Weekly Close

After a brief breakout above $94k last week, Bitcoin closed just below it at $93.6k. This is technically a False Breakout above $94k and does increase the likelihood that Bitcoin is headed lower, but we closed too close to the $94k resistance for this to be clear signal. The last chance the bulls have is to hold the Range Low at $91k and use that as support to get back above $94k. Lose that level and the bears take over once again. I still expect more downside for Bitcoin, but I’ll be watching this week’s price action closely to see if bulls step in and show some strength.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment remains in the Neutral region. This relief rally did its job of resetting market sentiment and getting investors hopeful once again, but it still hasn’t reclaimed the major levels required to fix market structure. So far it looks like a textbook bearish sentiment reset before further continuation to the downside. That remains my base case until those major levels get reclaimed.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to slowly grind higher. This would usually be a bullish tailwind for Bitcoin, but so far price action hasn’t really followed through. I do still believe The GLI is the main driver of Bitcoin’s macro trend, but I also can’t ignore the weakness in Bitcoin’s price action. It seems as though capital flows are prioritizing precious metals over Bitcoin to protect wealth from currency debasement and until that changes, I want to be cautious in assuming Bitcoin has to go up because The GLI is.

Bitcoin and The Global Liquidity Index.

Inflation

We will be receiving an update to the FED’s preferred measure of inflation, Core PCE, on Thursday, January 22nd. Now that the deterioration in the labor market has somewhat stabilized, the market is turning its attention back to inflation. A hotter than expected print will likely push rate cut odds even further back while a cooler than expected print will pull them closer. It will be interesting to see what the data print ends up showing and how the market will react.

Core PCE.

The Bigger Picture

Bitcoin continues to chop around in our Fair Value region. It seems as though not many investors are interested in buying at these prices and I still believe Bitcoin needs to trade lower before we see some real strength. Lower prices will allow more coins to move from weak-handed speculators to strong-handed hodlers. Right now a lot of investors are still hopeful Bitcoin has bottomed and I hope they’re right, but those same investors will end up capitulating in the Cheap region if/when we get there. I’d see revisiting the Cheap region as a major accumulation opportunity, but I know it isn’t guaranteed. So I have enough spot exposure to take advantage of upside if we get it.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

I rotated some Ethereum and Solana into Bitcoin today. When Bitcoin broke its market structure back in November, I said I would use a relief rally as an opportunity to reduce risk. Now that it has happened, I will stick to my plan. It also helps that we have entered a new tax year so the tax burden will be deferred to next year. It’s impossible to know how high this relief rally will go so I won’t try to time it perfectly, but by rotating some Ethereum and Solana exposure into Bitcoin, I still give myself upside exposure while greatly reducing my downside risk. I’ll continue to rotate until I reach my desired allocations so that I can remain prepared no matter what the market decides to do.

Portfolio snapshot as of January 19th, 2026.

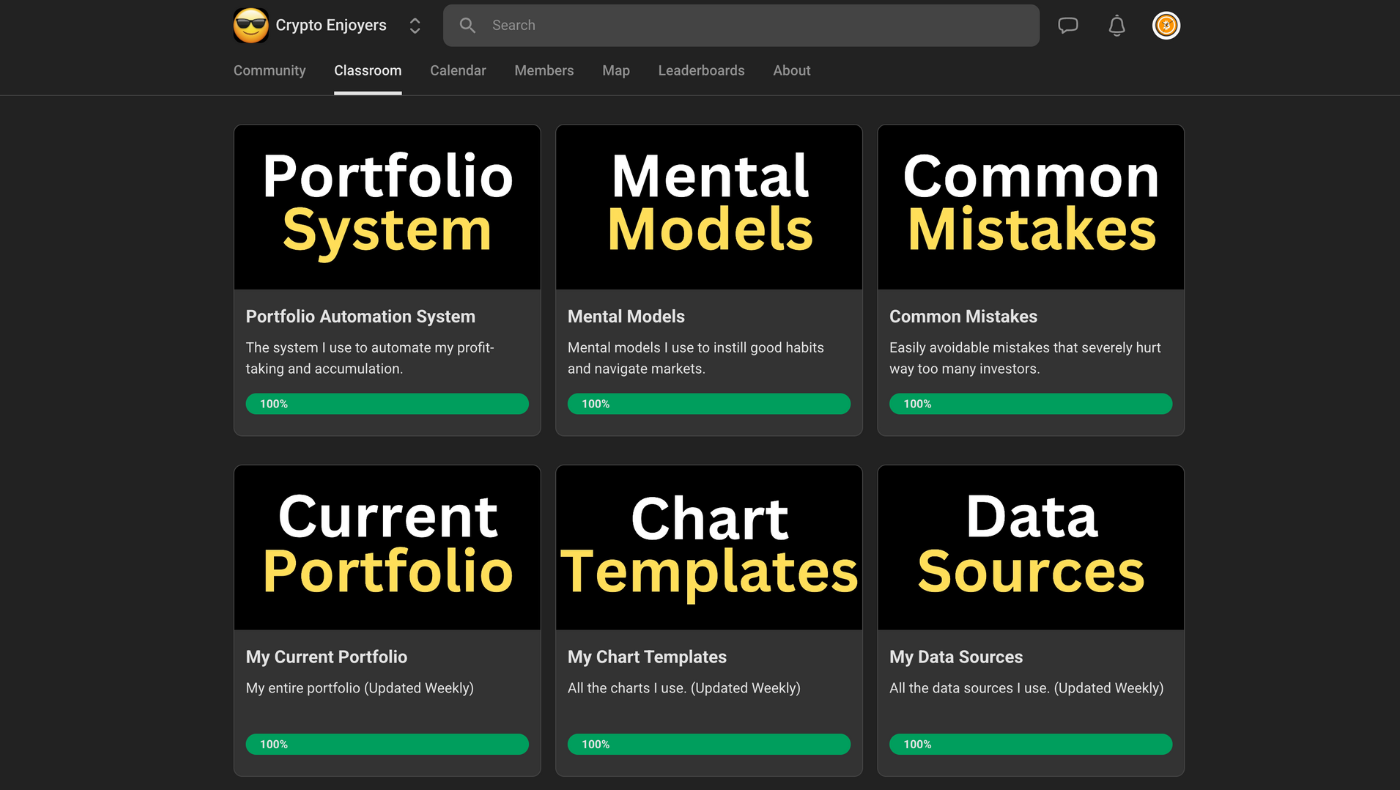

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to view my entire portfolio or would like to learn more about my Portfolio Automation System, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝