After a quick Friday selloff and choppy weekend, Bitcoin closed its weekly candle just above $114k. This ended up liquidating a bunch of leverage positions that were piling into the market in anticipation of an immediate breakout. Many of those leverage positions have now been liquidated and price is still maintaining its bullish structure. This is the exact type of volatility you’d expect at this phase of the cycle. Structure will remain intact as long as Bitcoin holds above $110k.

The Bitcoin Weekly Chart.

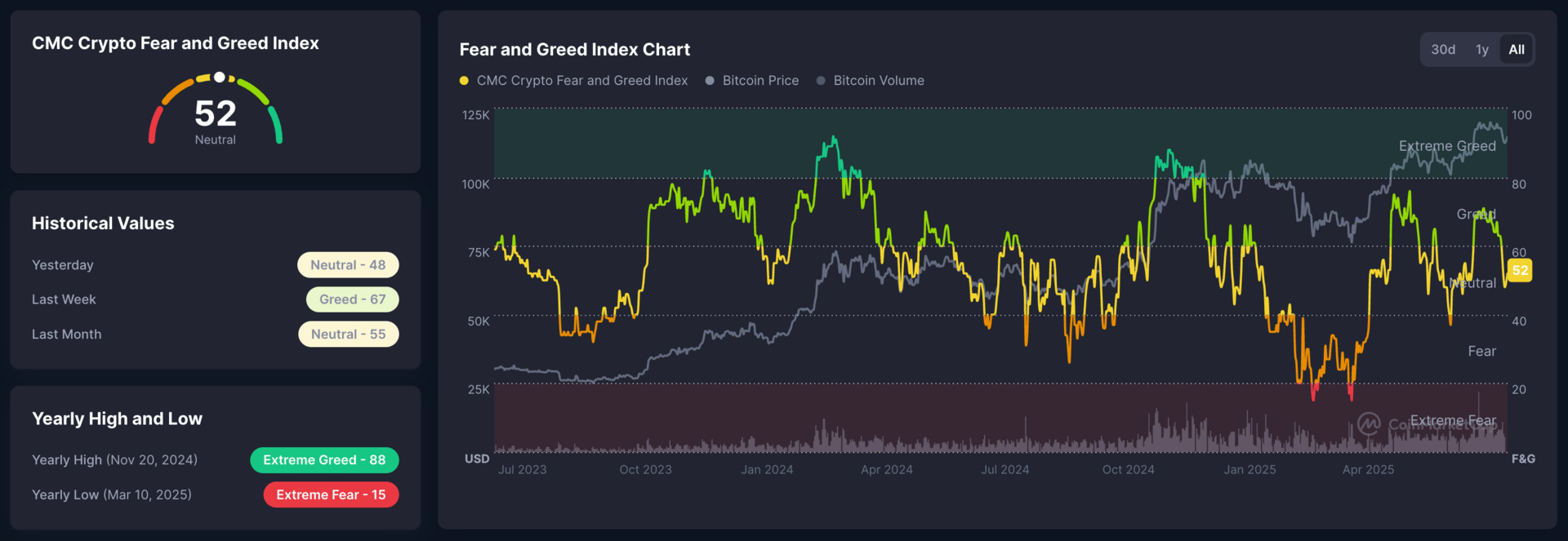

Market Sentiment

Market sentiment is now back in almost the exact center of the Neutral region. It’s amazing that sentiment is this calm with price still trading above $114k. All of the narratives that the market was celebrating just a week ago are still fully intact, but everyone has decided to ignore them and focus on the bearish narratives instead. This gives us a lot of room to rally higher without sentiment getting too overheated too quickly.

The CoinMarketCap Crypto Fear and Greed Index.

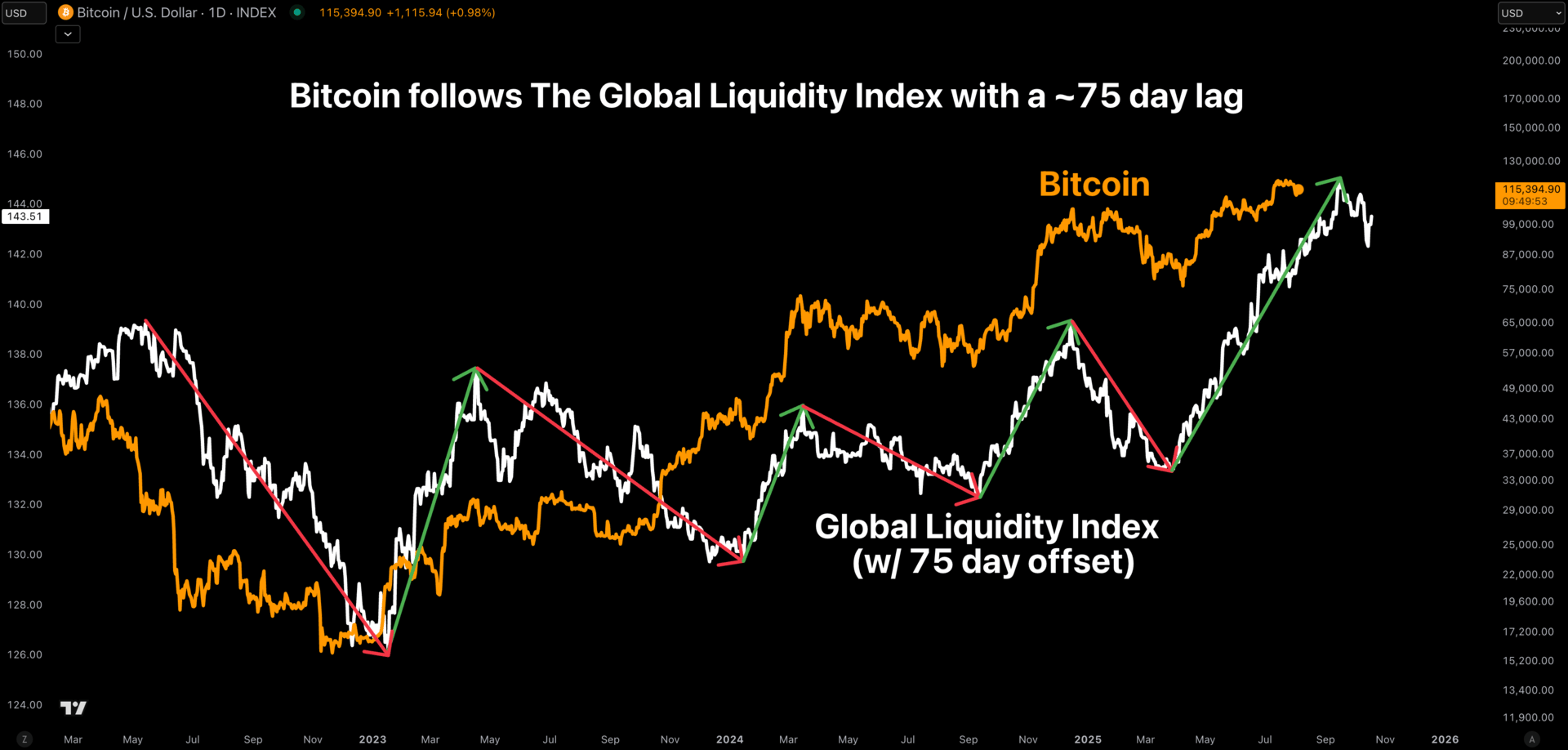

The Global Liquidity Index

The GLI has been in a clear downtrend for a few weeks now. This is painting a clear picture that things will get rocky for risk assets if this doesn’t change soon. We can’t completely rely on just this data point to make decisions, but it is something I take seriously given how well it has worked for us this entire cycle. So we will continue to monitor it as we approach mid-September when Bitcoin is expected to rollover based on the lagged correlation.

Bitcoin and The Global Liquidity Index.

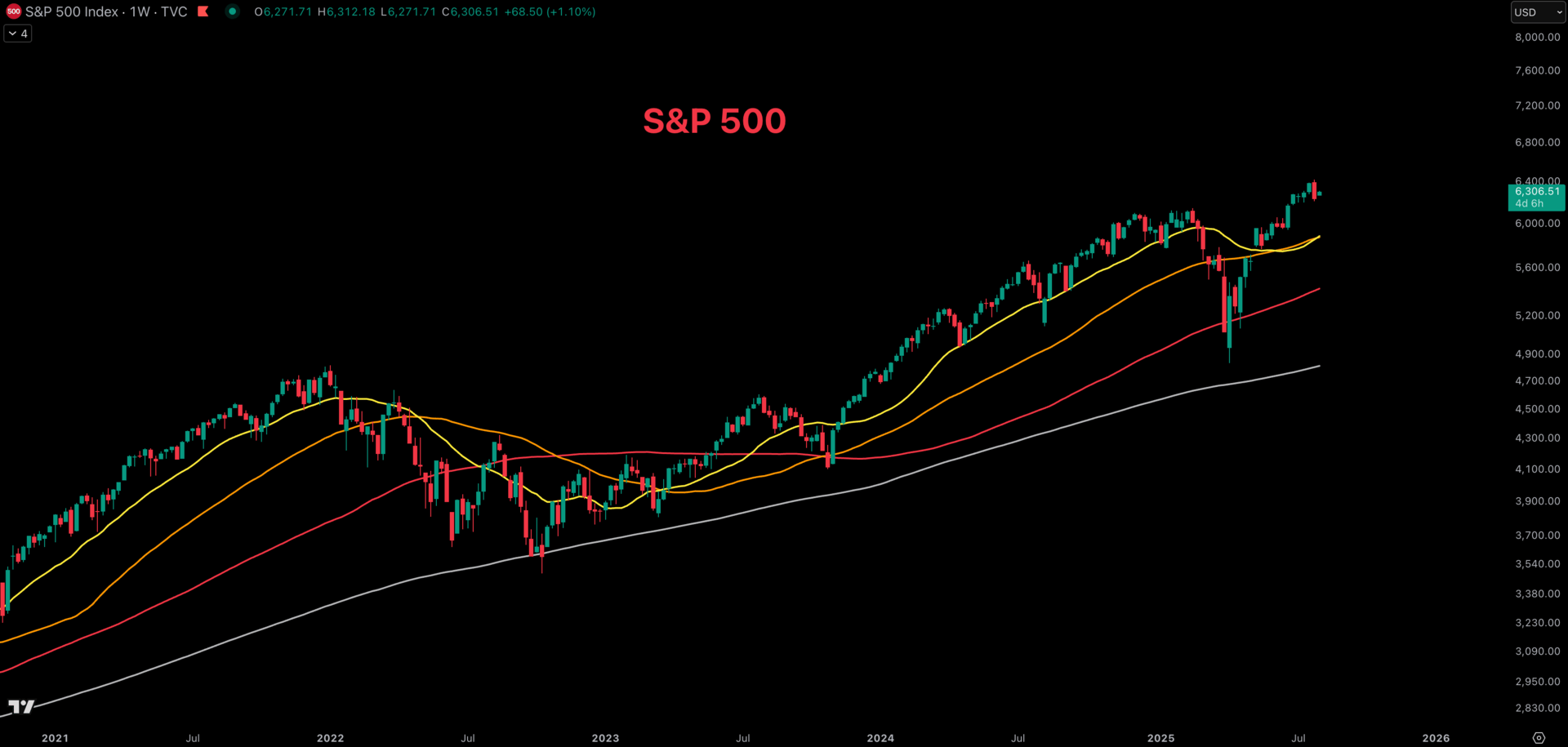

The S&P 500

The S&P 500 had a bearish engulfing weekly candle last week. This is usually a pretty strong sign that a correction is imminent. I will be watching it closely this week to see if there is follow through to the downside and how that will impact Bitcoin. The S&P 500 has gone up in almost a straight line since the tariff drama back in April so corrections are normal. It may however impact our current base case for Bitcoin.

The S&P 500.

The Bigger Picture

Based on current price structure we would ideally like to see Bitcoin bottom here in the blue region. This would confirm that this was just a leverage washout and would keep us above our invalidation at $110k. We could even trade down to the Green region and still technically be above our 50-week moving average that has acted as macro support, but I would prefer if it didn’t come to that.

How Low Will Bitcoin Go?

What I’m doing with my portfolio

No changes were made to my portfolio this week. I am still quite happy with my current allocations and feel prepared for almost all possible outcomes. I’ll deploy some cash if the market provides a bigger discount, but for now I am more than willing to just sit on my hands and see what the market decides to do.

Portfolio snapshot as of August 4th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, check out the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝