The Weekly Close

After a very strong week, Bitcoin closed its weekly candle right above $104k. This close now puts it above the range mid of our previous trading range at $100k and allows us to now target the range high at $109k. This is our 5th green week in a row so brief and sharp pullbacks can happen at any time, but with this much momentum, it seems highly likely that Bitcoin will see new highs very soon.

The Bitcoin weekly chart.

Sentiment Check

After the impressive rally we have seen over the past few weeks, market sentiment has finally returned to the Greed region for the first time since January. It is crazy to think the we were in Extreme Fear just over a month ago. Nothing changes sentiment quite like some quick and aggressive upwards price action. With Greed back in the air, I believe it is only a matter of time before we enter Extreme Greed and enter price discovery once again.

The CoinMarketCap Crypto Fear and Greed Index.

Global Liquidity Index

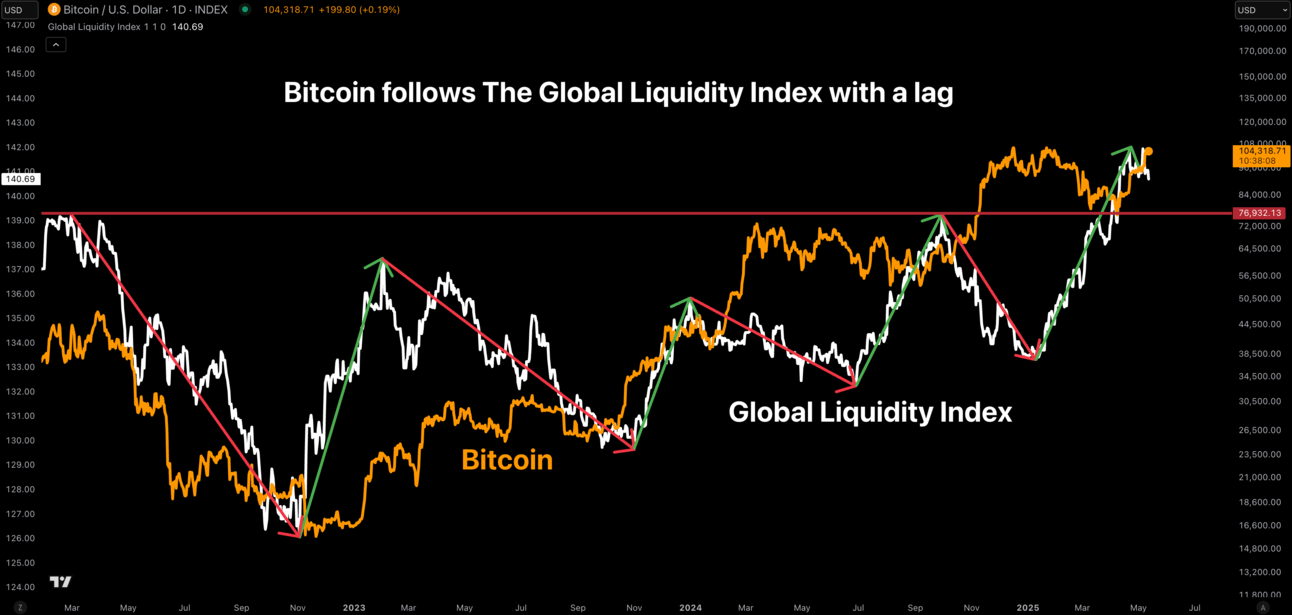

The Global Liquidity Index has been flatlining over the past week or so. It is too early to tell if this is the beginning of a new downtrend or just a pause before it heads higher. If it is the beginning of a new downtrend there should still be plenty of time for Bitcoin to rally before the lag kicks in. So I’ll be monitoring The Global Liquidity Index quite closely over the next few weeks to see if it provides any warnings as to what could come next for Bitcoin.

Bitcoin and The Global Liquidity Index.

Macro

All eyes will be on the updated inflation data we will be receiving this week. We are getting a CPI print on Tuesday, May 13th and a PPI print on Thursday, May 15th. These prints are important because the FED has been using inflation being above target as an excuse not to cut rates while the labor market continues to weaken. If we do end up seeing a cooler than expected print, I expect the market to start pricing in more rate cuts immediately as it will likely put way more pressure on the FED to lighten up on the policy tightening that we have experienced over the past few years.

Core CPI.

Bigger Picture

It’s hard to ignore the macro breakout we have seen on The Global Liquidity Index. We have only seen 2 previous occurrences of this breakout is Bitcoin’s history and both led to very impressive rallies. Of course, I don’t expect this rally to be anywhere near as large because Bitcoin is a larger asset now and diminishing returns is inevitable, but it does make it easy for me to remain optimistic that we still have higher to go this cycle and that the top for Bitcoin isn’t in yet.

Bitcoin and The Global Liquidity Index’s Macro Breakouts

What I’m doing with my portfolio

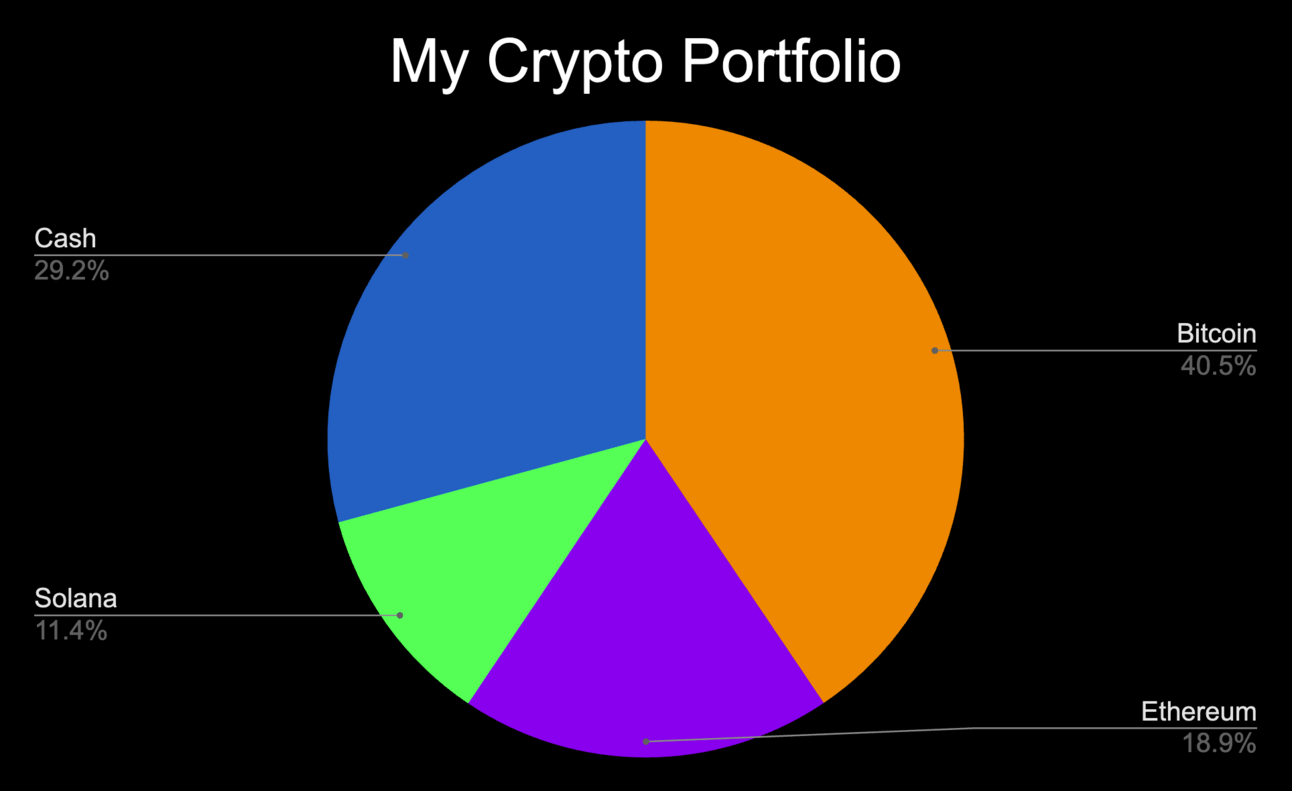

After an incredible week for all of the assets in my portfolio, especially Ethereum, my system called for some profit-taking across my positions once again. At this stage of the cycle, my cash target is 30%, but I am more than happy to let the remaining 70% ride. It’s nice to see Ethereum and Solana finally showing some strength after getting crushed during Bitcoin’s correction in March and April. It also feels good taking some profits now that Greed is back after making some great dip buys during the Extreme Fear. Now all that’s left to do is to sit back and see how high Bitcoin wants to go over the next few months.

Portfolio snapshot as of May 12th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, early bird pricing for the Crypto and Macro Enjoyers program is available as I build out the second course. You can learn more here:

It feels great to finally see so much green in this market again after the doom and gloom we experienced over the past few months. There will always be surprises and bumps along the way, but the macro trend remains clear. All we have to do is remain patient and keep our emotions in check as we try and navigate the volatility. As always, I hope you have an amazing week and the future looks bright. 🫡