The Weekly Close

After a pretty aggressive rejection at $123k, Bitcoin closed its weekly candle just above $117k. A red candle with a wick to the upside is not ideal, but it’s also not surprising that some investors decided to take some profits when Bitcoin crossed $120k for the first time. We’ll have to see if we get follow through to the downside after that rejection or if that was just a brief hiccup before Bitcoin continues its rally higher.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment continues to linger in the Greed region which is what you would expect during these market conditions. I’m not seeing any crazy signs of froth quite yet, but it is clear that sentiment is beginning to heat up quite quickly. Especially with the recent moves in some altcoins. Another week or 2 of this price action and sentiment will likely enter the Extreme Greed region.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI saw a bounce within its downtrend last week and it’s difficult to tell if this is just a bounce before heading lower or a reversal. We should get more clarity this week on what the trend over the next few weeks will be. For now, I am not seeing anything too concerning for the GLI quite yet.

Bitcoin and The Global Liquidity Index.

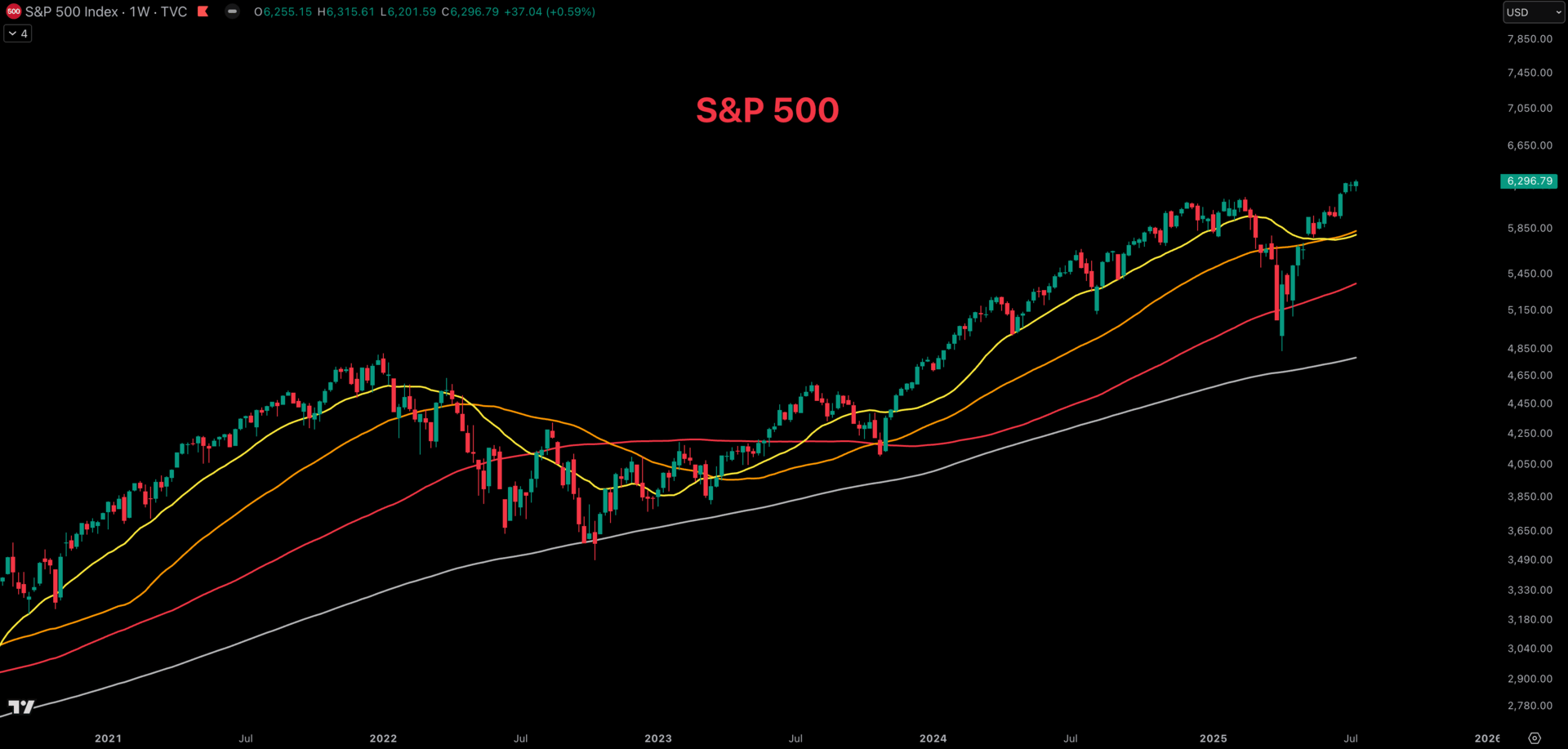

The S&P 500

The S&P 500 has continued to make new all time highs week after week. This is incredibly important for Bitcoin to continue its climb because investors have much higher risk appetite for Bitcoin and crypto when their traditional investments are doing well. We will continue to monitor the S&P 500’s price action, but as long as it remains strong, Bitcoin should still have more room to run.

The S&P 500 weekly chart.

The Bigger Picture

Bitcoin is getting so close to our Very Expensive region. All it would take is one good week of price action. For now Bitcoin is still at the upper end of our Expensive region and quite far from Fair value. So I am not interested in buying any at these prices, but happy to take small profits for now.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

I took a decent amount of profit on just Ethereum this morning. It was incredibly difficult to do as it has been skyrocketing recently, but I reminded myself that my most difficult sales in the past were the best ones. The same way some of my most difficult purchases were the best ones. I still have a decently sized Ethereum position so I would love nothing more than to see it keep rallying higher, but incase we do see a correction or top sometime soon, I’ll be happy I locked-in some profits and stuck to my plan.

Portfolio snapshot as of July 21st, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝