The Weekly Close

After a choppy week, Bitcoin closed just under its Range Low at $91k. We really want to see that level reclaimed so that this relief rally can start to build some momentum. Until then, we likely see more chop and sideways price action thanks to the upcoming FOMC meeting on Wednesday. Many people are expecting this relief rally to go higher, including myself. So it wouldn’t surprise me if Bitcoin surprises us with some downside before that happens.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment remains in Fear. Investors are definitely starting to become a little more optimistic compared to the despair they felt a few weeks ago, but there is still a ton of anxiety in the air. I’d love to see this relief rally make it all the way back to Neutral before price rolls over, but that isn’t guaranteed.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI is still trying to start a new uptrend. We really want to see new highs for The GLI soon to help this Bitcoin relief rally. We know that Bitcoin usually follows The GLI, but there has been a divergence recently. Showing serious Bitcoin weakness as money has started chasing other assets. We will receive more clarity on what to expect for liquidity once we hear Powell’s speech on Wednesday.

Bitcoin and The Global Liquidity Index.

The FED Funds Rate

The market is still pricing in only three rate cuts over the next 12 months. The FED will be publishing their economic projections at the FOMC this week and that should provide much more clarity as to what investors can expect for 2026. A dovish surprise would be bullish for risk assets, but a hawkish tone would likely spook markets. I’m sure most investors are waiting until after the meeting to make any big investment decisions.

FED Funds Rate Projection.

The Bigger Picture

Bitcoin is still in the lower half of our Fair Value region. This isn’t a fire sale by any means, but it’s not that Expensive either. It can be a great place to DCA as long as you have a long time horizon. I already have exposure so I don’t feel the need to add any at current prices. I’d love to get an opportunity to buy in the Cheap region sometime within the next few months.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

I sold some BTC, ETH and SOL this morning. I still expect this relief rally to head higher, but I know I won’t be able to time things perfectly. I sold enough to bring my cash position back near my target. I’ll happily sell more if we continue to see higher prices otherwise I’ll just sit on my hands and see what happens.

Portfolio snapshot as of December 8th, 2025.

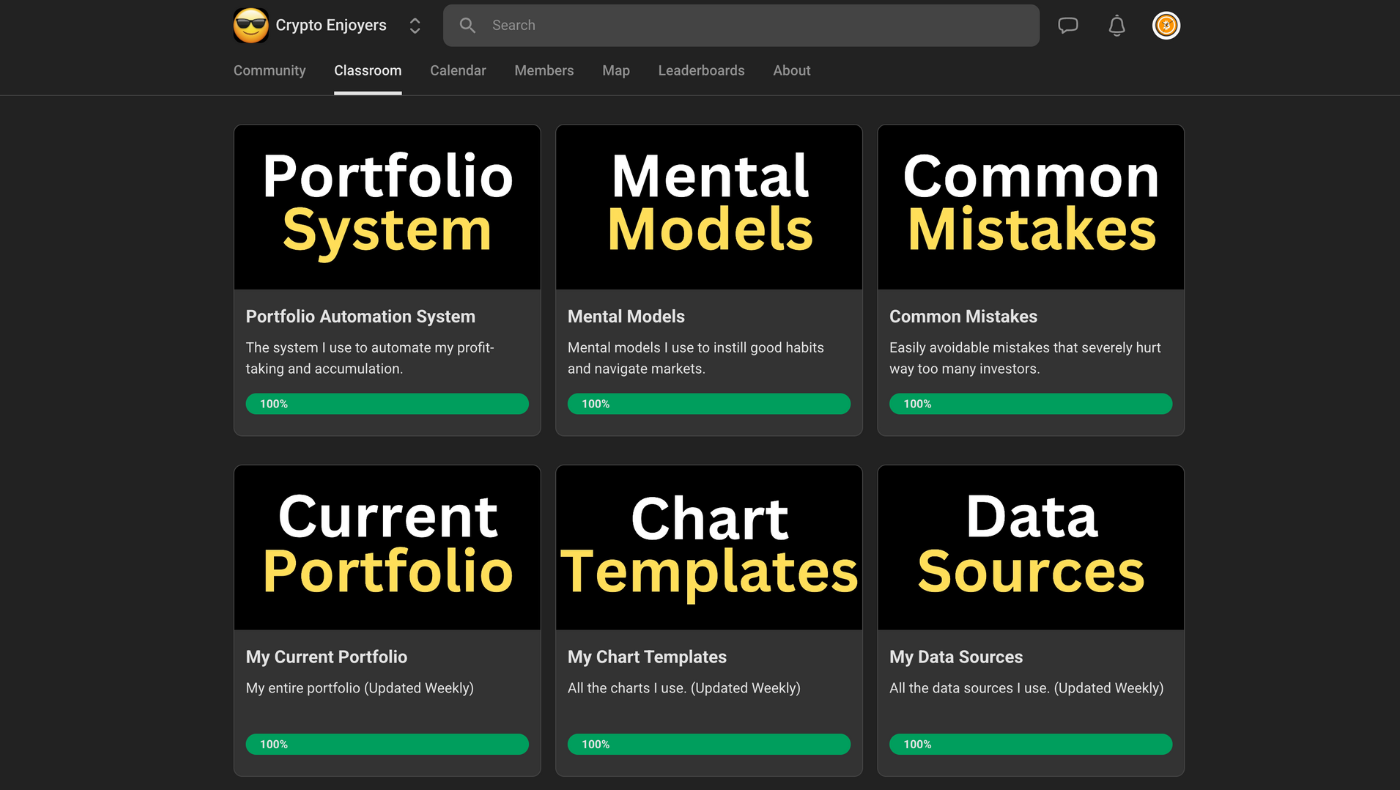

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝