The Weekly Close

After a relatively quiet week, Bitcoin closed its weekly candle just above $111k. For now, it has managed to bounce off of our previous Range High and 20-week moving average. This is why it is so important to treat support as support until the market tells us otherwise. Instead of jumping to conclusions too soon. All we need now is some continuation to the upside this week.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment has been in and around the Neutral region for quite a while now. It is clear that investors are slowly but surely giving up hope and capitulating during this boring chop and consolidation period. This is exactly what you’d expect to see during bull market corrections. Until our support levels get broken, I am optimistic we have higher to go.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI has been slowly grinding its way higher recently. The market has been pricing in more rate cuts thanks to last week’s labor market data which weakens the dollar and increases The GLI. I expect a large move for the GLI over the next 2 weeks once we receive updated inflation data this week and more clarity from the FED in next week’s FOMC meeting.

Bitcoin and The Global Liquidity Index.

Inflation

We will be receiving an update to CPI and Core CPI on Thursday, September 11th. Now that the market has acknowledged the weakening labor market, all eyes will turn to inflation to try and gauge what the FED will do going forward. I expect quite a bit of volatility going into this print. The market expects a Core CPI print of 3.1% YoY which would match the previous month. A higher than expected reading would result in some panic while a lower than expected reading could result in some investor optimism.

Core CPI.

The Bigger Picture

Bitcoin is still comfortably within our “Expensive” region. It isn’t “Cheap” by any means, but it isn’t incredibly overheated either. This makes it easy for me to remain calm through current price action because if we were entering a bear market from these levels, it would likely be a shallow one. I’m happy to accumulate at lower prices if we get them, but I am also happy to take more profits if we see new highs.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

No changes were made to my portfolio this week. The market has been flat for a while now so there hasn’t really been any need to take action. It’s nice to see Solana moving its way up here after Ethereum stole the show for a while. This is why it is so important to be patient with our assets as opposed to chasing the pump of the day. I still believe this market has higher to go and feel well positioned for that outcome.

Portfolio snapshot as of September 8th, 2025.

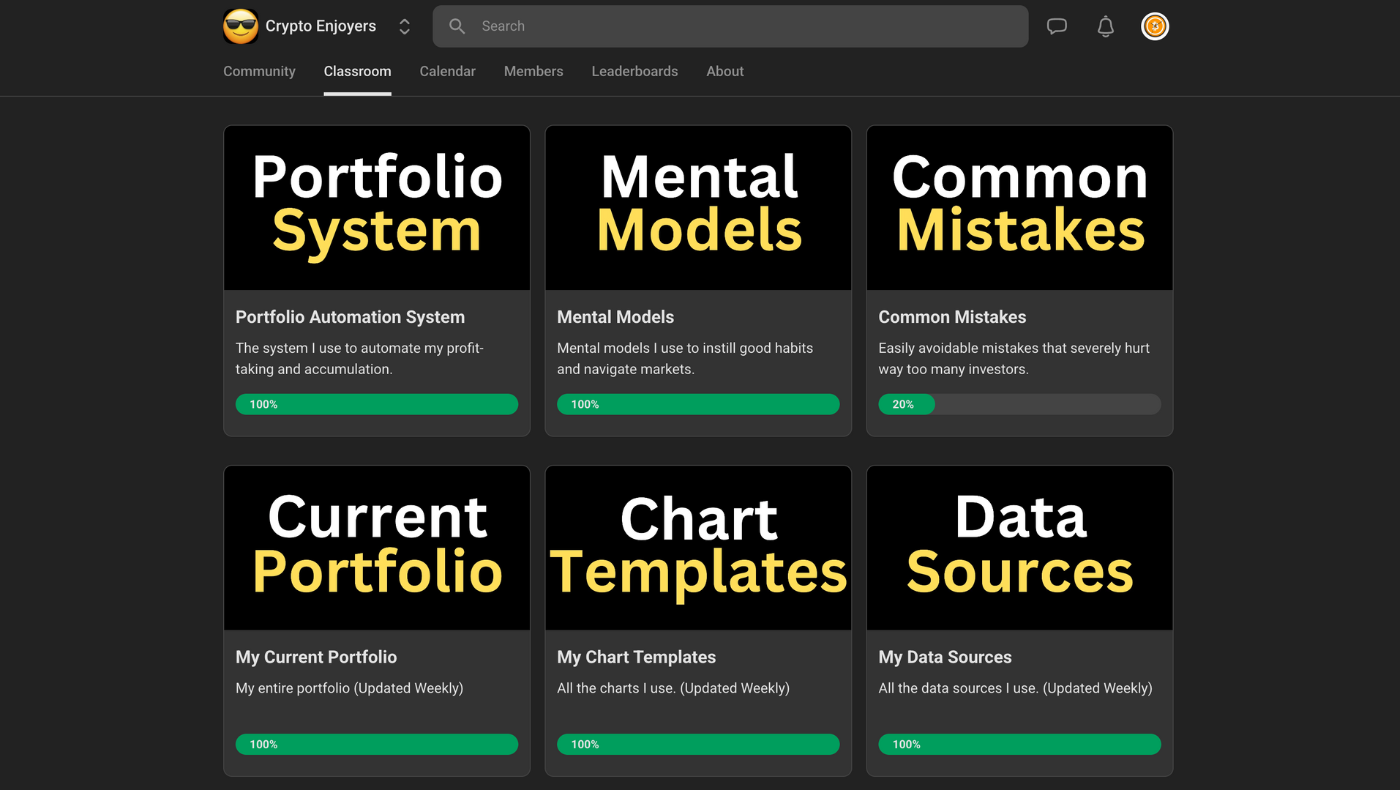

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝