The Weekly Close

After briefly making a new all time high, Bitcoin closed its weekly candle right at the $109k Range High. This week’s price action will be crucial to see whether we see a breakout this week or enter an overdue pullback. Regardless, I still believe Bitcoin has higher to go this cycle and the “double top like 2021” calls will only further increase my conviction that the top isn’t in yet. I have never seen the majority call the top accurately and recency bias is incredibly powerful in this market. Everyone is so traumatized by 2021 that they call a double top at every opportunity. That makes it way more likely that we will have a different looking top this cycle.

The Bitcoin weekly chart.

Sentiment Check

Market sentiment is still in the Greed region. This will likely be the case as long as Bitcoin continues knocking on an all time high breakout. I wouldn’t be surprised if we see a brief dip back to Neutral sometime soon before we make our big move into Extreme Greed. It’s rare for markets to go up in a straight line and that is exactly what this rally has done over the past few weeks. After so many green weeks in a row, it would make sense to see some mean reversion or a brief shakeout of leverage positions. All we can do for now is wait and see what Bitcoin wants to do.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

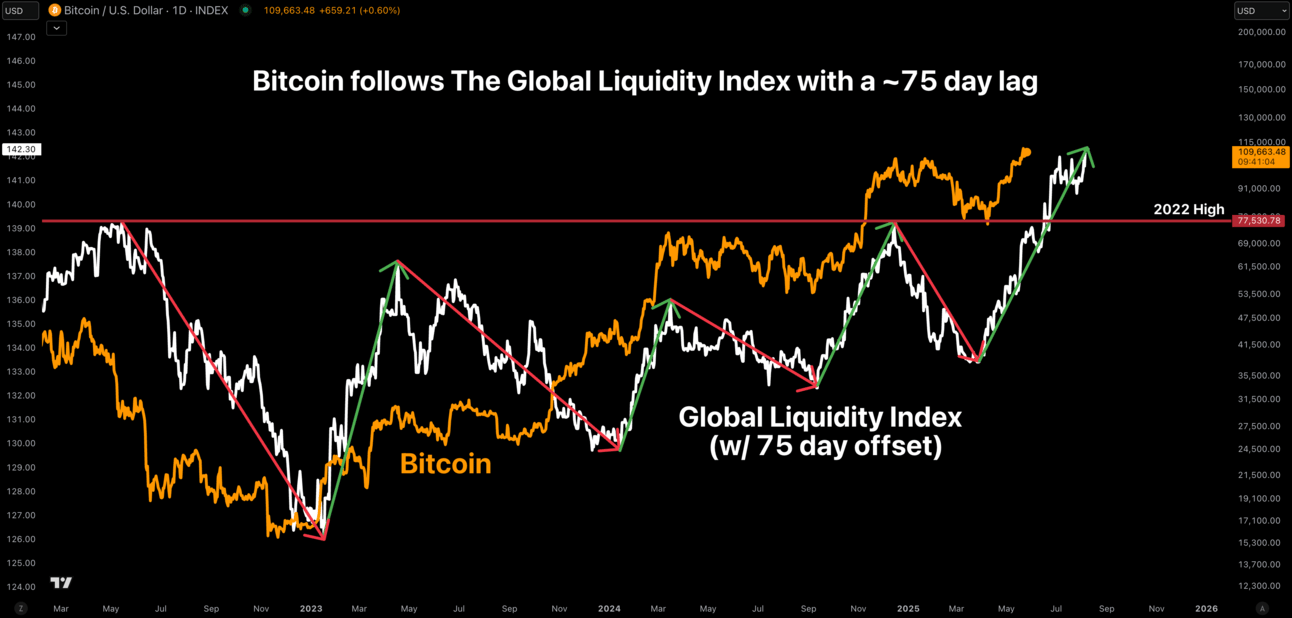

Last week the Global Liquidity Index made new highs. We have waited for weeks to see whether it was entering a new downtrend or just consolidating before new highs and we finally got our answer. This gives me even more conviction that even if we see a brief pullback for Bitcoin, the top isn’t in for this cycle yet. I do expect Bitcoin to diverge from this indicator eventually, especially as more and more investors start to blindly rely on it, but I am happy to continue using it alongside other data points as long as it keeps working. Which it most certainly has so far.

Bitcoin and The Global Liquidity Index.

Macro

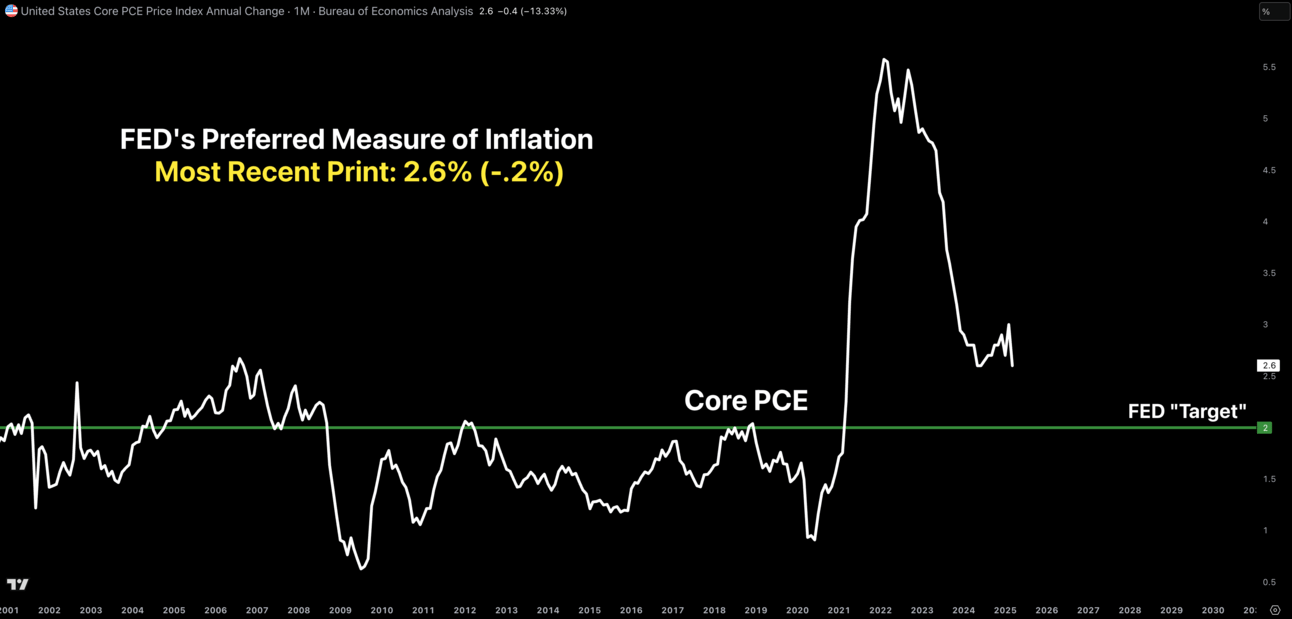

We will be receiving updated data for the FED’s preferred measure of inflation on Friday. We know the market is relying on rate cuts later this year and stubborn inflation could put a wrench in that idea. The expected Core PCE print is 2.6% which would match the previous print. This shouldn’t impact markets too much. However, if it comes in above expectations that would likely spook investors into believing that inflation is heating up again. On the other hand, a lower than expected print would be a bullish catalyst as it would increase the likelihood of more rate cuts.

Core PCE.

The Bigger Picture

Bitcoin has been following the “Early Cycle Scenario” quite closely and it will be interesting to see if that trend continues. I am open to this cycle topping out later in the year, but that would require very favorable monetary policy from the FED and very favorable tariff policy from the Trump administration. Macro concerns are the main reason why I believe this cycle will top early this year, but I am open to changing my mind if the data calls for it. For now, we will continue to take things one month at a time and let the market tell us its next move.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

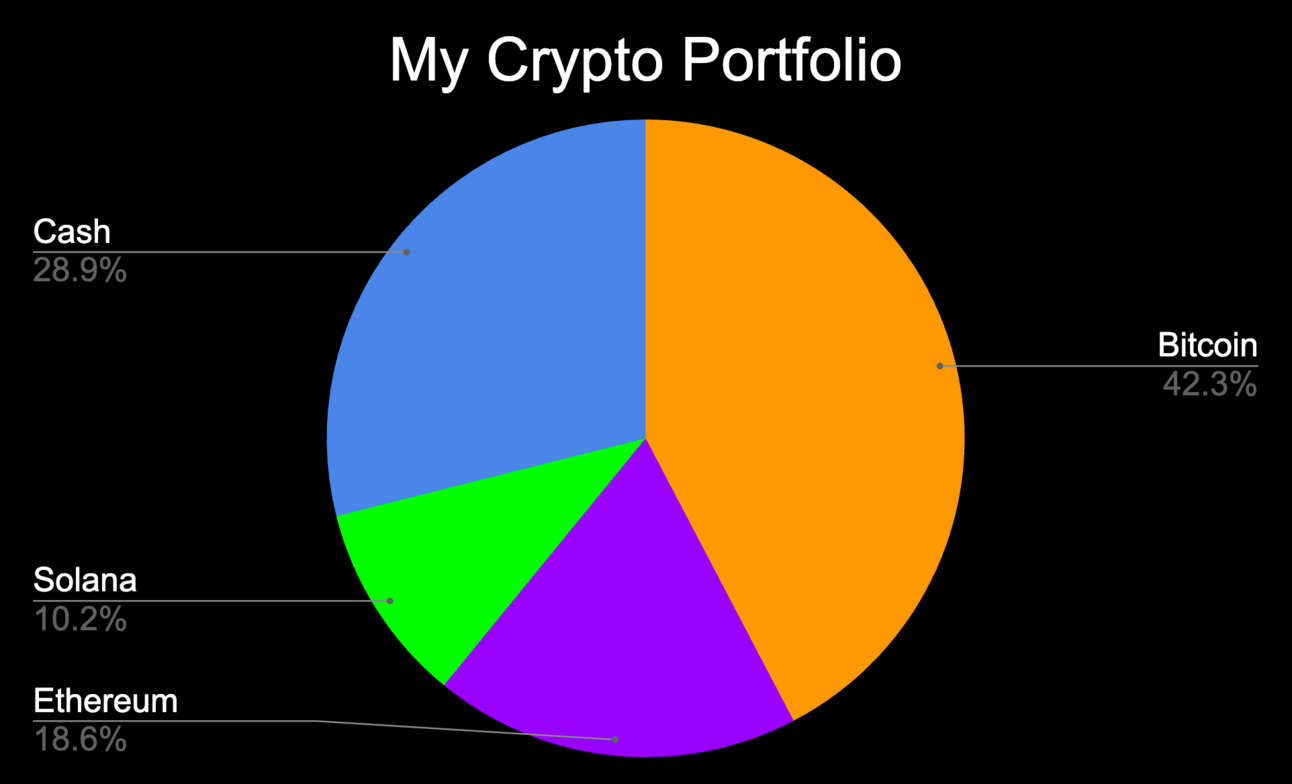

No changes were made to my portfolio this week. I am still quite comfortable with my allocations and the market hasn’t moved enough for my system to call for any more profit-taking. It feels good knowing I will be satisfied no matter the outcome of this year because I have taken enough profits along the way to take advantage of this cycle, but also have enough remaining exposure to take advantage of more upside if it comes. All we have to do now is wait and see what the market decides to do over the next few months.

Portfolio snapshot as of May 26th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, early bird pricing for the Crypto Enjoyers program is available as I build out the Mental Models course. You can learn more here:

I know the market is pretty split right now over whether we still have a lot higher to go or if the market is close to topping. Unfortunately, there is no way to know for sure. All we can do is try to prepare for multiple outcomes while also adapting to the data and price structure as it changes. For now, I still believe we have higher to go even if there is some volatility along the way. As always, I hope you have an amazing week and the future looks bright. 🤝