The Weekly Close

After an almost week long battle at our $109k Range High, Bitcoin closed its weekly candle just above it. Hugging a resistance level for almost an entire week just to close above it is usually a great sign that a breakout is imminent. The sellers are slowly being exhausted at this very stubborn price level and it is only a matter of time before the buying demand takes over. Price discovery should start any day now.

The Bitcoin Weekly Chart.

Market Sentiment

It’s amazing that market sentiment is still in the Neutral region while Bitcoin is flirting with new all time highs. It will likely take a price discovery rally to bring Greed and excitement back into this market. This is why monitoring sentiment is so important. When Bitcoin first reached these price, the market was in Extreme Greed. When the market revisited these prices we only made it up to Greed. Now we are back at those prices and market sentiment is Neutral. With sentiment fully reset, Bitcoin has the perfect backdrop to make new highs.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to make new highs day after day. I am still on the lookout for an eventual local top on this metric, but this uptrend has remained resilient for months now. It is now pointing to a Bitcoin rally all the way until September of this year. I don’t expect it to predict Bitcoin’s price movements to the exact day, but it is promising to see that The GLI is still going higher. I will continue to monitor it and include it in my analysis until it stops working.

Bitcoin and The Global Liquidity Index.

Macro

The US Dollar Index has been in a downtrend since the beginning of the year and has acted as a huge tailwind for the Global Liquidity Index uptrend we have seen. With rate cuts being pushed back further and further it is only a matter of time until we see a meaningful bounce for The DXY. I will be monitoring its price very closely over the next few weeks to see when that bounce happens and what it does to the Global Liquidity Index.

The US Dollar Index (DXY).

The Bigger Picture

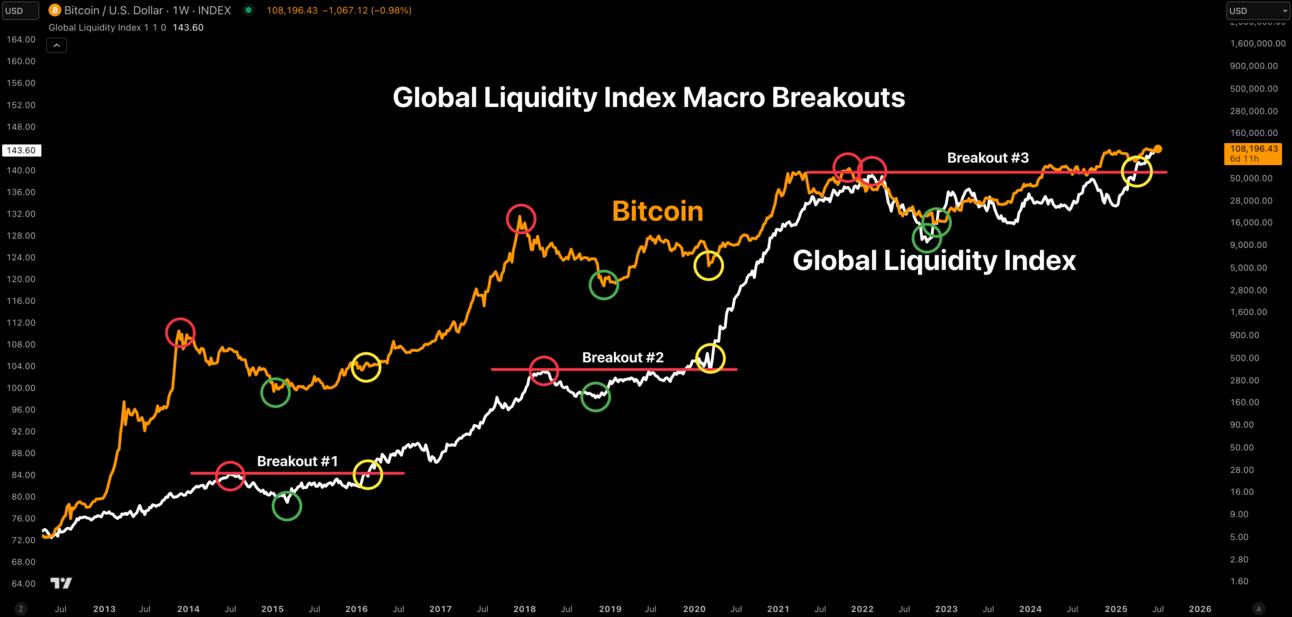

It’s hard not to be optimistic when looking at what Global Liquidity Index macro breakouts have done for Bitcoin in the past. The correlation is hard to ignore and usually the best phases of the cycle have happened when the Global Liquidity Index has broken out to new highs and that just happened recently in April. It’s tempting to get caught up in short-term noise, but zooming out and looking at this chart makes it quite easy for me to remain calm and patient.

Global Liquidity Index macro breakouts.

What I’m doing with my portfolio

No changes were made to my portfolio this week. The market has been trading sideways for about 2 months now and I have made no changes during that time period. I would imagine that most traders that tried to trade this choppy price action have ended up with less money than they would have had if they just sat on their hands. In markets, the best action is usually no action. This is easy for me to do because I have allocations that I am comfortable with. If I had way too much cash and less spot holdings, it would be hard to resist the FOMO and if I had too little cash and too much spot exposure, it would be hard to resist the Fear of the top being in. We all have to find our own happy medium that makes sense for us.

Portfolio snapshot as of July 7th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, early bird pricing with lifetime access for the Crypto Enjoyers program is still available as I finish creating the final module of the Mental Models course. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝