The Weekly Close

After a false breakdown earlier in the week, Bitcoin closed it’s weekly candle just above our $100k resistance level and range high. This is technically a confirmed breakout and should lead to continuation higher. However, it would have been a much stronger signal if we closed near the high of the week around $106k without the large wick we left to the upside. I’d like to see Bitcoin hold above $100k for the entirety of this week and maintain that breakout. Trading back below our range high would be a major sign of weakness and would greatly increase the likelihood of a deeper pullback.

The Bitcoin weekly candle closed at $101,211.13 (+7.09%) on January 19th, 2025.

Temperature Check

Although we had a wild weekend with the incoming US president and his family members launching memecoins on Solana, sentiment remains relatively subdued at the high end of our “Neutral” region. It’s nice that we’ve seen a sentiment reset from the “Extreme Greed” region we were in a few weeks ago, but we never visited the “Fear” region during our last correction. I would like to see one last shakeout into that “Fear” region post inauguration to fuel our next major move higher.

The CMC Fear and Greed Index is at 58 which represents “Neutral”.

Global Liquidity

Global Liquidity is still my main concern for Bitcoin over the next few weeks. It’s nice to see that it is bouncing off it’s recent low, but Bitcoin still hasn’t priced in the global liquidity drop over the past few months. Many investors are ignoring this because of all the hot narratives surrounding Trump’s inauguration like the Bitcoin Strategic Reserve or him weakening the dollar which should increase Global Liquidity. However, Bitcoin’s lagging relationship with global liquidity tells us what the next few weeks likely have in store and any of the changes to the dollar that Trump implements likely won’t impact Bitcoin for awhile.

The Global Liquidity Index remains low after it’s downtrend that began on October 1st.

The Dollar

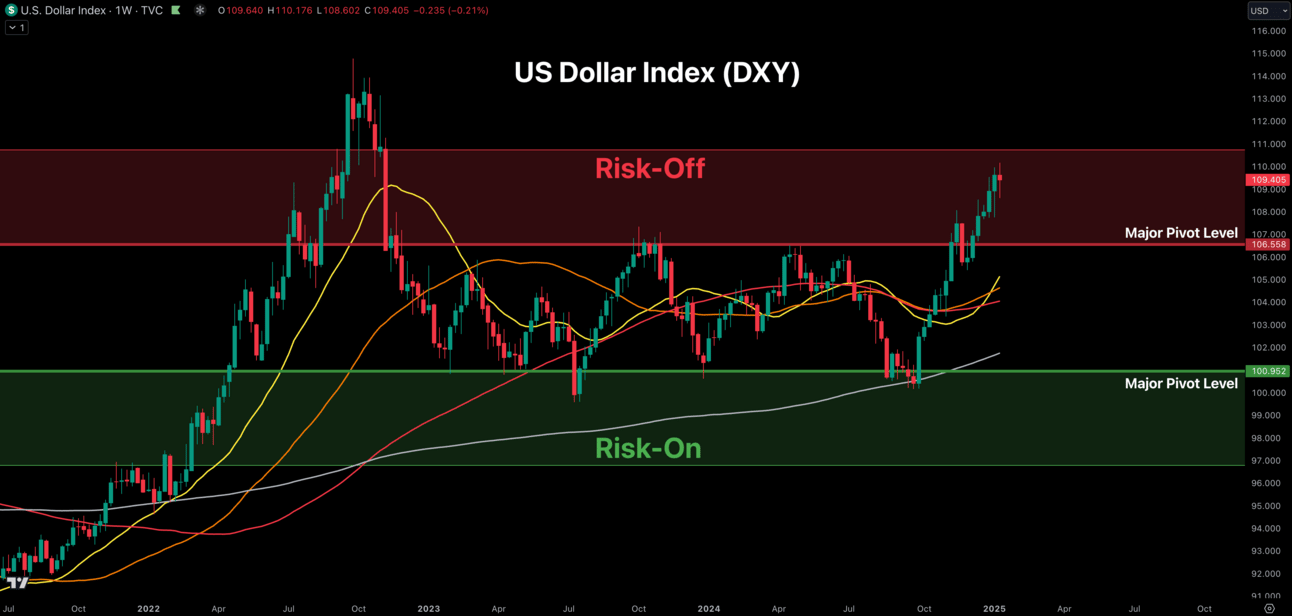

The DXY is still deep within our “risk-off” region and continues to be the main drag on global liquidity. The market still has only 1 rate cut priced in for 2025 and until that changes, I don’t expect a reversal in the DXY. We still have a low unemployment rate and stubborn inflation so the FED doesn’t have an excuse to ease sooner or more aggressively. The only path I see to more rate cuts in the short-term would be liquidity issues in the US financial system or extreme volatility in markets, neither of which we have seen. So for now all we can do is patiently wait and monitor the rate cut expectations and DXY.

The Dollar Index remains deep in the “Risk-off” region at $109.405.

This Cycle

I remain cautiously optimistic this cycle isn’t over with my base case remaining a late Q1 early Q2 top for Bitcoin, but many investors appear to be underestimating the volatility we could see over the next few weeks before that happens. Trump has promised everything to everyone so Bitcoin and traditional markets are already quite optimistic and many investors have already bought in before this inauguration. This is where the common pattern of “buy the rumor, sell the news” comes from. Many were calling for this months ago, but have gone silent now that the day has actually arrived.

Bitcoin cycle scenarios and their likelihoods.

My Portfolio

I took some profits across my holdings this morning. I can’t ignore the drop we have seen in global liquidity and my gut feeling is that this inauguration will be a sell the news event to shake out late buyers before rallying higher. This is also what we have seen in previous elections for traditional markets. Solana’s incredible move over the weekend as a result of Trump’s memecoin launch made taking some profits easier as well. It also helps that my portfolio was near the lower end of my 30-40% cash allocation range for Q1. I know it’s quite possible we rally here, but I can’t help but lock in some gains at these prices after all the insanity we have seen over the past week.

Portfolio snapshot as of January 20th, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. I still can’t believe Bitcoin trading above $100k has become a normality when it was a dream less than a year ago. I also can’t believe a US president and his family members are launching memecoins on Solana. All we need is some love for Ethereum to round out this insane cycle. As always, make sure to have a plan and avoid relying solely on your emotions or narratives to make decisions. Taking profits along the way has definitely reduced some of my potential gains, but it has made managing my emotions and remaining rational and calm a piece of cake. I hope you find a strategy that does the same for you because you’ll need it over the next few months. 🫡