The Weekly Close

After a chop-filled week, Bitcoin closed another weekly candle below our $100k psychological resistance level. As long as we can hold above our local low at $91k, this remains a normal consolidation period to reset sentiment, wash out leverage and accumulate for our next move higher. I remain optimistic we will resolve this consolidation to the upside, but I am prepared for the alternative scenario where we don’t.

The Bitcoin Weekly chart.

Temperature Check

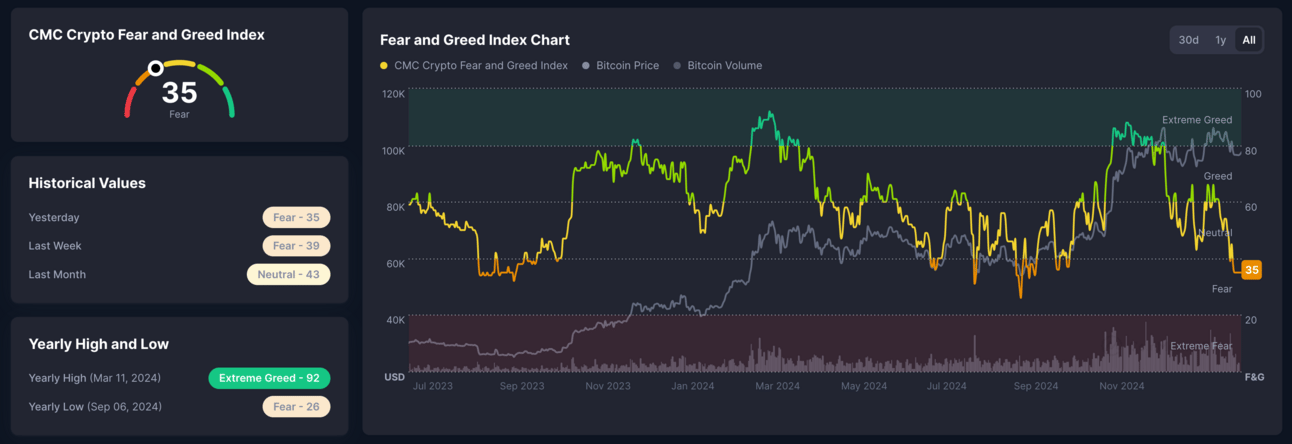

It’s crazy to think that just 2 months ago the market was in the “Extreme Greed” region and everyone was calling for a supercycle and altseason because the US would start buying Bitcoin. Here we are just 2 months later in the “Fear” region and now everyone is relatively certain the top is in and that we will never see alts go up again. I believe we will see “Extreme Greed” once again, the same way I knew we’d see “Fear” again during the “Extreme Greed” period last November.

The CoinMarketCap Crypto Fear and Greed Index.

Global Liquidity

Global Liquidity continues to consolidate after it’s recent bounce. We really want to see this metric continue higher alongside a drop in the DXY so that Bitcoin can have more juice to rally higher this cycle. We are still pricing in the Global Liquidity downtrend that ended recently in mid-January so we may still have some chop ahead of us in the short-term. However, we know central banks have only one option with an economy that is this indebted and that’s to continue increasing liquidity over time and I expect Bitcoin to be one of the main beneficiaries of that.

Bitcoin and The Global Liquidity Index.

Inflation

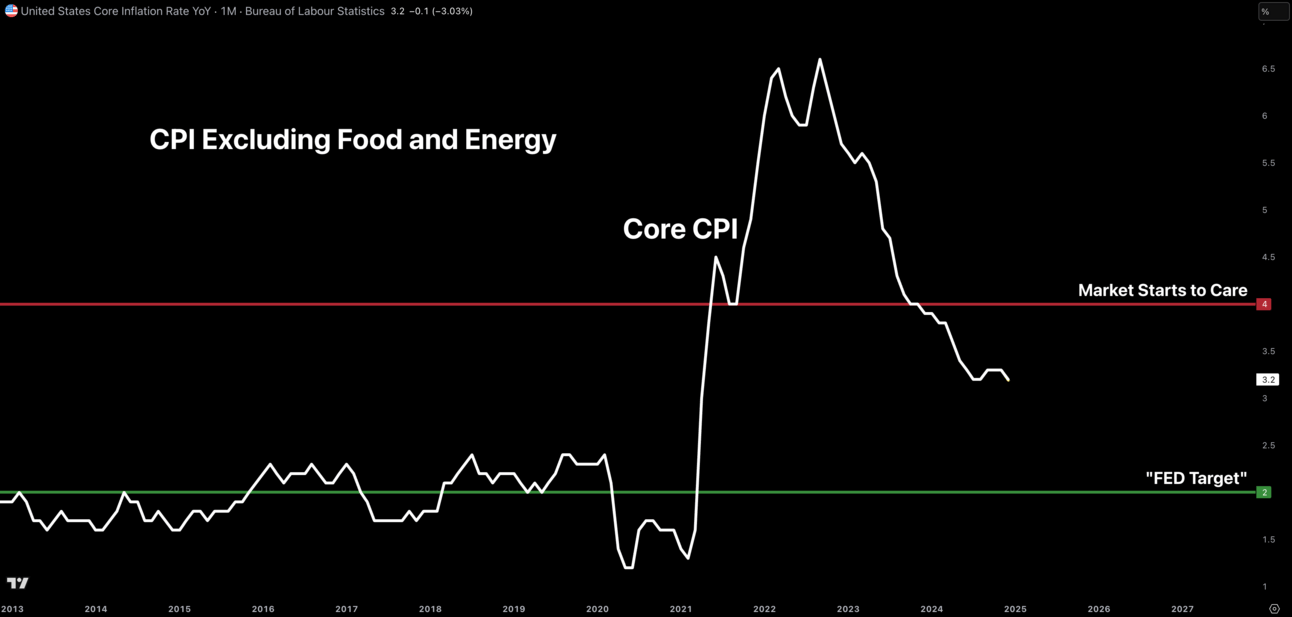

The most important economic data this week is Wednesday’s CPI print. After last week’s strong labor market print, we know the FED and the market will turn their attention to inflation to find out whether it is still decreasing or if it will start heating up again. The incoming print should have a large impact on FED rate cut expectations and markets as a result. The expectation going into the print is 3.1%, so we’d like to see that number or lower. A higher print would spook markets into believing inflation may be entrenched which would not be good for our risk assets like Bitcoin.

The Core CPI.

Big Picture

Zooming out and looking at the Bitcoin weekly chart makes it clear that this is just another consolidation phase during a bull market and that our assumption should be that the trend will continue. Could there be a black swan event that collapses everything? of course. Could this be a distribution range that ends the cycle here? of course. But markets and investing are a probabilities game with no guaranteed outcomes so I will continue positioning myself for what i believe is the most likely scenario while managing my risk enough so that I don’t get wrecked if I’m wrong.

Bitcoin Cycle Scenarios and their likelihoods.

What I’m doing with my portfolio

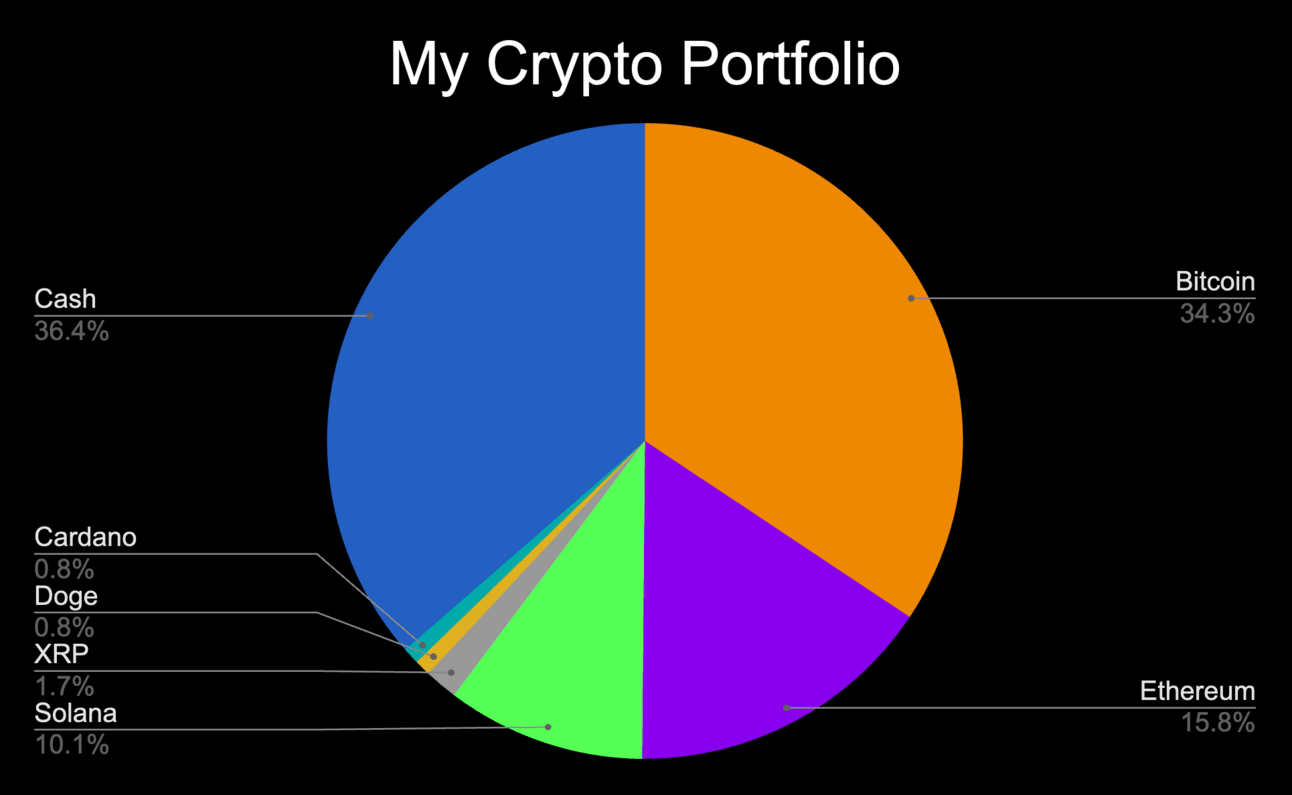

The combination of the market being fearful and my cash position reaching the upper bound of my 30-40% target, encouraged me to add some altcoin exposure yesterday. It’s also convenient that these larger and older market cap altcoins are first in line for ETFs, which should be a strong catalyst in the right conditions. These are not large positions compared to my existing holdings, but I want to slowly work my way towards a market cap weighted portfolio so that I can automate my decision making and also make my reasoning simpler for myself and everyone that enjoys my content. Over the next few weeks I will slowly shift my portfolio to my desired allocation percentages.

Portfolio snapshot as of February 10th, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. I know there’s a lot of fear and uncertainty being spread by content creators right now because that’s what gets clicks and views during these phases. The same way FOMO and promises of riches content does best during greed phases, but I do believe that the future is bright and that those of us that calmly and rationally navigate this time period will benefit greatly on the other side. I’d love to hear from you via a reply to this email if you have any questions or feedback so I know that someone is there on the other side. 😂 Otherwise, I hope you have an amazing week. 🤝