The Weekly Close

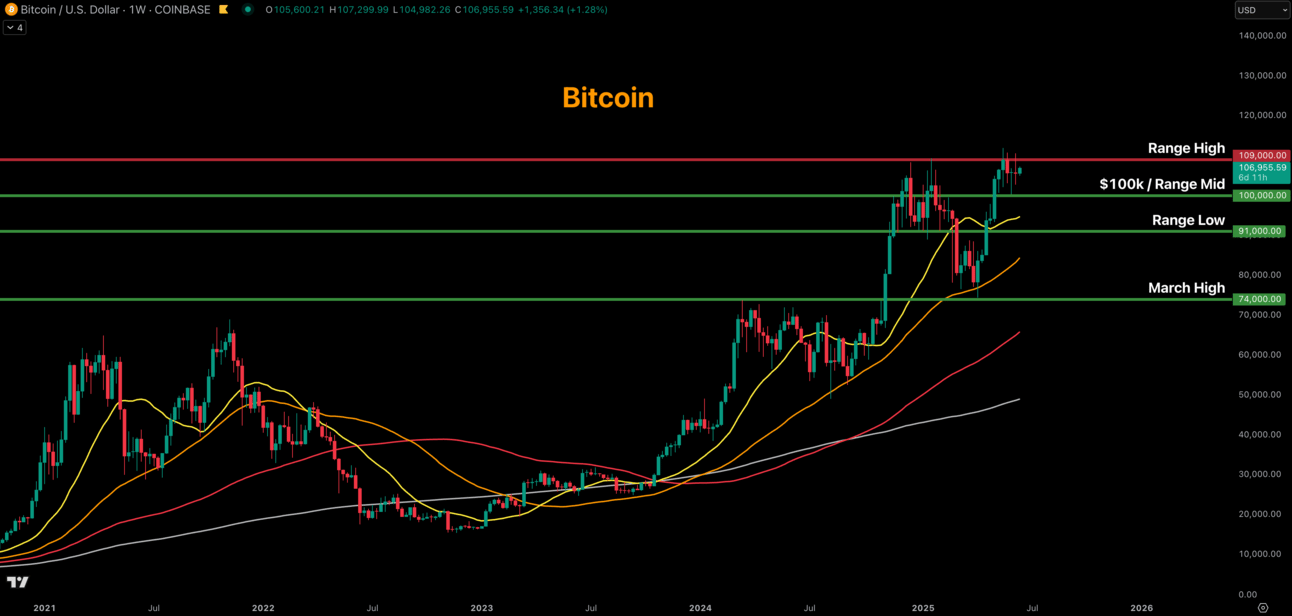

After another failed breakout above our $109k Range High, Bitcoin closed its weekly candle back under $106k. For now this just looks like healthy consolidation between our $109k Range High and $100k Range Mid. Another dip below $100k would not surprise me at this stage, but I do expect this pullback to be brief and for Bitcoin to re-enter price discovery soon.

The Bitcoin Weekly Chart.

Market Sentiment

After a brief rise into Greed last week, market sentiment is back in the Neutral region. It’s crazy to think that a $106k Bitcoin doesn’t even keep sentiment in Greed anymore. Sentiment seems to be worsening by the day as more and more market participants get frustrated that Bitcoin is not breaking out yet, but that is exactly what you’d expect from a sentiment reset.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues its relentless grind higher week after week. This is by far the longest GLI uptrend of the cycle and it is one of the main variables keeping me optimistic that this cycle still has higher to go. Bitcoin can still consolidate and have short-term corrections along the way, but the macro trend remains clear.

Bitcoin and The Global Liquidity Index.

Macro

This week is an FOMC meeting week so I expect market participants to keep a close eye on what the FED announces. The chances of a rate cut this meeting are essentially 0 because the FED has given the market a heads up before announcing every previous rate cut and they have not done that this time around. However, I will be listening to their comments surrounding ending QT quite closely. The FED Balance Sheet has stopped decreasing recently and I’m interested to see if the FED will announce when they plan to end QT if they haven’t ended it already.

The FED Balance Sheet.

The Bigger Picture

The worst case scenario I can realistically see for Bitcoin right not is a brief revisit of the mid to low $90ks, but we do not need to go that low. Bitcoin already hit the “Likely” region we laid out weeks ago and that checked off my minimum target for this correction. Anything below $90k would be a warning sign that the cycle may be over.

Bitcoin support levels and their probabilities of being revisited.

What I’m doing with my portfolio

No changes were made to my portfolio this week. Bitcoin continues to chop sideways so there really hasn’t been any reason to change anything. I’d love to see another dip buying opportunity before we enter price discovery, but I’ll still be happy with higher prices if that dip never happens. For now, all that’s needed is patience and discipline as this consolidation plays out.

Portfolio snapshot as of June 16th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, early bird pricing with lifetime access for the Crypto Enjoyers program is available as I finish building out the Mental Models course. You can learn more here:

I hope you have an amazing week and the future looks bright. 🤝