The Weekly Close

After a week of volatility and executive order related uncertainty and drama, Bitcoin closed right above our $100k support level. The large wick to the upside is a bit concerning and shows that sellers stepped in aggressively last week, forcing Bitcoin to close ~$7k below our weekly high. As long as we remain above $100k on a weekly closing basis, the chop in between should be considered noise.

The Bitcoin weekly candle closed at $102,563 (+1.34%) on January 26th, 2025.

Temperature Check

The CMC Fear and Greed Index remains quite healthy in the “Neutral” region. We had moments of both fomo and fear last week thanks to various media headlines and I’m sure most short-term traders lost money getting chopped up in the volatility. Spending time in this region is a healthy reset in preparation for our next rally and I wouldn’t mind seeing a brief dip into the fear region to fully reset sentiment.

The CMC Fear and Greed Index is at 55 which represents “Neutral”.

Global Liquidity

Global Liquidity continues to be a valuable cheat code this cycle. Many investors get frustrated by the ~2.5 month lag and give up on the metric just before Bitcoin follows. We have discussed the Global Liquidity downtrend, that began October 1st, for months now. It prepared us for this Bitcoin chop period that began around mid-December (~2.5 months after the Global Liquidity downtrend started). All we need now is for the uptrend in Global Liquidity to continue so that we can have the perfect backdrop for Bitcoin’s next rally.

The Global Liquidity Index has been increasing since January 9th.

The Dollar

The DXY continues to be the main short-term driver for Global Liquidity. This week we have a pivotal FOMC meeting on Wednesday, January 29th which should have an impact on FED rate cut expectations and the DXY as a result. Tariff talk from Trump is another DXY driver that I’ll be keeping an eye on this week. A DXY downtrend would be great for Global Liquidity and our risk assets like Stocks and Bitcoin.

The Dollar Index remains deep in the “Risk-off” region at $107.075.

Bigger Picture

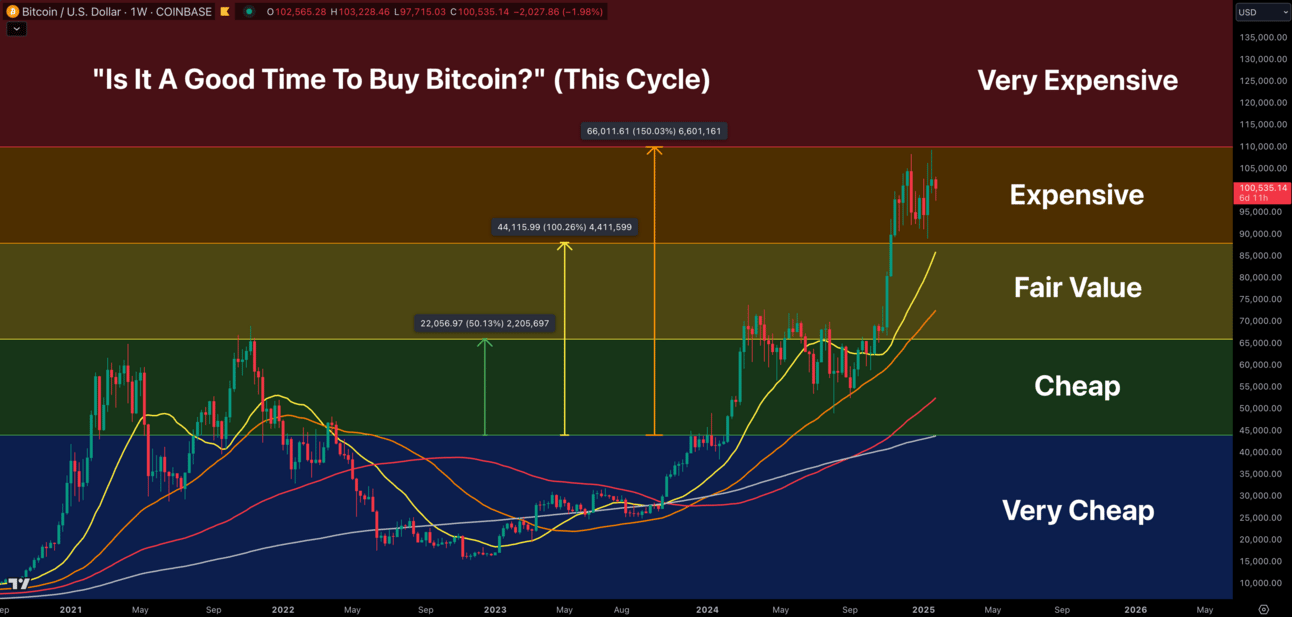

I like using the chart below to give me a general unbiased view of how I should be thinking about my spot holdings. It uses a simple extension from Bitcoin’s 200W MA to decide whether Bitcoin is cheap or expensive (this cycle). I wouldn’t consider buying Bitcoin anywhere above the “Fair Value” region which is why I have been taking some small profits during our time in the “Expensive” region. I will take profits more aggressively if we visit the “Very Expensive” region and I’m optimistic that we will reach that area before this cycle ends.

Bitcoin remains in our “Expensive” region with a price 100%+ above it’s 200W MA

What I’m doing with my portfolio

No changes being made to my portfolio this week. The beautiful thing about a longer-term strategy is that most of the time you really shouldn’t be doing anything. I can only imagine the stress many market participants must be under as they watch their riskier altcoins plummet or watch price approach their liquidation level on their leveraged trade. When it comes to investing, usually less is more. The main obstacle between us and our goals isn’t research or perfect timing, it’s mental fortitude and management of emotions.

Portfolio snapshot as of January 27th, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. I still believe we have higher to go this cycle and all we have to do is survive the volatility until that happens. The end of the cycle is usually the most volatile, so having a plan is a pre-requisite for success. Relying on narratives and social media posts will result in panicking during buying opportunities and euphoria during profit-taking opportunities. That’s why I rely on simple yet effective metrics like Global Liquidity, sentiment and extensions from key moving averages. 2025 should be a wild ride. Glad I get to experience it will all of you. 🫡