The Weekly Close

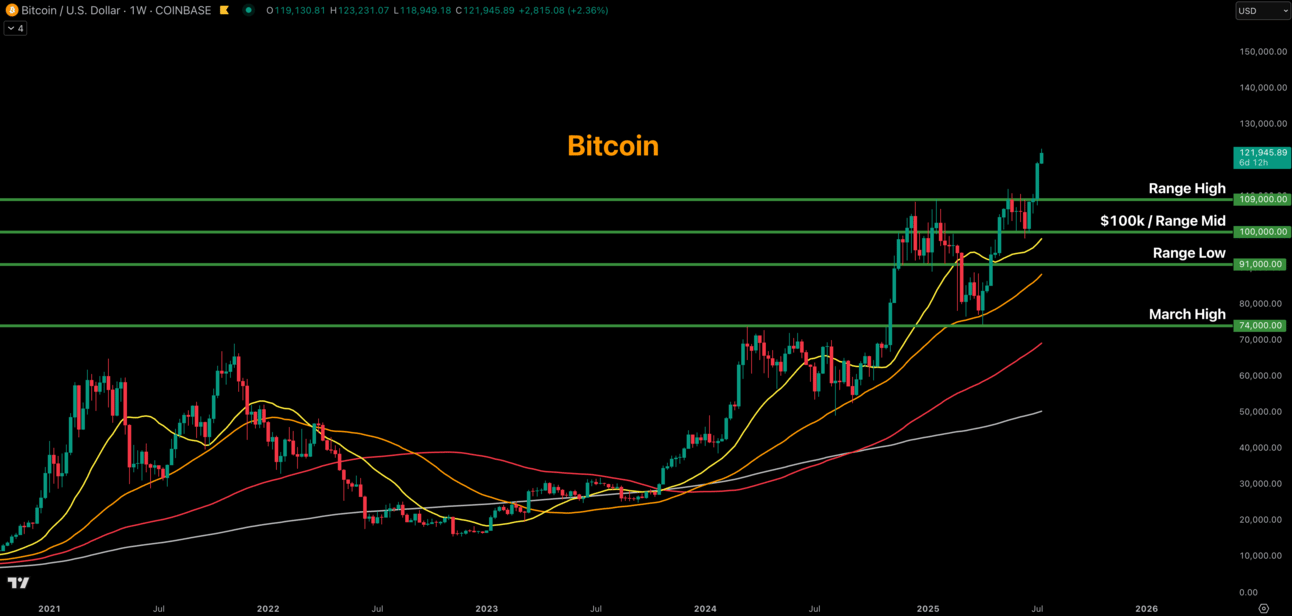

After finally breaking out above our $109k Range High, Bitcoin closed its weekly candle just above $119k. Feels great seeing a clean breakout above a resistance level that we have been below for almost 8 months now. Now that Bitcoin has entered price discovery, there aren’t really any good support or resistance levels to strategize based off of. All we can do is sit back and let price action develop.

The Bitcoin Weekly Chart.

Market Sentiment

As expected with any all time high breakout, market sentiment is back in Greed. This is completely normal and isn’t a cause for concern as of right now. Every major local top this cycle has coincided with Extreme Greed and I don’t see why this one would be any different. This is the time to remain calm and not let Greed force us into making any rash decisions or changes.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

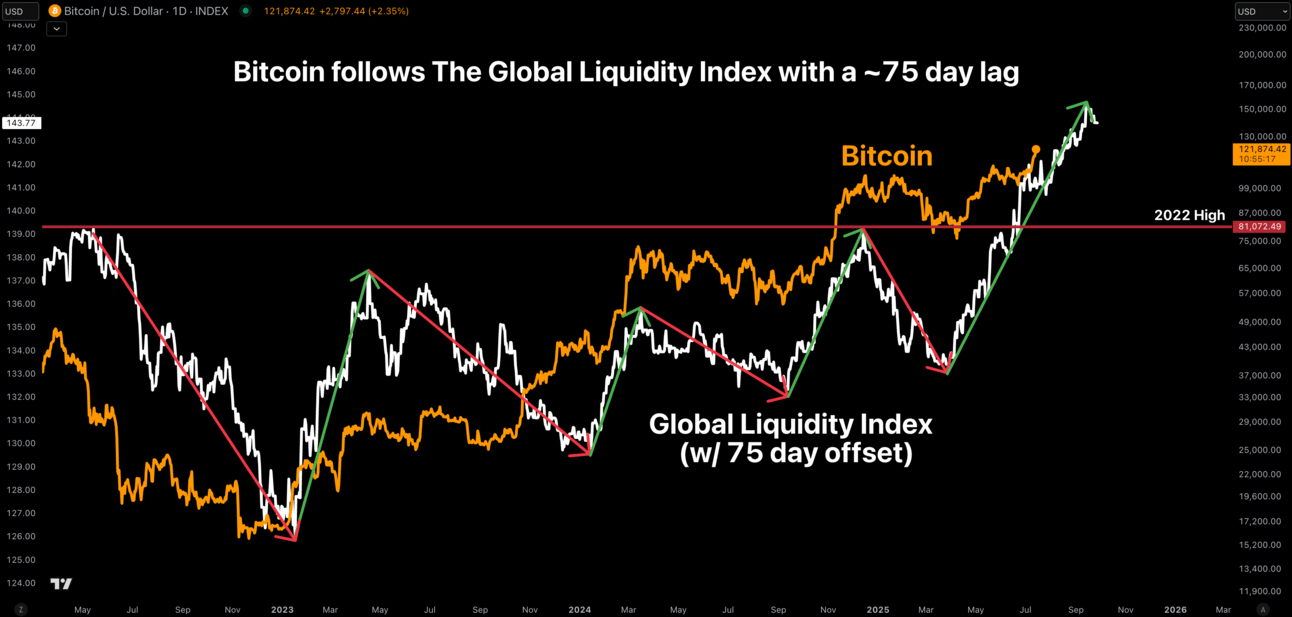

The GLI has been going down for about 2 weeks now, but it is still too early to know if this is a quick pullback or the start of a new downtrend. If this is the start of a new downtrend, it would point to a Bitcoin top by around mid-September. If it isn’t, we may be in for a wild ride for the remainder of the year. I will keep an eye on this metric to see what it decides to do before becoming too concerned or jumping to any conclusions.

Bitcoin and The Global Liquidity Index.

Macro

Tomorrow, July 15th, we will be receiving updated inflation data. The market is expecting a Core CPI reading of 3% which would be a 0.2% increase over the previous YoY reading. As long as the print comes in-line with market expectations, it shouldn’t be an issue. The market has already priced in this print by pushing rate cut expectations to September of this year. We don’t want to see an upside surprise as that will likely strengthen the dollar and put more downward pressure on Global Liquidity.

Core CPI.

The Bigger Picture

It’s incredible how well Bitcoin has been following our Early Cycle scenario outline over the past few weeks. I’m sure it will diverge eventually as it is just a rough outline, but it is much easier to plan when things go as expected. I am still open to other possible outcomes like a rally into Q4 or even an extended cycle into 2026, but those outcomes aren’t my base case as of right now. Things will become clearer once we get more price action at these prices and build some market structure.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

I took some profits across all 3 of my holdings this week. It feels great finally being able to take profits once again after watching the market trade sideways for so long. I am still quite happy with a 30% cash allocation at this stage of the cycle and feel quite comfortable with the 70% spot exposure because I am still expecting higher prices. If we see another big move this week, I will happily lock-in more profits once again. If we see a correction, I will be happy knowing I locked-in some profits at higher prices beforehand. It’s a win-win scenario in my book.

Portfolio snapshot as of July 14th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, early bird pricing with lifetime access for the Crypto Enjoyers program is still available for 72 hours now that the Mental Models course is complete. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝