The Weekly Close

After a wild week full of fear and cycle top calls, Bitcoin managed to save the weekly chart and close above our $91k range low. This price action is incredibly similar to what we saw in March 2023 during the banking crisis and January 2024 during the Grayscale ETF outflows where many investors panic sold and got caught wrong footed below the trading range. We should see new highs within the next few weeks as investors are now forced to close their shorts and FOMO back into the market to chase price.

The Bitcoin Weekly chart.

Temperature Check

Last week we saw the lowest CMC Crypto Fear and Greed Index reading of the cycle. Many investors began focusing on bearish narratives and why prices should go lower which is normal during corrections and fear. It’s clear that we have seen a full sentiment reset and washed out all of the greed and froth we saw in late November and early December. Peak fear should be behind us and we should now start seeing optimism begin to seep back into the minds of investors.

The CoinMarketCap Crypto Fear and Greed Index.

Global Liquidity

Global Liquidity has been in an uptrend for almost 2 months now. We should see Bitcoin begin to follow within the next 1-2 weeks. It’s amazing how many investors ignored the Global Liquidity downtrend during Extreme greed and for weeks they have been ignoring the uptrend during Extreme Fear. This confluence of sentiment and Global Liquidity has been a great compass this market cycle. As long as we see Global Liquidity continue to rise, I expect new highs on Bitcoin very soon.

Bitcoin and The Global Liquidity Index.

The Labor Market

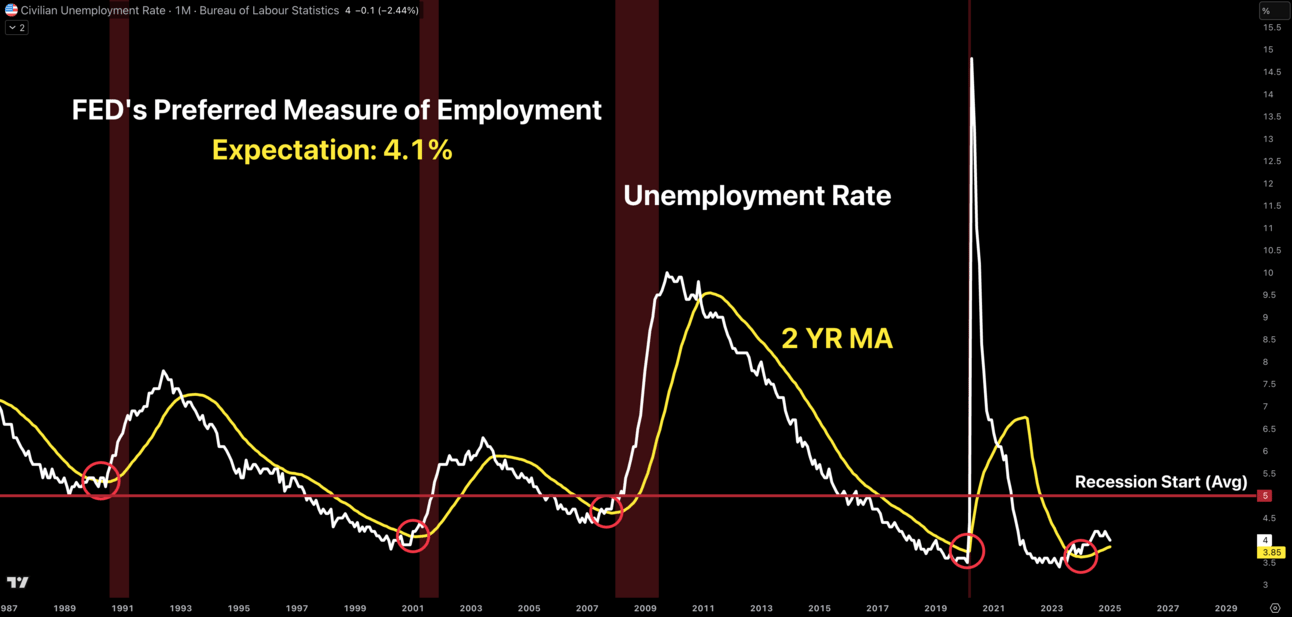

The most important event this week is the Unemployment rate print on Friday March 7th. The market is expecting a 4.1% print which is only .1% above our previous reading. We really want to see this reading come in-line with expectations or remain flat at 4.0%. A surprise in either direction would not be good for risk assets. A reading above 4.1% would worry the market that the labor market is deteriorating quickly and a reading below 4.0% would crush hopes of any FED rate cuts in the near future. The federal layoffs should not show up in the data for a few more months so I am optimistic that this print will come in near expectations.

The Unemployment Rate.

Big Picture

The low should be in for this correction and it perfectly tapped the support range we outlined months ago. We saw many investors say it was impossible for Bitcoin to go that low because of all the bullish narratives and greed we had at the time. Then when we did reach that level, many investors lowered their price targets and said we should go much lower because of all the fear and bearish narratives. This is the cyclicality of market sentiment and we have watched it play out over and over again this cycle.

Bitcoin support levels and their likelihood of being revisited.

What I’m doing with my portfolio

Buying the fear worked out for us once again. The same way taking some profits during Extreme Greed did. I’m happy with my current positions going into what will likely be a volatile March. I will take small profits if my cash falls back below 30% or if we see Extreme Greed once again. It’s too bad my stop losses got hit on some of my recent altcoins purchases, but I’m glad I was able to rotate those funds into Solana near the lows. I feel better holding Solana through volatility anyway. There isn’t much to do now aside from sitting back and enjoying the rewards for the risk we took last week buying the Fear.

Portfolio snapshot as of March 3rd, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. The last few months have been a great example of why it’s so important to have a plan and system and not just rely on our emotions to make decisions when the time comes. I’m sure many investors bought more than they could afford to lose during Extreme Greed near the highs and were then forced to panic sell during Extreme Fear near the lows. We have all made those mistakes at some point in our journey. I expect March to be incredibly volatile in both directions, but I am optimistic that we will see new highs on Bitcoin soon. Let’s see what happens, and I hope you have an amazing week. 🤝