The Weekly Close

After another bounce off of the 100W moving average, Bitcoin closed just under $89k. Sellers are still in control as long as we keep closing weekly candles below $91k. Bitcoin is being compressed into a very tight range here as the 100W MA rises towards the $91k Range Low. The move once we get out of this range will likely be a violent one.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment remains in Fear. Investors are slowly becoming more optimistic now that price has gone sideways for a few weeks. The same way investors start to get more pessimistic when price goes sideways for a long time during a bull market. It’s important to not become complacent and start to feel FOMO just because price has gone sideways for awhile.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI is still attempting to grind higher. It hasn’t broken out into a new uptrend yet, but it has been getting closer. An expansion by The GLI here would be a solid tailwind for Bitcoin and other risk assets. Bitcoin has been struggling ever since The GLI ended its most recent major uptrend and began chopping sideways for months.

Bitcoin and The Global Liquidity Index.

The FED Balance Sheet

The FED has officially begun QE. We can see that with the +$4.4B change to the balance sheet. They are starting quite slow compared to historical standards at $40B a month, but QE is still QE. This will likely be a huge tailwind for risk assets over the medium to long-term, but investors will likely need to survive some short-term volatility until the pace of QE becomes more aggressive.

The FED Balance Sheet

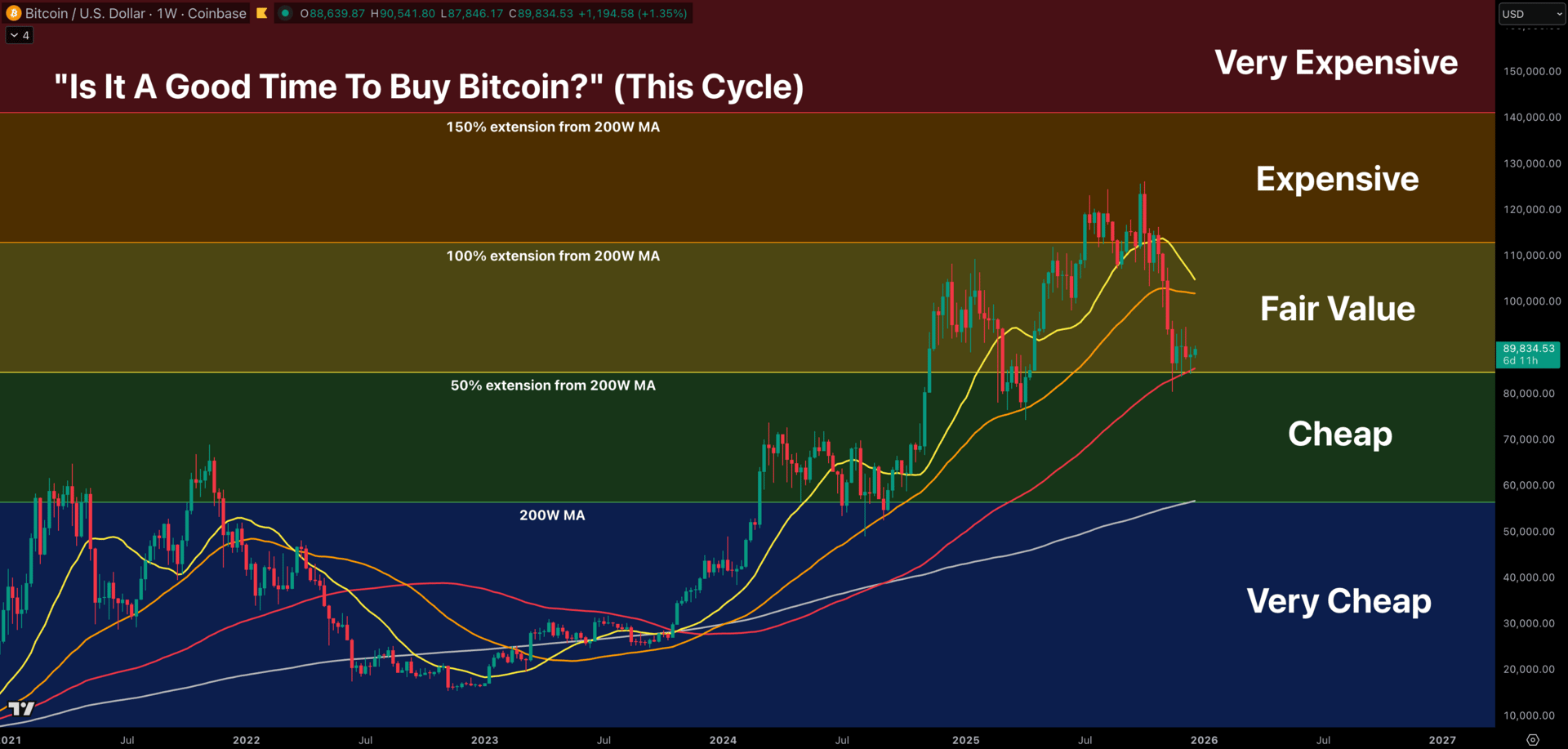

The Bigger Picture

Bitcoin is still consolidating at the bottom of our “Fair Value” region. Every time Bitcoin gets close to the “Cheap” region, buyers seem to step in. I still expect an opportunity to accumulate Bitcoin in the “Cheap” region within the next few months. Until then, I am happy to sit on my hands and be patient until Bitcoin decides what it wants to do.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

No changes were made to my portfolio this week. Prices are almost exactly where they were at this time last week so my allocations are still near their targets. I feel well prepared no matter what the markets throws at us in 2026 and would love nothing more than to see a continuation of our bull market. However, if the downtrend stays intact, I’ll happily use that as an opportunity to accumulate at lower prices. This is the advantage granted to those that have a long time horizon.

Portfolio snapshot as of December 22th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝