Weekly Close

After another week of chop within our trading range, Bitcoin closed its weekly candle just under $88k. We are still waiting to see which way Bitcoin decides to breakout of this range. Based on all the rejections and false breakout above the $91k range high, the base case is that we will retest the range low at $81k. For now, there isn’t much to do, but to patiently wait for the market’s next move.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment remains in Fear. The market hasn’t seen much relief since the most recent selloff, so investors are still nervous that prices will be headed lower. I expect a relief rally in early 2026 that will take the Fear and Greed Index to atleast Neutral. Until then, we need to rely on our systems and not our emotions to make good decisions while everyone else rides an emotional rollercoaster in this trading range.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to slowly grind higher. It’s too early to call this a new uptrend like the 4 other uptrends we have seen this cycle, but it is a step in the right direction. As of right now, The GLI is pointing to a Bitcoin relief rally starting in Early February. The timing won’t be exact, but I do still believe The GLI is a useful tool that we can use alongside other data points. That thesis is further solidified by the fact that Bitcoin has really struggled ever since the GLI stopped trending higher and started chopping sideways.

Bitcoin and The Global Liquidity Index.

The US Dollar Index

The US Dollar is one of the main drivers of The GLI. A weak dollar increases The GLI and a strong dollar decreases it. As of right now, the US Dollars looks quite weak with that recent close below its 20W MA. A breakdown in the dollar would be a strong tailwind for The GLI and risk assets as a result. We’ll keep a close eye on how the FED’s monetary policy impacts The US Dollar as we enter 2026.

The US Dollar Index.

The Bigger Picture

My base case is still that Bitcoin has entered a bear market. The exact path Bitcoin will take on the way down or how long it will take is impossible to know, but having a base case greatly helps when navigating downturns and juggling multiple possible outcomes at once. Risk management and capital preservation are the priority until we see some real signs of strength. Most investors underestimate how long these periods can drag on for and usually end up capitulating at much lower prices.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

No changes were made to my portfolio this week. Price has barely moved over the past few weeks so anyone trying to trade within this range or rely on their emotions to buy or sell has likely lost money. The best action during these periods is usually no action. We have our plan and system in place so until Bitcoin actually breaks out of this choppy range, nothing about the current outlook changes. I expect a lot of volatility in 2026 so I look forward to plenty of opportunities to both buy the dip and take profits when my system calls for it.

Portfolio snapshot as of December 29th, 2025.

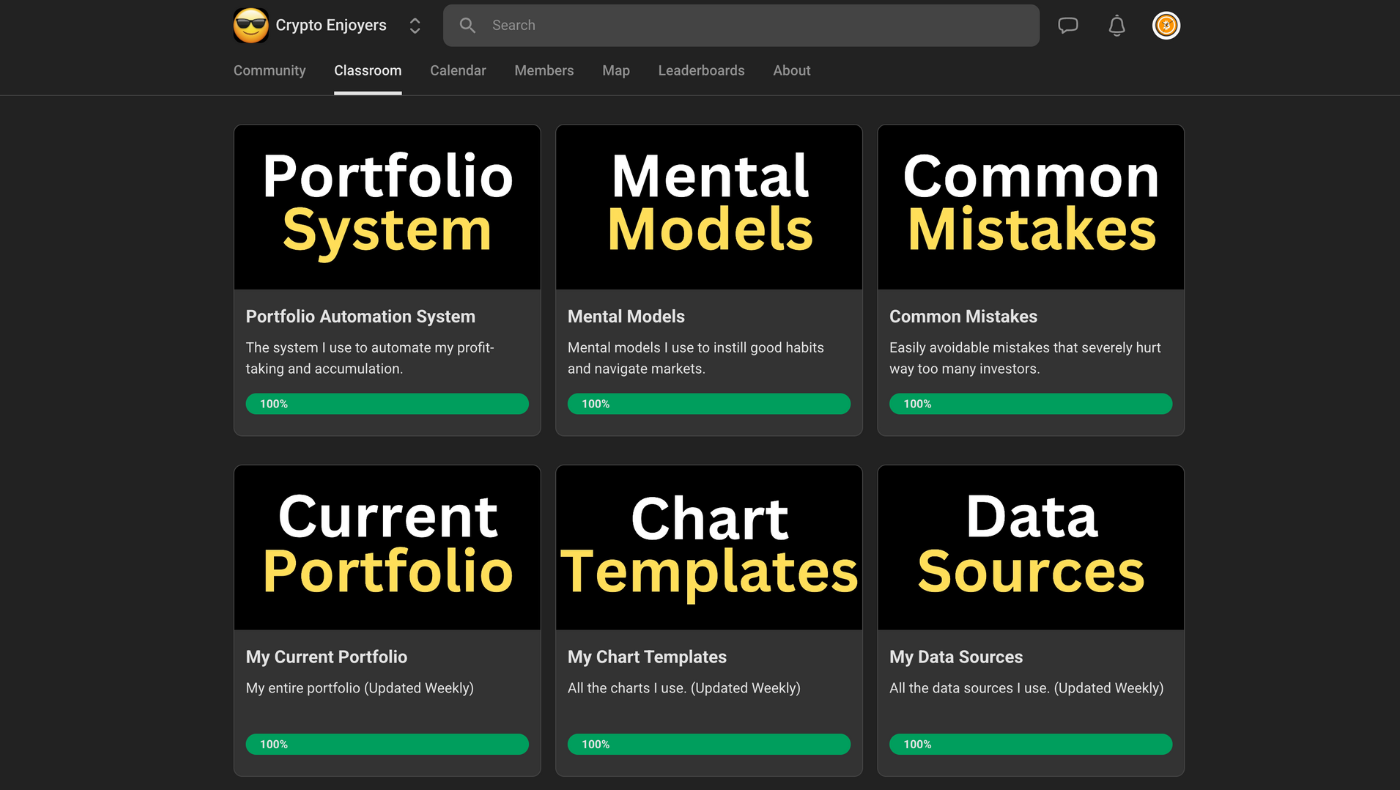

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝