Weekly Close

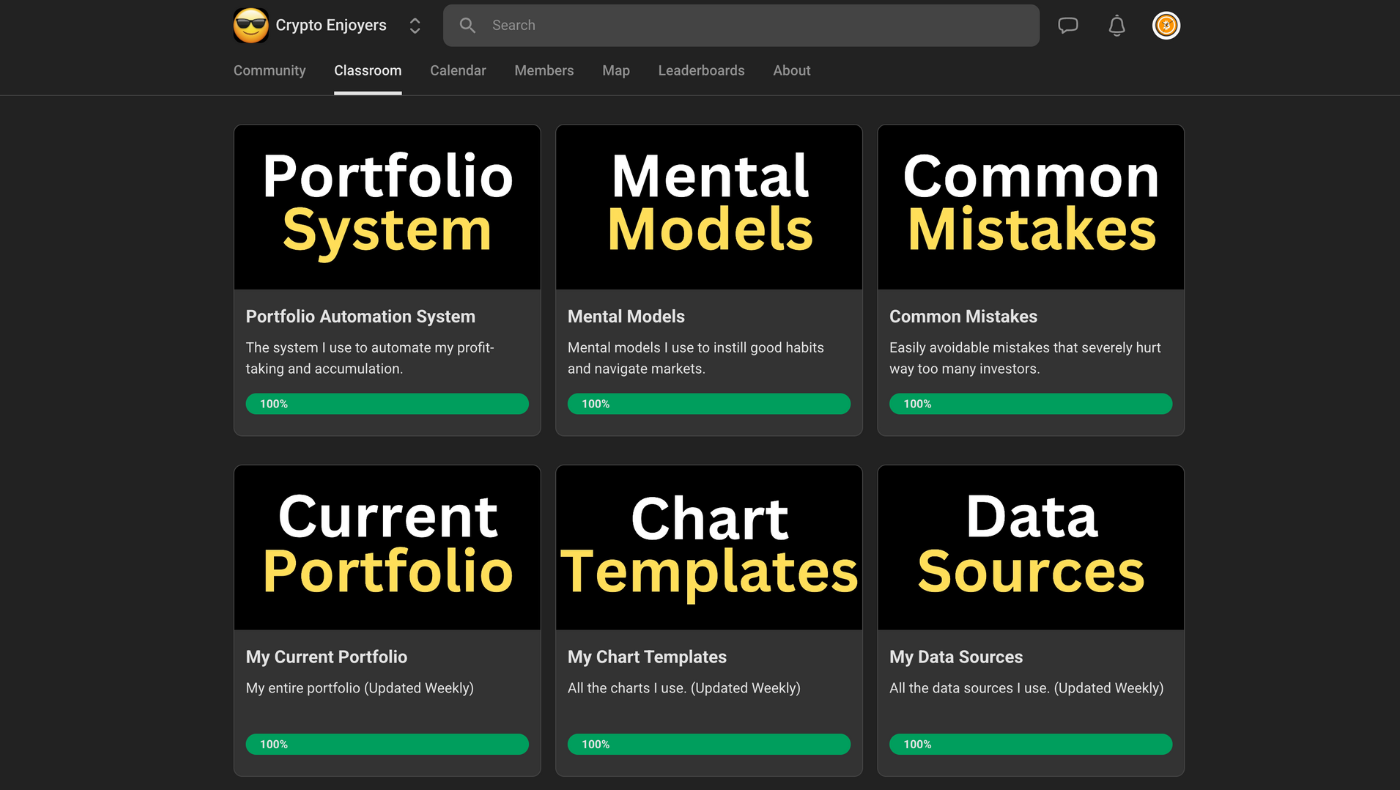

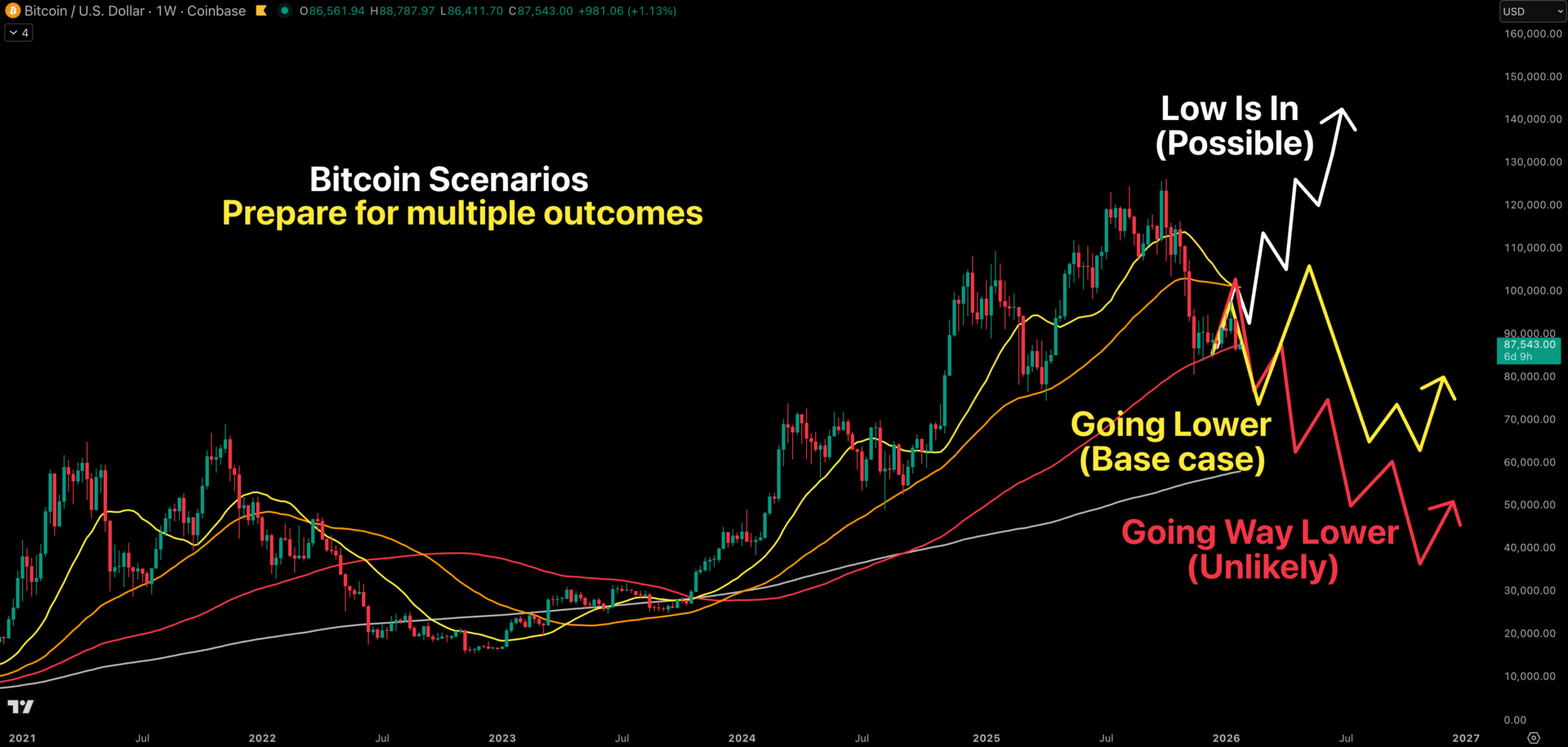

After selling off throughout the week, Bitcoin closed its weekly candle back below the $91k Range Low at ~$86.5k. After the False Breakout we had the prior week, pressure remains to the downside. The next important level is the $81k Local Low that was set back in November before this consolidation period began. My base case remains that Bitcoin is heading lower in the near future.

The Bitcoin Weekly Chart.

Market Sentiment

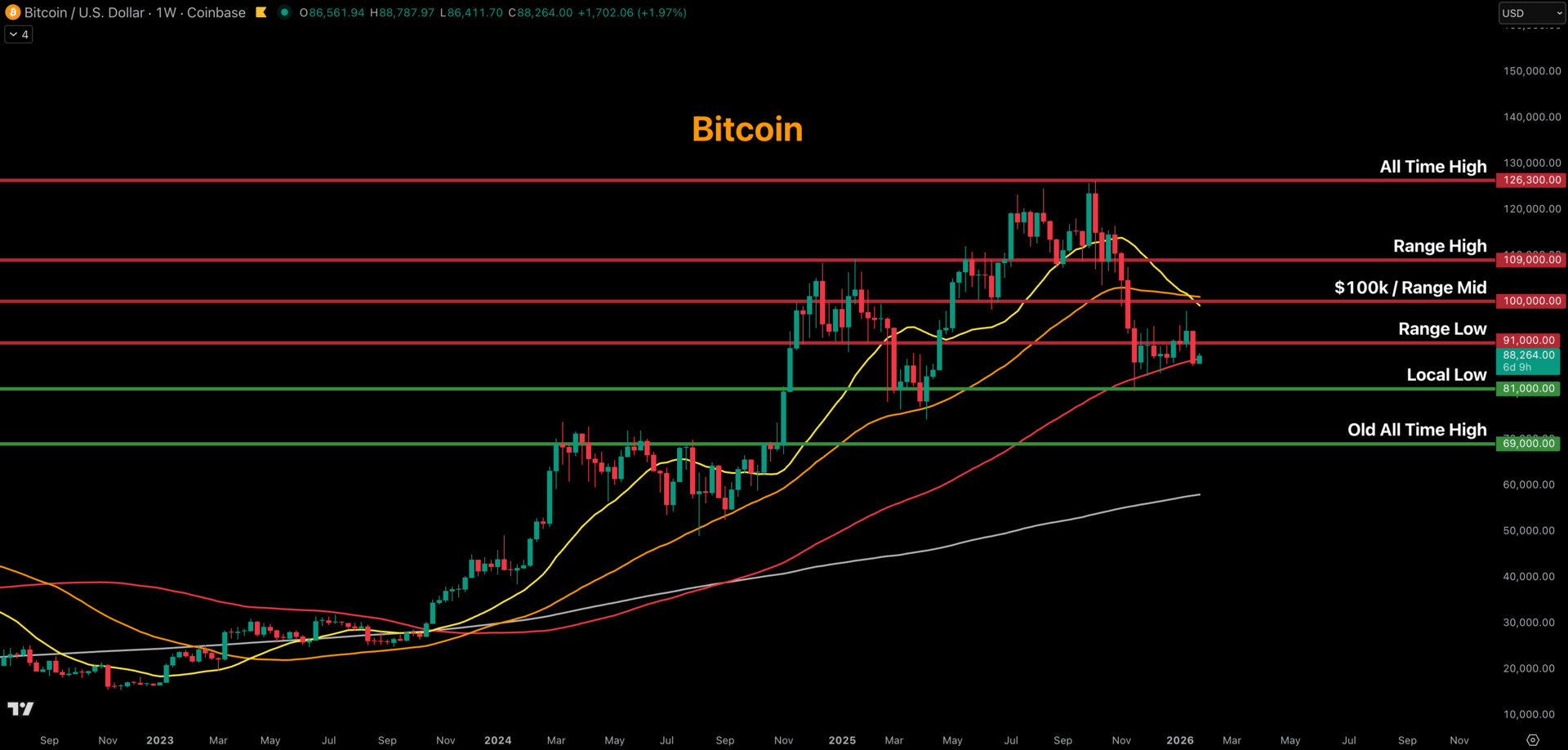

Market sentiment has returned to Fear. We got the relief rally back to Neutral that we had been expecting ever since sentiment entered Extreme Fear and now investors are getting fearful again as price sells off. This is classic bear market behavior for Bitcoin. It’s likely that we are headed back to Extreme Fear as Bitcoin heads to lower prices.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

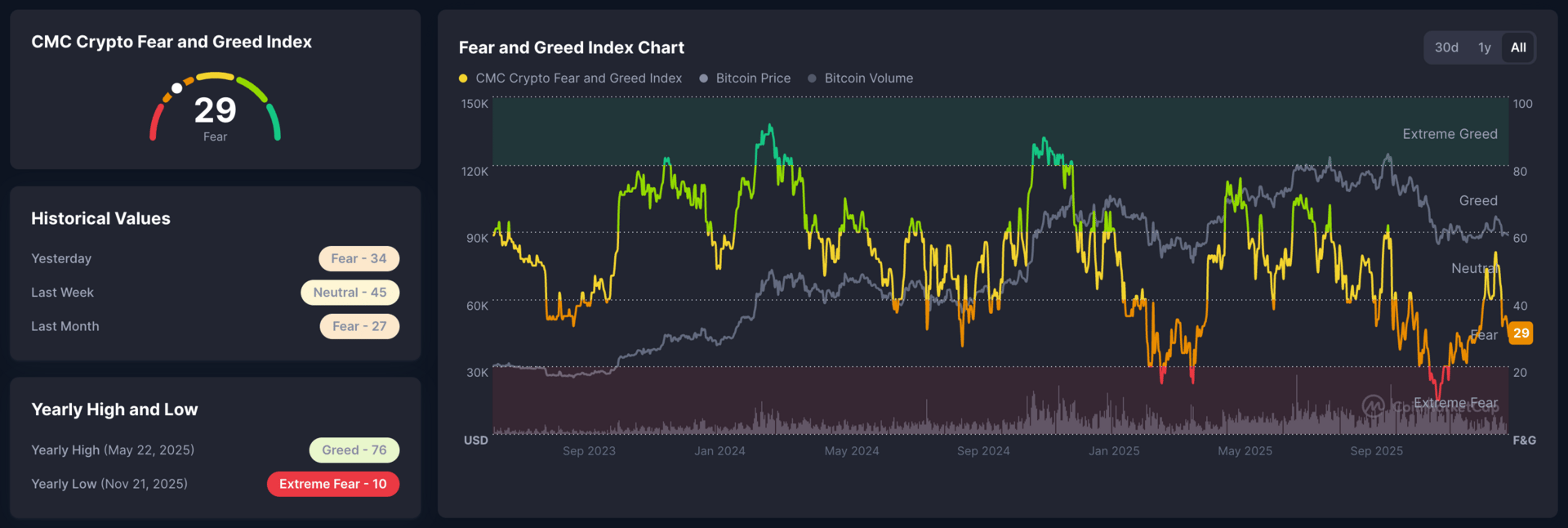

The GLI continues to rise pretty rapidly. This usually acts a strong tailwind for Bitcoin, but Bitcoin continues to look weak. Perhaps it’s because capital is piling into metals and stocks while ignoring Bitcoin for now. I plan to remain cautious until Bitcoin actually shows some signs of strength. It’s dangerous to assume that we have to go up after the GLI immediately just because that approach has worked in the past. Until Bitcoin proves to us that it is bullish, I’ll remain patient.

Bitcoin and The Global Liquidity Index.

FOMC Meeting

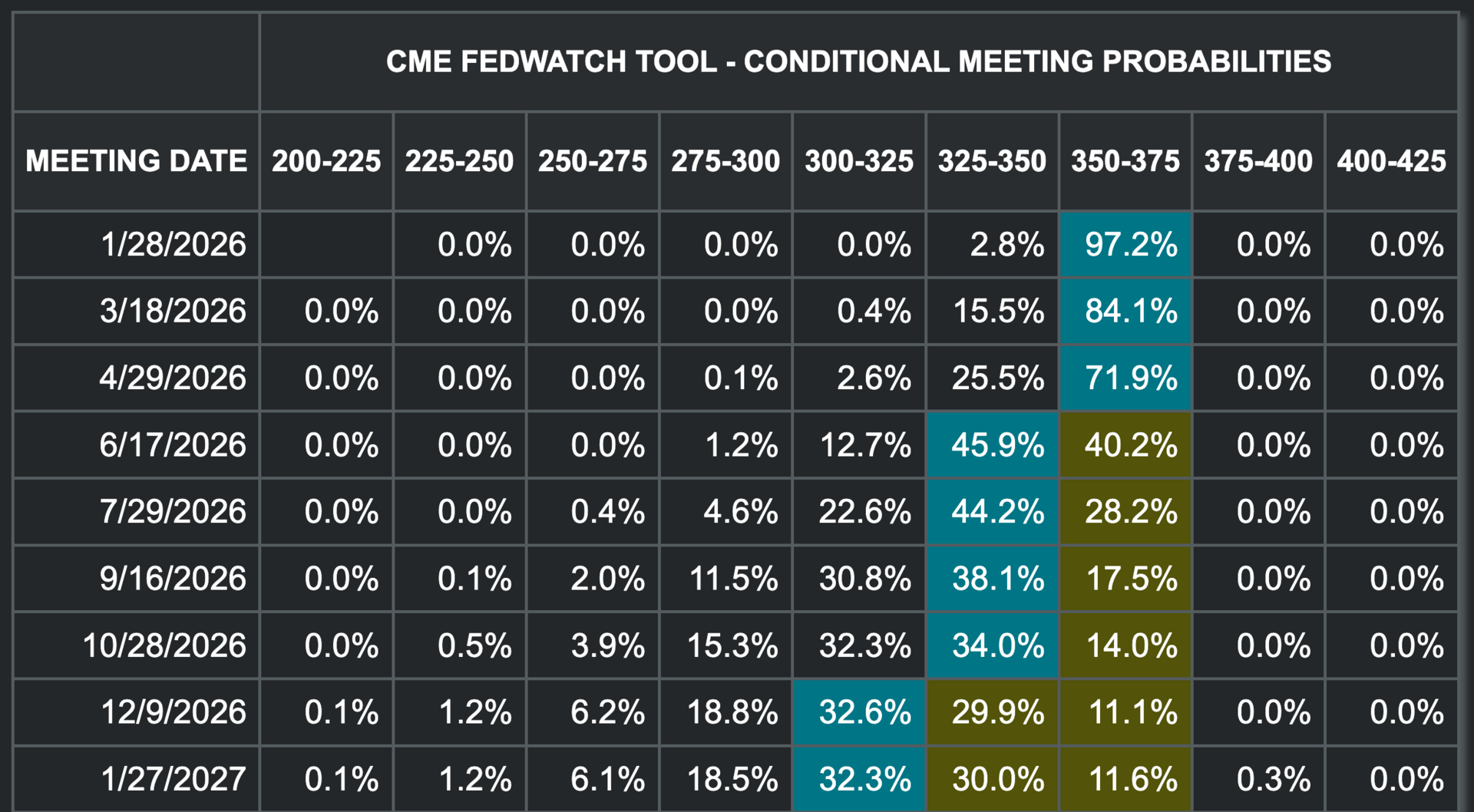

We have an FOMC meeting coming up on Wednesday, January 28th. As of right now the market is only pricing in 2 rate cuts over the next 12 months. It will be interesting to see if that number increases or decreases after hearing Powell’s speech. I expect market participants to watch this upcoming FOMC meeting very closely after what happened recently with Powell’s investigation.

FED Rate Cut Expectations.

The Bigger Picture

My base case that Bitcoin is going lower remains unchanged. Price action continues to look quite weak and it is likely that we need to visit some lower prices for buyers to feel more tempted to step in. There’s always a possibility that the low is in, but the likelihood of that continues to decrease given the recent price action. I still expect a shallow bear market that will catch most investors off guard, but we’ll discuss that more when the time comes. For now, I’ll just patiently sit on my hands and wait for more appealing prices to buy.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

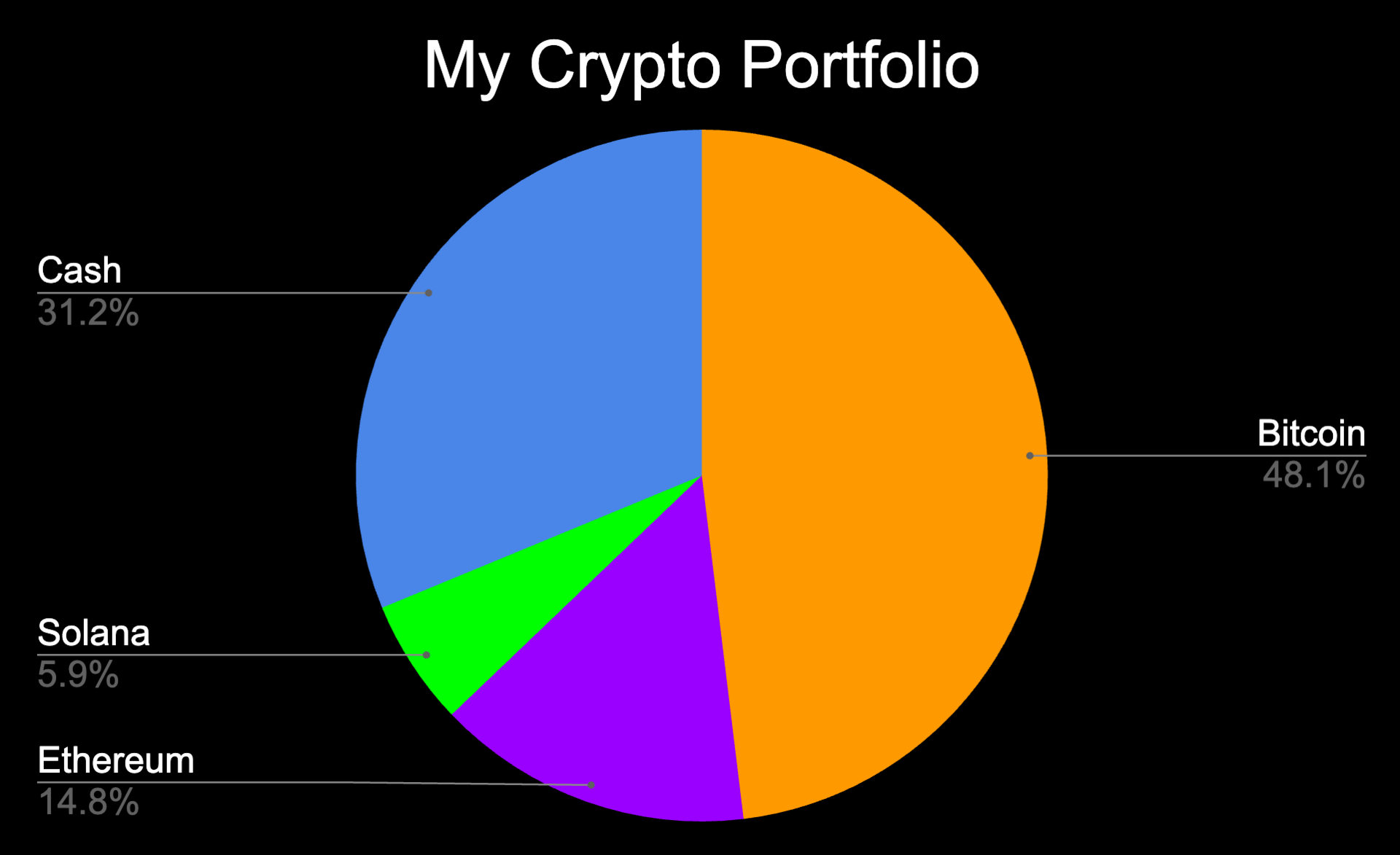

I rotated some more Ethereum and Solana into Bitcoin this morning. I will keep doing so until I get to my desired allocations. My portfolio has been altcoin heavy longer than it should have been and I am using this relief rally as an opportunity to rebalance. Having a decent sized cash position and Bitcoin heavy portfolio makes me feel well positioned for additional downside while also giving me enough upside exposure incase the low is already in. You can never go wrong being prepared for multiple outcomes as an investor.

Portfolio snapshot as of January 26th, 2026.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to view my entire portfolio or would like to learn more about my Portfolio Automation System, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝