The Weekly Close

After a relatively quiet week, Bitcoin closed its weekly candle just above $106k. This is a pretty significant close for many reasons. For one, this is the highest Bitcoin weekly close ever and should lead to continuation, even if we do get some consolidation first. We have also now seen a weekly open and close above our Range Mid and psychological resistance level at $100k which makes this move a confirmed reclaim of that level. That leaves just one level left for Bitcoin to enter price discovery and that is the Range High at $109k.

The Bitcoin weekly chart.

Sentiment Check

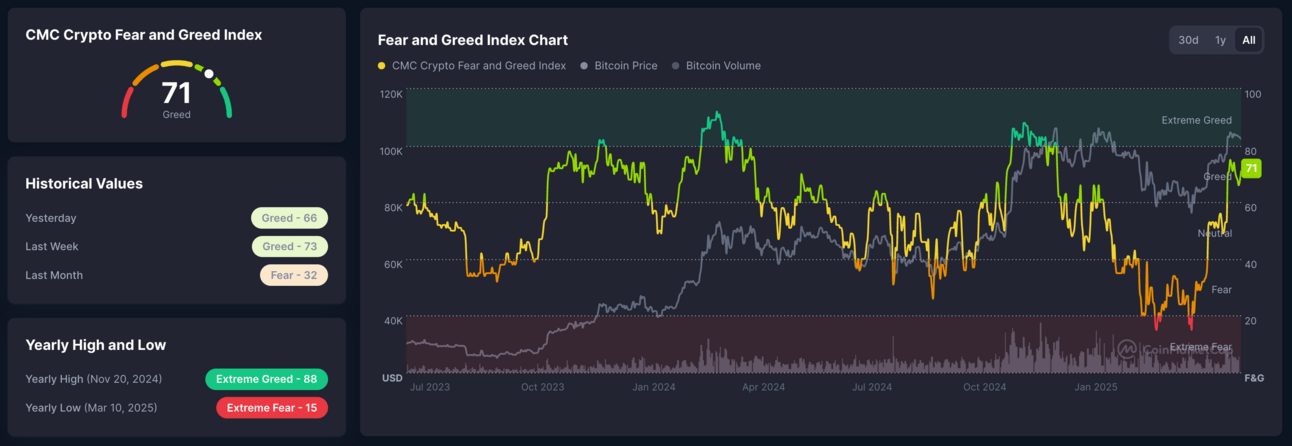

Market sentiment is still comfortably in the Greed region. This is where the best price action tends to happen because we are seeing many participants start to fomo back into the market now that all the narratives have flipped bullish. I will not get too cautious until we re-enter the Extreme Greed region which likely won’t happen until Bitcoin finishes climbing the wall of worry and makes new highs. For now, all we have to do is remain calm and control our FOMO as everyone starts to become overly excited.

The CoinMarketCap Crypto Fear and Greed Index.

Global Liquidity Index

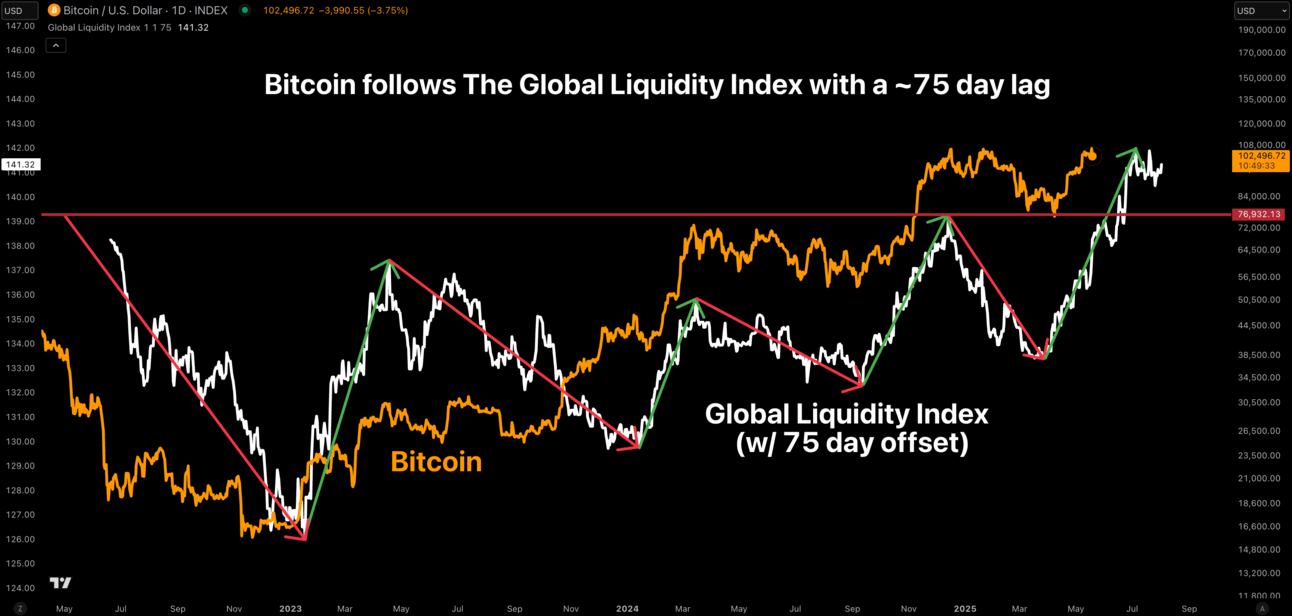

The Global Liquidity Index continued to chop sideways and slightly down last week. It still isn’t clear if this is a new downtrend or just some chop before it continues its run higher. The good news is that Bitcoin should still have at least a month of runway higher thanks to the lagged effects of Global Liquidity. So we have plenty of time to see if this is in fact the beginning of a Global Liquidity Index downtrend or if it will maintain the uptrend we have been in for months now.

Bitcoin and The Global Liquidity Index.

Macro

The price action of the S&P 500 has been truly astounding over the past few weeks. This has truly been a max pain rally for anyone that sold near the lows during all the doom and gloom with the tariff drama. We are overdue for a correction and perhaps filling some of the gaps we left behind are the ideal levels for that correction to reach. That would likely align with a correction for Bitcoin as well. The tough part is predicting the timing of when that will happen, so I try to focus on the bigger picture which remains quite bullish.

The S&P 500 Index.

Bigger Picture

We are very close to being able to retire this “How Low Will We Go?” Bitcoin chart. My worst case scenario for a pullback here would be a retest and higher low in the low $90ks, but I am not convinced we have to go there. For now all we can do is remain patient and wait for the market to give us more clarity on what will happen next. Considering multiple possibilities has been incredibly valuable for us this cycle and I don’t plan on changing that approach anytime soon.

Bitcoin support levels and their likelihood of being revisited.

What I’m doing with my portfolio

No changes were made to my portfolio this week. The market has remained relatively flat and it does feel good knowing I locked-in some Solana and Ethereum profits last week incase Bitcoin enters a deeper pullback that drags altcoins lower. At this stage of the cycle, I am quite comfortable having a 30% cash position because we are already so far removed from the bear market lows. Although I have already taken some profits, I would love nothing more than to see the market keep rallying higher over the next few months.

Portfolio snapshot as of May 19th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, early bird pricing for the Crypto and Macro Enjoyers program is available as I build out the second course. You can learn more here:

I know there is a ton of anxiety out there over what will happen in the short-term and whether Bitcoin will breakout this week or experience a sharp pullback to wash out leverage traders, but I’d encourage you to zoom out and focus on the bigger picture as well as where we are in the cycle. I have found that it is so much easier to remain calm and make good decisions when I do that. As always, I hope you have an amazing week and the future looks bright. 🤝