The Weekly Close

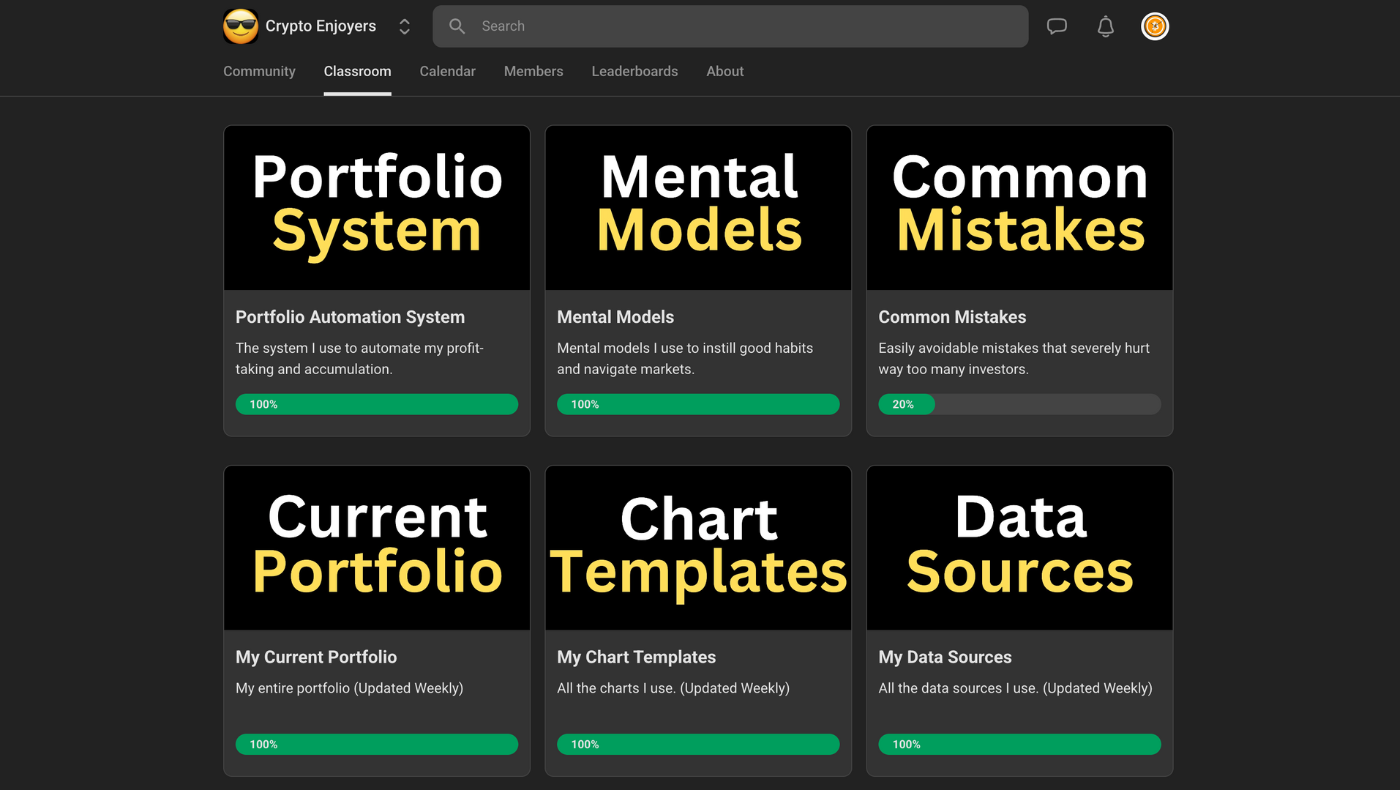

After a wild week of volatility, Bitcoin closed its weekly candle back below $114k. It would have been better to see a stronger close for Bitcoin, but price is still holding above our major pivot level at $109k. As long as we stay above that previous Range High, my base case is that Bitcoin still has higher to go.

The Bitcoin Weekly Chart.

Market Sentiment

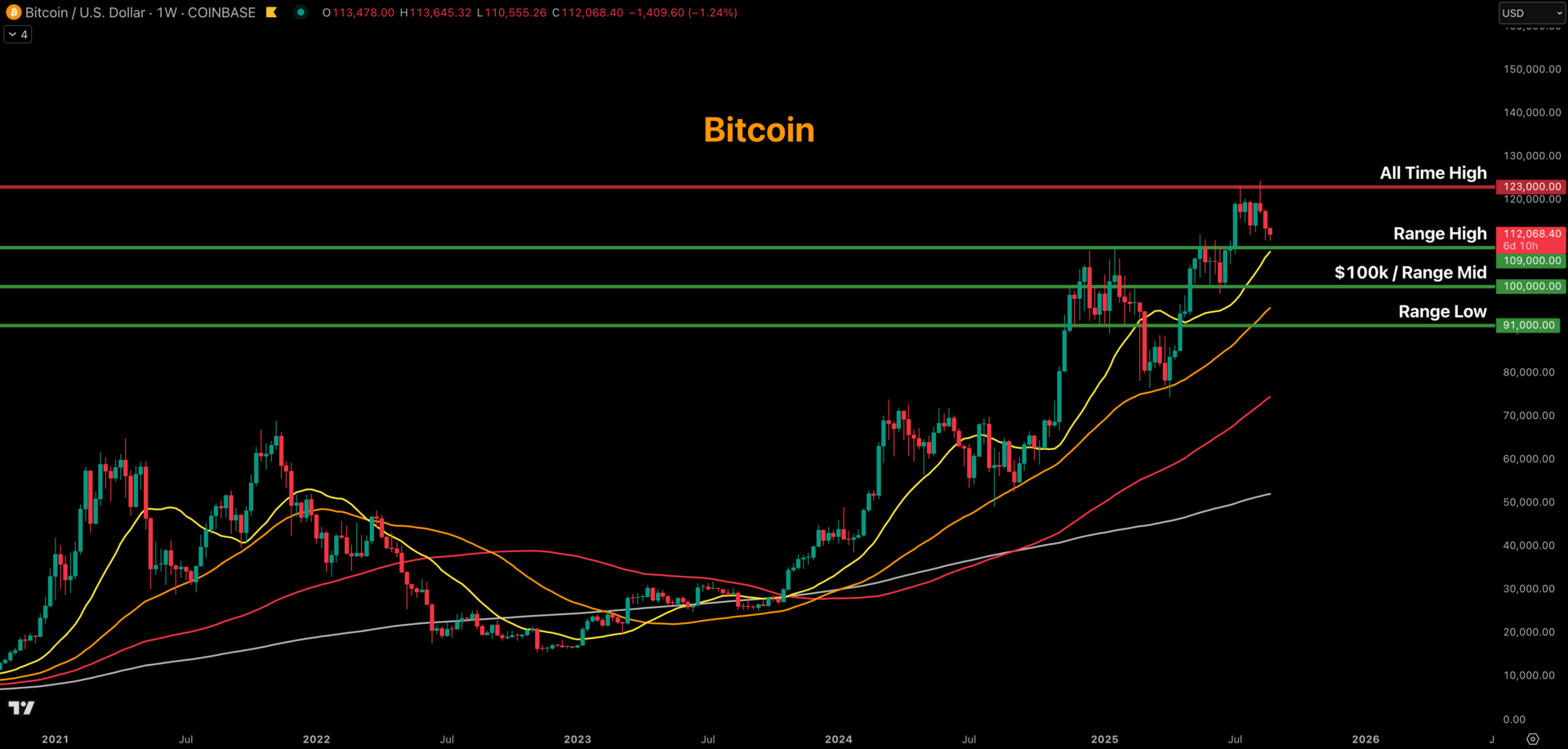

Market sentiment is now in the exact center of the Neutral region. This makes sense because price has been going sideways for a few weeks now. There seems to be an even split between investors that are terrified the top is in for the cycle and investors that are expecting way higher prices. For now, this looks like a healthy sentiment reset before our next move higher.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI is showing early signs of reversing its downtrend. It has bounced and is now going sideways near its previous highs. The next move by The GLI should have a large impact on risk assets. New highs would increase the likelihood that this cycle extends longer than we currently expect. New lows would further strengthen our conviction that we will have a major top in September. For now all we can do is monitor the data and see what happens.

Bitcoin and The Global Liquidity Index.

Inflation

We will be receiving an update to the FED’s preferred measure of inflation, Core PCE, on Friday, August 29th. We know how important rate cut expectations are to The GLI and investor sentiment. The market expectation for this Core PCE print is 2.9% YoY. Ideally, we would see this print come in at or below market expectations to prevent the market from pushing back rate cut expectations once again.

Core PCE.

The Bigger Picture

My base case is remains unchanged. I believe we will see a final push for Bitcoin sometime soon. What comes after that will rely heavily on what The GLI and rate cut expectations do over the next few weeks. As we long as we continue to monitor the data and prepared for multiple outcomes, we can’t lose.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

I rotated a good amount of profits from my Ethereum holdings into Bitcoin. It was incredibly difficult to do. Ethereum is the darling of the market right now and Bitcoin has become the boring choppy side act. However, following my system hasn’t failed me yet this cycle and I know it gives me the highest likelihood of success in the long-term. Being in Bitcoin also greatly reduces my downside risk compared to Ethereum after the incredible rally Ethereum has experienced over the past few weeks.

Portfolio snapshot as of August 25th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝