The Weekly Close

After a small bounce, Bitcoin closed its weekly candle just above $90k. Unfortunately, Bitcoin was unable to reclaim our previous Range Low at $91k. This will likely result in more short-term chop. Investors are waiting for a relief rally, but are likely underestimating how long it will take that relief rally to play out.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment just barely exited Extreme Fear and entered Fear. In a bull market this would be considered a huge buying opportunity, but in a bear market, this is the norm. So it’s important that we take our time accumulating and stick to a plan that doesn’t rely solely on our emotions to make decisions in this environment.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI is showing early signs of a new uptrend. We know Bitcoin has been struggling ever since The GLI flatlined a few months ago, so a new uptrend for The GLI would be a nice tailwind for Bitcoin. There are quite a few catalysts for The GLI this month. The FED will be ending QT, the new FED chair will likely be announced and the FED will publish their economic projections for 2026. It will be very interesting to see how rate cut expectations and The GLI react to these events.

Bitcoin and The Global Liquidity Index.

Inflation

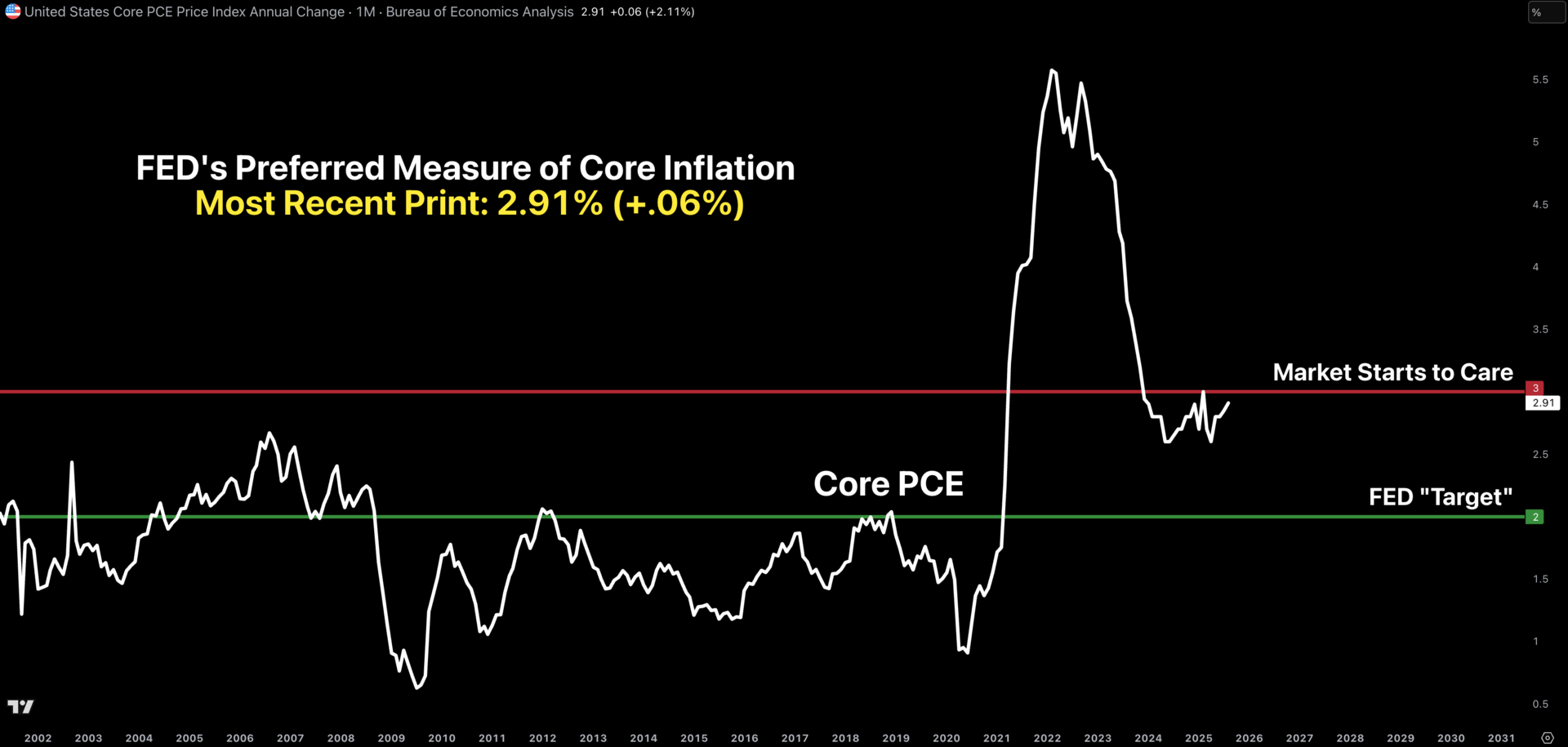

We will finally be receiving an update to Core PCE, the FED’s preferred measure of inflation on Friday, December 5th. This delayed report will include September’s data that was not published thanks to the US Government shutdown. The market will be paying close attention to this report to try and gauge what we should expect for October and November’s inflation data. We really want this print to come in cooler than expected for the market to become more optimistic on rate cuts.

Core PCE.

The Bigger Picture

I am still operating under the assumption that we are in a Bear Market. I would love nothing more than to see Bitcoin show some strength and confirm that this was all one big Bear Trap, but as of right now, there are no signs of that being the case. This means we have to prioritize survival over short-term gains. Bear markets are a long and grueling process that result in most investors throwing in the towel and giving up on the market altogether. Being mentally prepared for what’s to come is one of the best tools we have at making it through.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

No changes were made to my portfolio this week. I have a long time horizon so I’ll happily buy more if we see lower prices and I’ll happy take profits if we see higher prices. For now my cash allocation is very close to its target so no changes were required. The next few months will likely be full of chop so having a plan and sticking to it is crucial. Otherwise we will find ourselves selling lows and buying highs like most retail investors do.

Portfolio snapshot as of December 1st, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝