The Weekly Close

After a relatively quiet week for Bitcoin, it closed its weekly candle just under $120k. Bitcoin almost completely undid the previous week’s selloff and this is usually a good sign of strength. It makes sense for Bitcoin to maintain this momentum and head higher over the next few weeks.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment has barely entered the Greed region. Market participants are now used to these price levels and will likely need prices to go higher to become very Greedy once again. We just need to remain calm and rational as everyone else rides the sentiment rollercoaster.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI is still in a downtrend. I see many people celebrating the tiny bounce we have seen, but for now it is still just lower highs and lower lows. The longer this goes on for, the higher the probability of a deeper correction in September.

Bitcoin and The Global Liquidity Index.

Inflation

We will be receiving an update to CPI and Core CPI tomorrow, Tuesday, August 11th. The market is expecting an increase to 3.1% YoY which is 0.2% above our previous reading. Inflation continues to trend in the wrong direction which will limit the FED’s ability to ease. However, as long as the number doesn’t come in above expectations, markets should be able to look past it since it is already priced in.

Core CPI.

The Bigger Picture

Bitcoin continues to follow our base case of a rally higher in August and then a correction in September. The Global Liquidity Index is providing more confluence to that thesis as well. We need to be open to other outcomes, but for now the base case remains unchanged.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

No changes were made to my portfolio this week. Bitcoin chopped sideways while Ethereum pushed higher so my cash position remains quite close to my 30% target. Having a system and plan at this phase of the cycle is a huge cheat code since the majority of investors just throw their money in without any type of strategy. We’ll continue to position and prepare for multiple outcomes so that we are never blindsided by a scenario we didn’t see coming.

Portfolio snapshot as of August 11th, 2025.

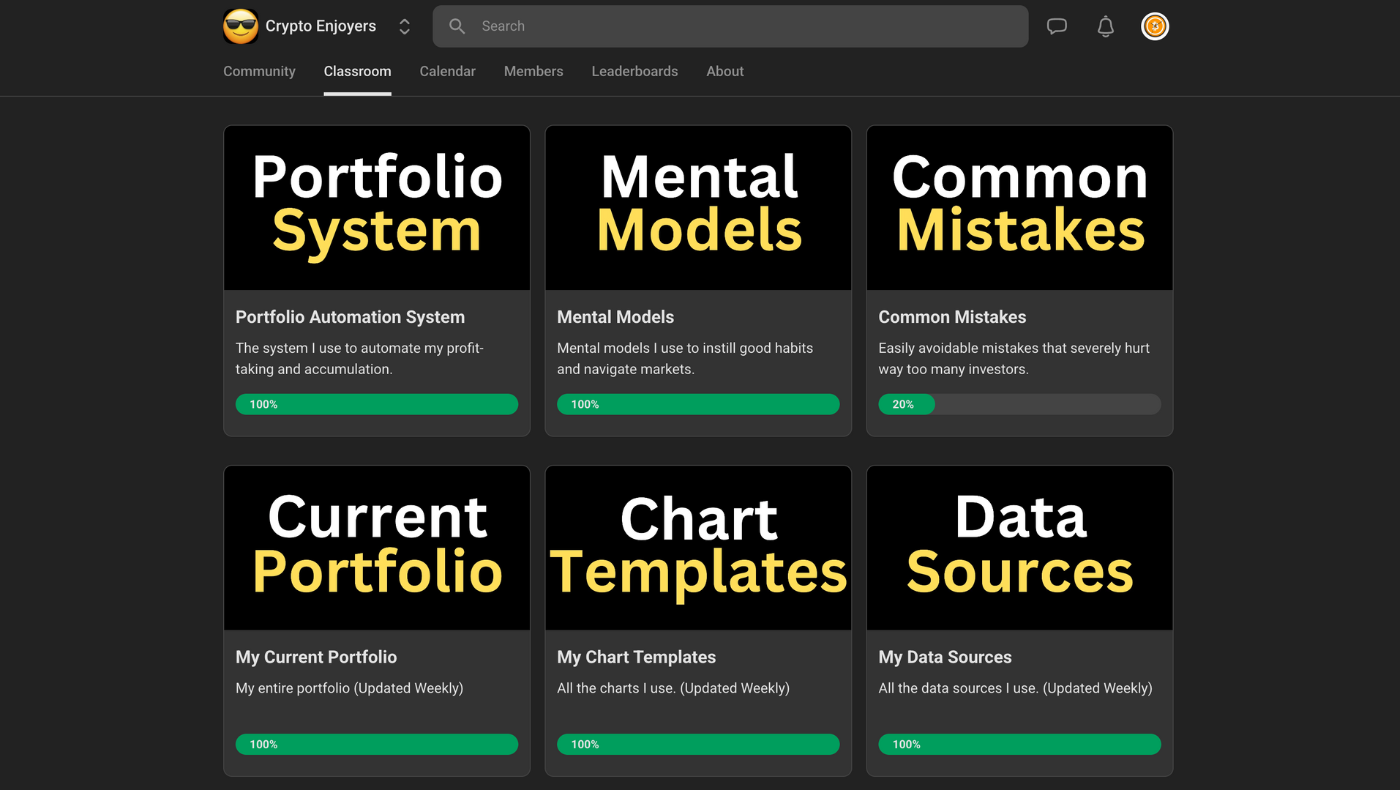

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, check out the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝