Weekly Close

After a decent move higher last week, Bitcoin closed its weekly candle just above $91k. This puts it just above our $91k Range Low and it will be interesting to see whether or not Bitcoin is able to continue higher and maintain above the Range Low after that close. This is when FOMO really starts to pickup again so it’s important to remain calm and stick to whatever plan you put together before this move happened.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment has left Fear and entered the Neutral region for the first time since October. This is the exact type of market sentiment reset that you’d expect from a relief rally. In bull markets, we expect corrections to reset greedy sentiment back to Neutral or maybe even Fear. In bear markets, we expect relief rallies to reset fearful market sentiment back to Neutral or maybe even Greed. Markets don’t go up or down in a straight line so monitoring sentiment is incredibly helpful when managing risk because we know sentiment resets are inevitable.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues its slow and steady grind higher. This is likely due to the recent dollar weakness as the market is pricing in the FED restarting QE. If this turns into a full blown uptrend, it could give Bitcoin the strength it needs to reclaim some major resistance levels. However, it is too early to call this a new uptrend for now. It’ll be interesting to keep an eye on it as we progress further into 2026.

Bitcoin and The Global Liquidity Index.

The Labor Market

We will be receiving an update to the unemployment rate this Friday, January 9th. The market is expecting the unemployment rate to rise to 4.7%. This would put even more pressure on the FED to ease more aggressively and perhaps be even more aggressive with rate cuts. It will be interesting to see how the market reacts to the print.

The Unemployment Rate.

The Bigger Picture

Bitcoin continues to find buyers every time it goes near the “Cheap” region. For now, it remains in the lower 1/3 of our “Fair Value” region. I look forward to taking some profits if we are truly in the relief rally that will take us much higher, but I’m also just as excited to deploy more capital in the “Cheap” region if granted the opportunity. We’ll have to wait and see what path Bitcoin chooses.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

No changes were made to my portfolio this week. Although it feels great to see some green, price is still in the same range it has been in for the past few weeks. I feel quite calm knowing I have 70% spot exposure going into this move so I’m not faced with the dread and FOMO of people who are 100% sidelined. The higher this relief rally goes the better, but it has a long way to go before undoing the price action damage of the most recent selloff.

Portfolio snapshot as of January 5th, 2026.

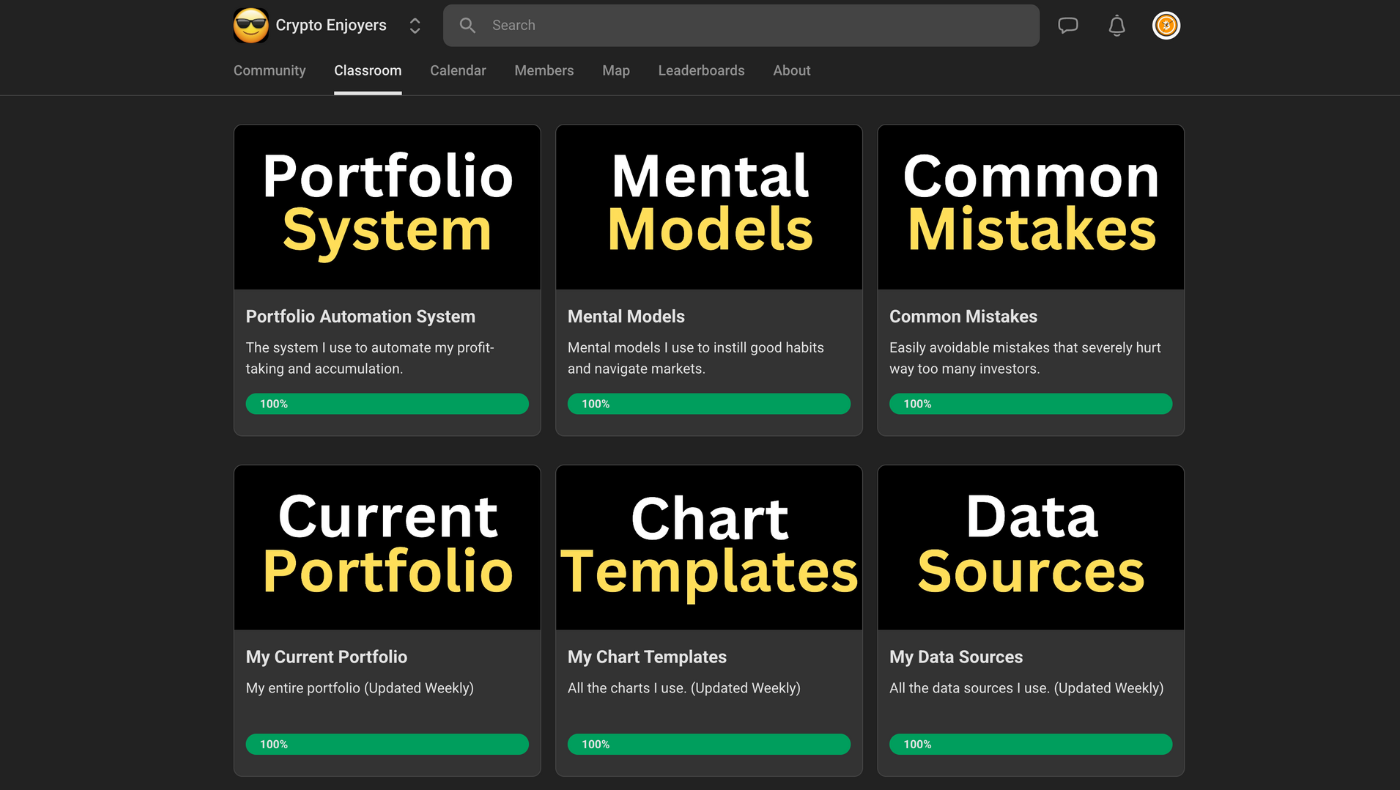

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to view to my entire portfolio, instead of just my crypto holdings, or would like to learn more about my Portfolio Automation System, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝