The Weekly Close

After another volatile week, Bitcoin closed it’s weekly candle just above $82k. As long as Bitcoin continues trading below $90k, the expectation should be that we will see more chop and consolidation. Anything above $70k and below $90k is just short-term noise meant to wreck leverage traders and emotional investors. April tends to be a good month for Bitcoin and other risk assets in general, so I will be watching this week’s price action closely to see if we can finally get some clarity on Bitcoin’s next trend.

The Bitcoin weekly chart.

Temperature Check

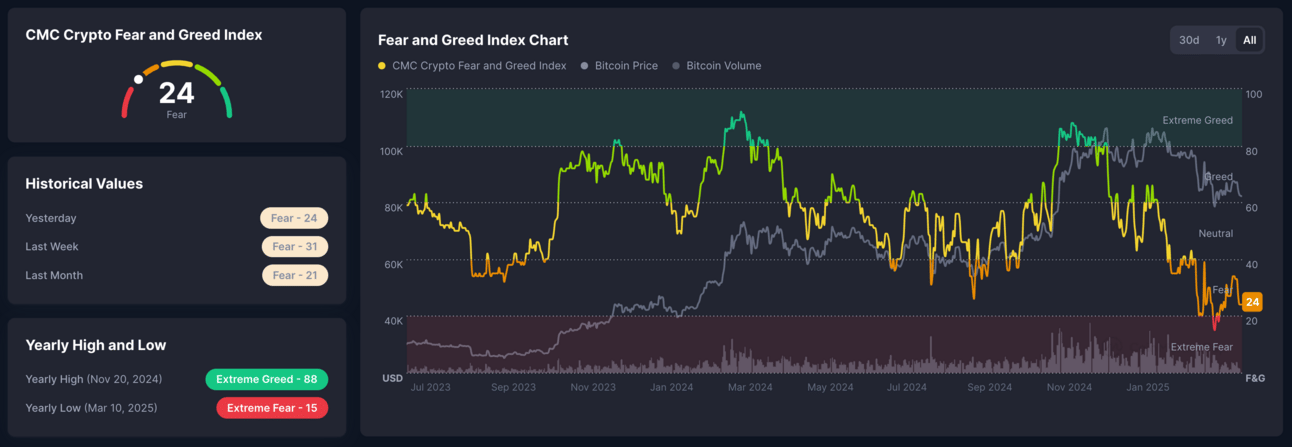

I don’t even need to look at the Fear and Greed Index to tell you that market sentiment is in the gutter right now. Although the index is technically above the “Extreme Fear” readings we saw 2 weeks ago, investors are becoming more and more frustrated with the price action as Bitcoin continues chopping around. This happens during every extended consolidation period because patience and discipline are very rare skills in this market. I tend to be nervous when the market is greedy and optimistic when the market is fearful because I have watched sentiment cycle back and forth between the two so many times.

The CoinMarketCap Crypto Fear and Greed Index.

Global Liquidity

Global Liquidity continues to point to higher Bitcoin prices. The exact timing of the lag is quite difficult to forecast, but my main focus is Bitcoin’s trend over the next few months. On a medium-term timeframe, Global Liquidity is painting a very clear picture. I will continue to use this metric until it stops working. Selling in December during the Global Liquidity downtrend was very difficult because everyone was convinced the market was going higher. Just like buying during a Global Liquidity uptrend has been difficult because everyone is convinced the market has to go lower. According to this chart, we should see Bitcoin start it’s next rally in early April.

Bitcoin and The Global Liquidity Index.

Macro

S&P 500 weakness continues to be a drag on Bitcoin. With Bitcoin being further out on the risk curve, it makes sense that investors are de-risking and selling their Bitcoin as the S&P 500 sells off. Especially now that US spots ETFs are a large portion of Bitcoin’s price discovery and are held on the same brokerages as traditional assets. It’s incredibly difficult to predict what the S&P 500 will do in the short-term with all of this tariff uncertainty, but I remain bullish on the S&P 500 when zooming out and focusing on larger timeframes. Especially after the recent uptrend in Global Liquidity.

Bitcoin and The S&P 500.

Bigger Picture

Being prepared for multiple outcomes is a requirement to survive in this market. It makes sense to have a base case that you think is most likely, but it’s important to acknowledge the other possibilities so that you are not blindsided by a result that you didn’t think was possible. As long as Bitcoin continues to hold above macro support, I remain optimistic that Bitcoin has higher to go this cycle. Once that thesis gets invalidated with a loss of the 50-week moving average and March swing high at $74k, I will adjust my plan and position for alternative outcomes. All we can do for now is wait and see what the market decides.

Bitcoin cycle scenarios and their probabilities.

What I’m doing with my portfolio

No changes were made to my portfolio this week. I remain well positioned for all possible outcomes so there’s no need to make changes for the sake of making them. In markets, the best move most of the time is to sit on your positions and do nothing. It only makes sense to make changes when your plan or system calls for it based on a major change in the data or market structure. So I will make changes once Bitcoin breaks out of its current consolidation range between $70k and $90k.

Portfolio snapshot as of March 31st, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. If you’d like to learn more about my portfolio management system and approach to markets, early bird pricing is still available on the Crypto and Macro Enjoyers program I am building. You can learn more about it here:

These difficult time periods are what differentiate the investors that succeed from the ones that don’t. Any mistakes you have made are just learning opportunities to become a better investor going forward. Investing is a life-long journey so there will always be new opportunities to take advantage of. I remain optimistic that the best is still ahead. 🤝