The Weekly Close

After spending some time below the 50W MA at ~$103k last week, Bitcoin was able to close back above it. This is why it is so important to wait for weekly closes and not get caught up in short-term volatility throughout the week. For now, our macro structure remains intact. I would not be surprised if we retested the 50W MA this week to spook investors once again, but as long as we keep closing above it, I will continue to expect upside. If we close below it, we will have to shift our expectations.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment continues to be fearful. Many investors are capitulating here thanks to the 4-year cycle seasonality and concerning price action. Maybe they will end up being right, but emotions are usually a terrible guide in markets. Remaining calm and managing our risk during Greedy periods is exactly what allows us tor remain calm and collected during fearful periods like this one.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to chop around. We have not had a clear trend for months so it is no surprise that Bitcoin has been chopping around as well. We have some bullish catalysts on the horizon with the US Government shutdown ending and the announcement of the next FED chair expected soon. Both of which should help put the GLI back in an uptrend. Our job as investors is to be patient enough to survive the near-term volatility and see our long-term thesis play out.

Bitcoin and The Global Liquidity Index.

The US Dollar Index

The US Dollar Index continues to grind higher here thanks to the recent FED hawkishness and reduction in expected rate cuts. I still believe this is a short-term bounce that will roll over. The FED will need to ease more aggressively than the market is currently expecting to keep the economy and labor market from deteriorating drastically. We just need to survive long enough for that FED easing to play out.

The DXY.

The Bigger Picture

Bitcoin needs to hold above the 50W MA here for our Full Reset scenario to play out. A close below it will be a major warning sign that more downside and a longer correction could be underway. As usual, we will keep our minds open to multiple outcomes so that we are not blindsided by an outcome we thought was impossible.

Bitcoin Cycle Scenarios.

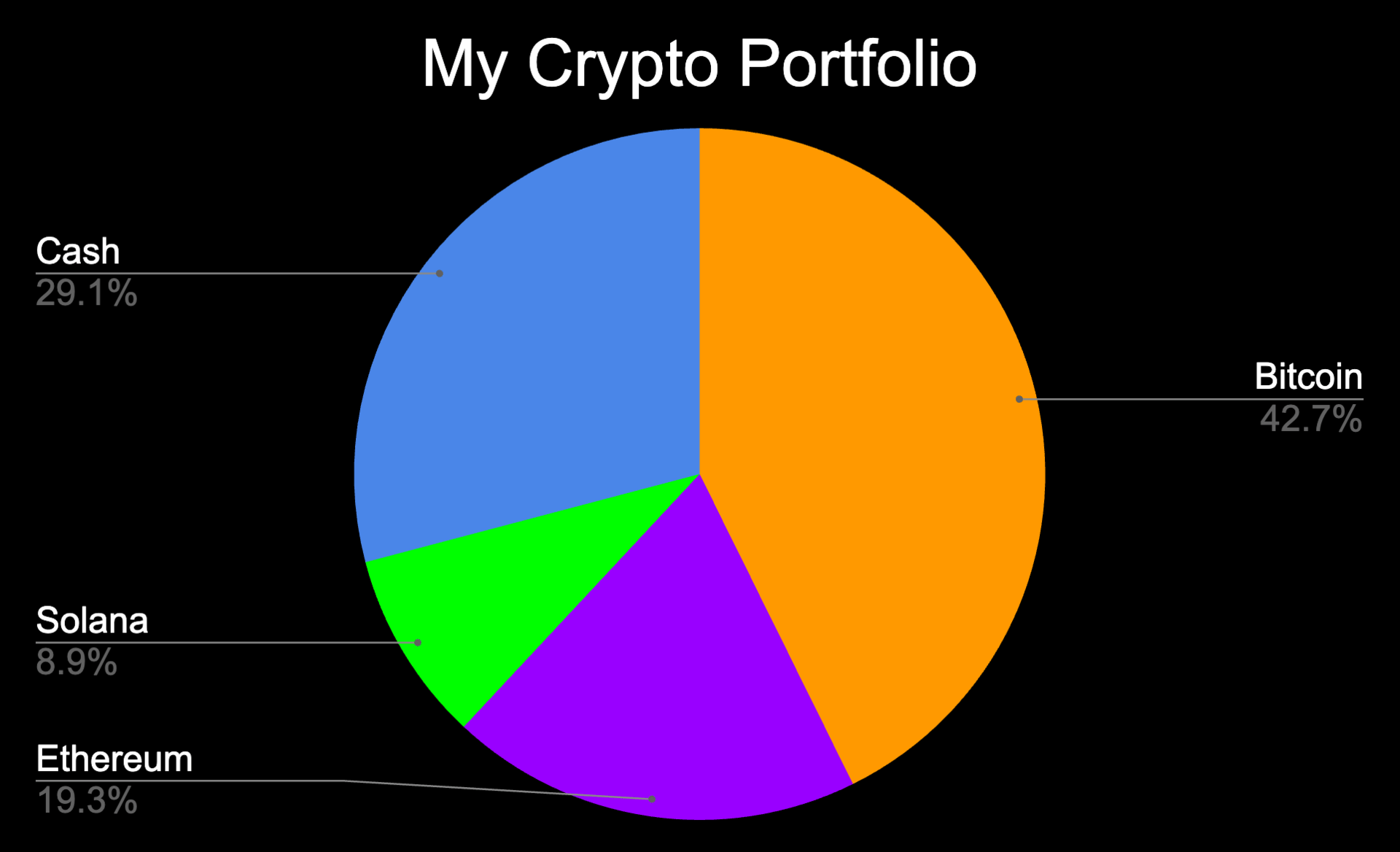

What I’m doing with my portfolio

No changes were made to my portfolio this week. Bitcoin closed above the 50W MA so our macro uptrend remains intact. Now we just have to sit back and see if bulls can maintain control with some follow through this week with another close above the 50W MA or if bears will take over with a close below it. I expect another week full of chop and volatility, but the clearest signal remains the weekly close.

Portfolio snapshot as of November 10th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝