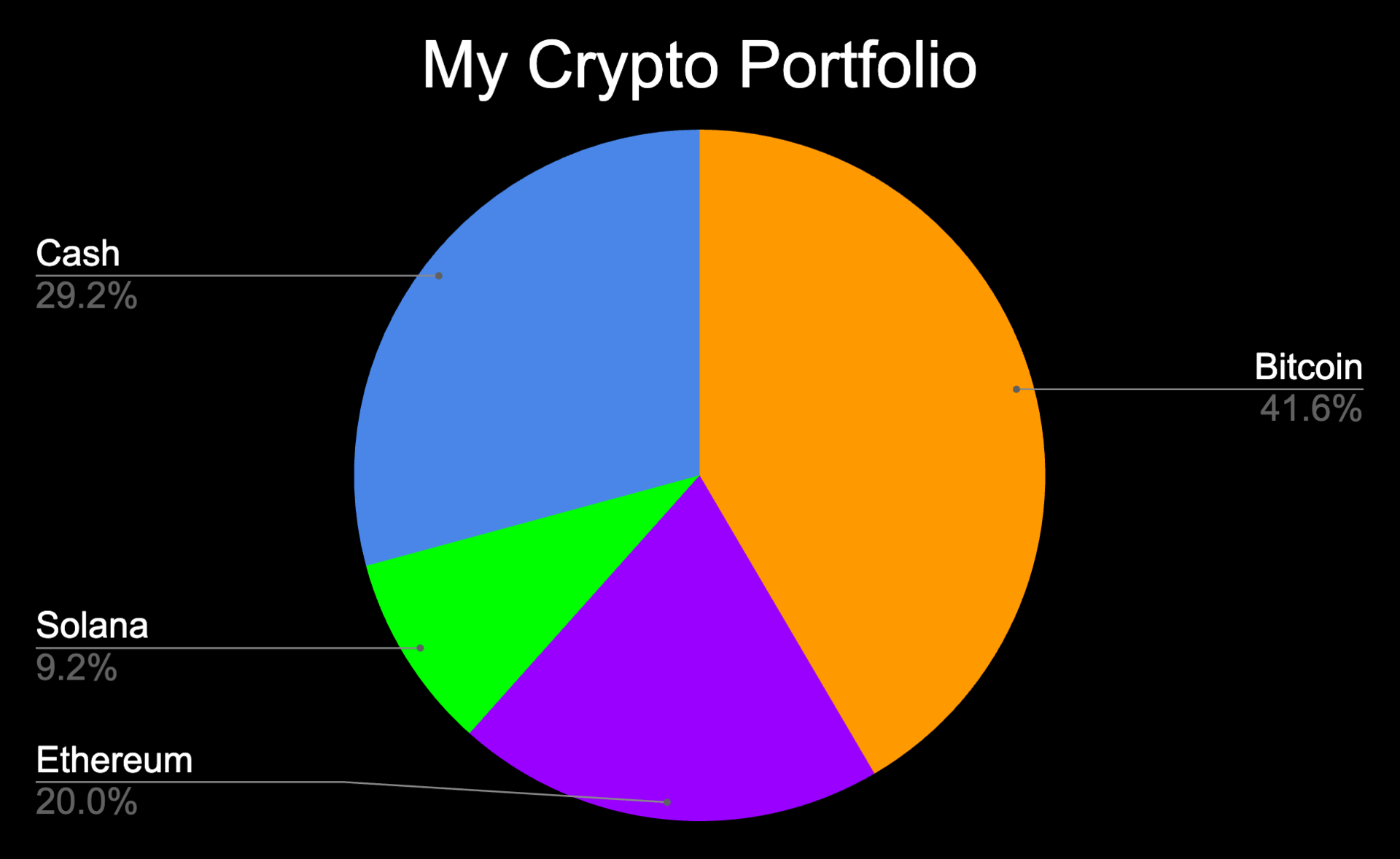

What I’m doing with my portfolio

I deployed some cash across my positions this morning. Not because I believe the bottom has to be in, but because my system called for it after last week’s drop. I didn’t get to buy the exact bottom this time, but I know sticking to this system will help me succeed in the long-term even if I don’t get perfect entries and exits at all times. It great enjoying my weekend and not having to stare at prices the entire time stressed as to what the market was going to do next. I liked what I saw with the weekly close and was able to calmly deploy some cash without any stress or anxiety.

Portfolio snapshot as of October 13th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. I am working on the final module for the “Common Mistakes” course and once that is completed, the program and community will be moving from a one-time fee to a monthly subscription. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝