Weekly Close

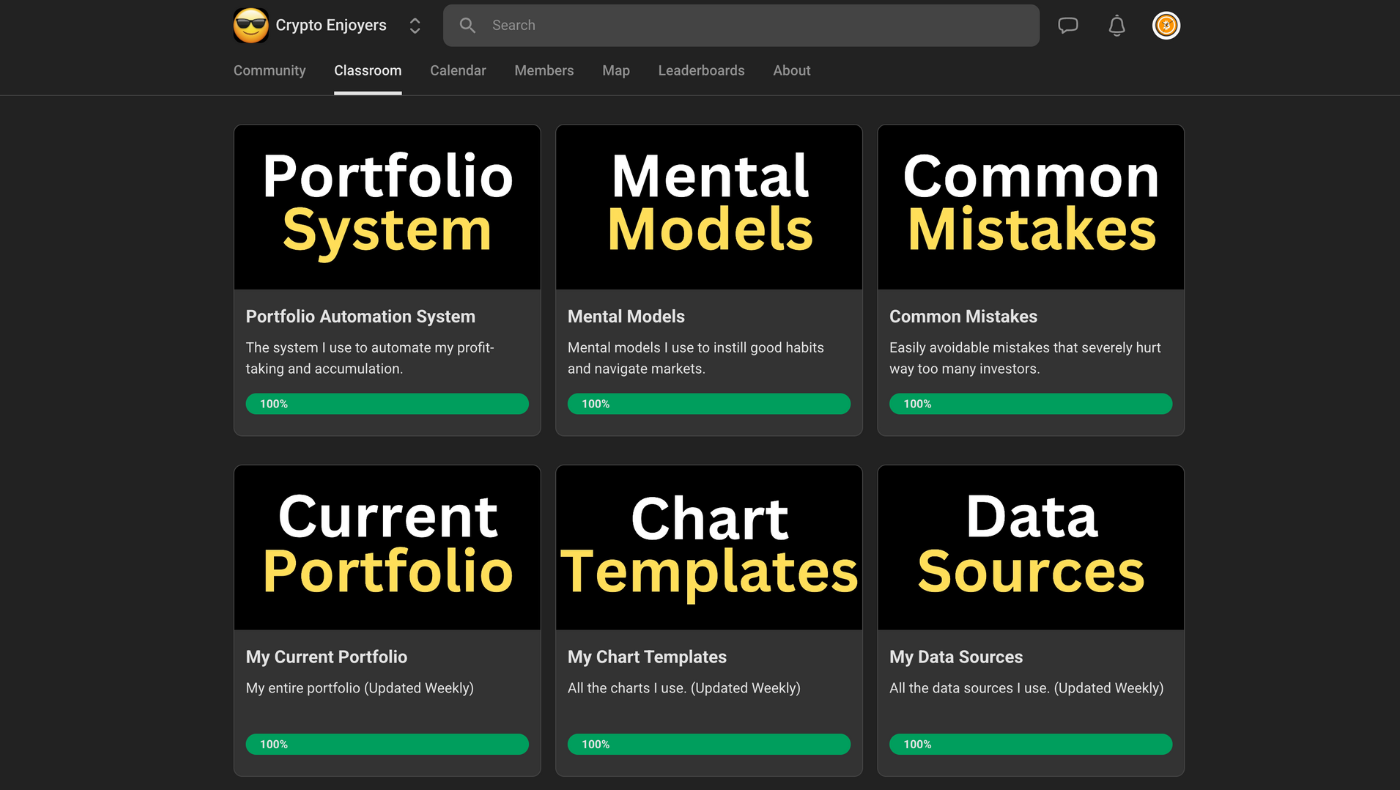

After a pretty violent selloff, Bitcoin closed its weekly candle below our $81k Local low at just under ~$77k. This is something we have been expecting for a few weeks now and it seems as though sellers are back in control. This is a clear breakdown and will likely take some time to build a base before recovering. Bears remain in control until we are able to reclaim and close back above our Range Low at $81k.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment is back in Extreme Fear. We got our sentiment reset relief rally back to Neutral and then the market sold off once again. This is exactly how Bitcoin always acts during bear markets. During bull markets, sentiment resets back to Neutral provide the fuel for rallies back into Greed. During bear markets, sentiment resets back to Neutral provide the fuel for selloffs back into Fear. Sentiment resets work both ways.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to rise rapidly. Over the past few weeks, that new liquidity has been chasing metals and having minimal impact on Bitcoin, but I will change my tune if Bitcoin actually starts to show some strength. I do believe The GLI is the main driver of Bitcoin in the long-term, but there can be periods where Bitcoin does its own thing for its own reasons. That’s why we have technical analysis to manage our risk and tell us when something isn’t right like in November of 2025 when Bitcoin broke a level it shouldn’t have if buyers were in control.

Bitcoin and The Global Liquidity Index.

The Labor Market

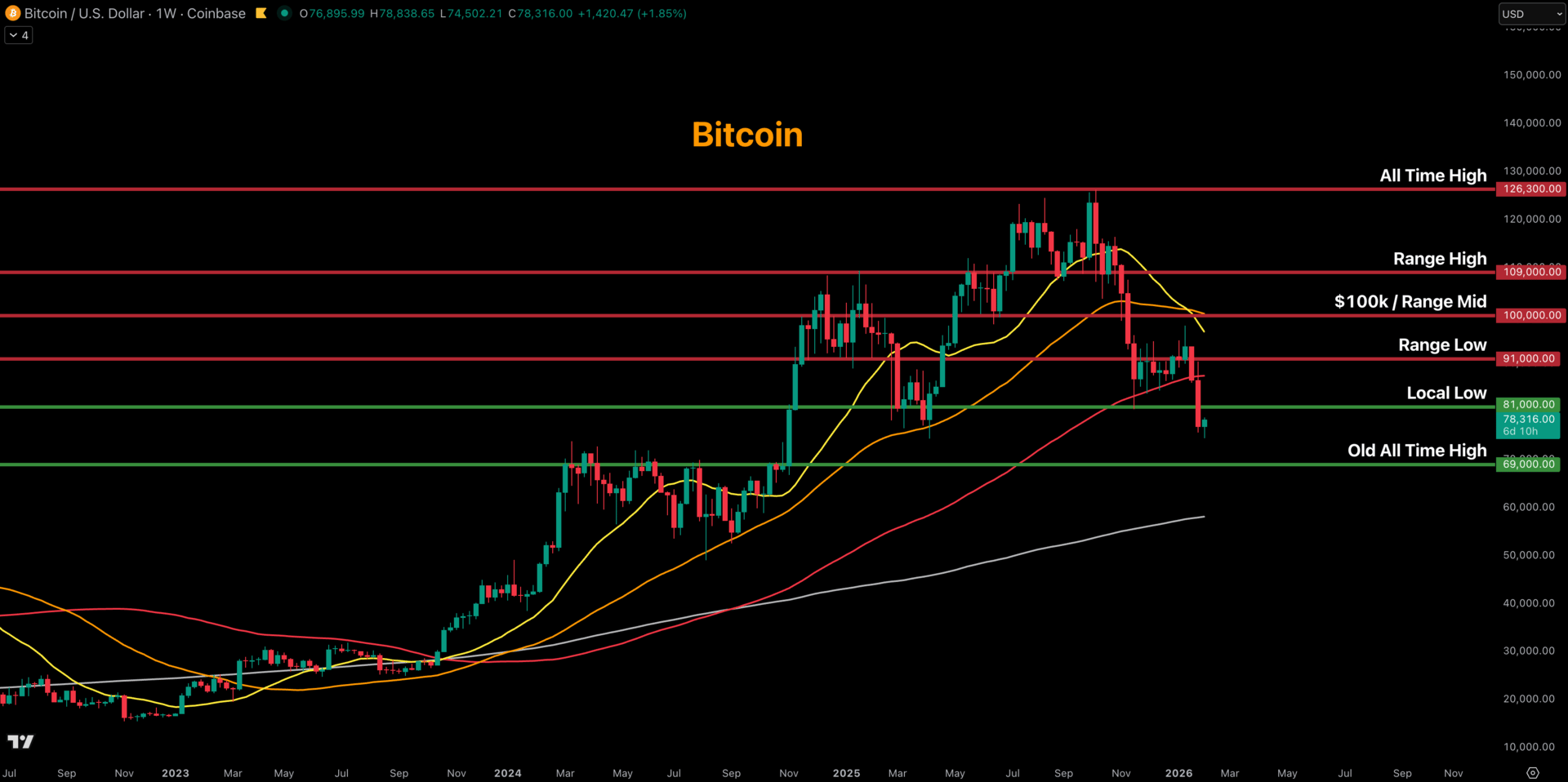

We will be receiving an update to the Unemployment Rate on Friday, February 6th. The market is expecting it to remain flat at 4.4%. So far the labor market has been slowly weakening under the surface, but it hasn’t done so quickly enough to warrant aggressive rate cuts on top of the two that the market is already pricing in for 2026. Investors will be watching this upcoming print closely to see where the data comes in relative to expectations and rate cut odds will likely react accordingly.

The Unemployment Rate.

The Bigger Picture

Bitcoin is finally in the Cheap region. This is an opportunity I have been patiently waiting for for quite a while now and it’s nice to see that Bitcoin finally made it. I see the Cheap region as an accumulation opportunity for investors with a long time horizon, but that doesn’t mean we can’t go lower. It is very possible that Bitcoin visits the Very Cheap region as well. I will navigate these possibilities by slowly deploying some capital in this region while also saving dry powder incase we go to the Very Cheap region. If we don’t end up going that low, I will just happily ride whatever exposure I do have to higher prices.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

I bought some Bitcoin today. The combination of entering the Cheap region and sentiment being in Extreme Fear made it feel great to finally put some dry powder to work. I did not buy any Ethereum or Solana because those allocations are already as high as I want them to be for this market environment. I have much higher conviction in Bitcoin so I want a heavier Bitcoin allocation alongside my cash because it still provides me with quite a bit of upside, but limits my downside compared to altcoins. I will continue to deploy cash until my portfolio reaches my desired allocations.

Portfolio snapshot as of February 2nd, 2026.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to view my exact portfolio changes each week, my entire portfolio and would like to learn more about my Portfolio Automation System, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝