The Weekly Close

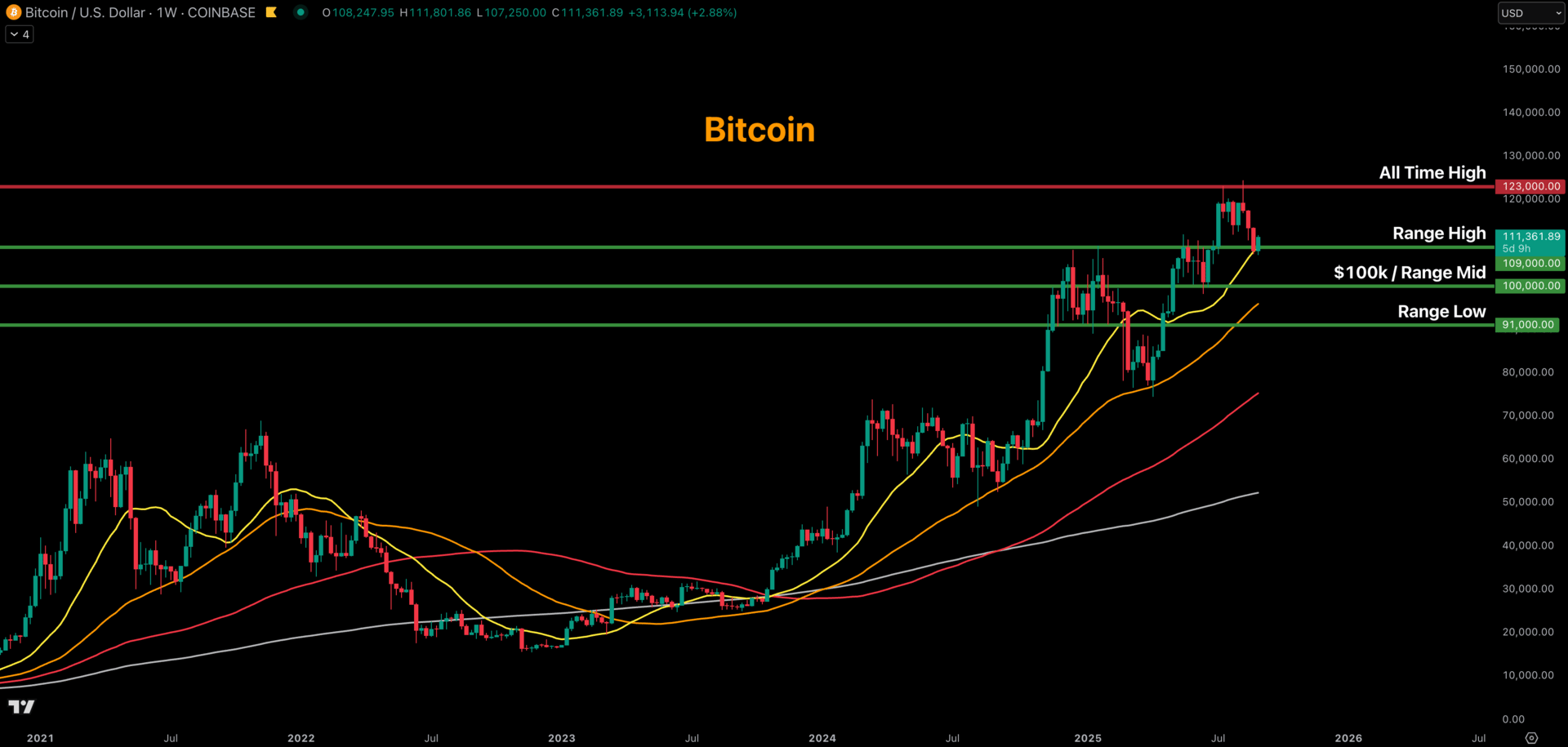

After a quick selloff and battle at the 20-week moving average over the weekend, Bitcoin closed its weekly candle just above $108k. This close was just below our $109k Range High, but was just above our 20-week moving average. For now this remains a bounce off support and we’ll have to see what price action looks this week to gain more clarity as to what comes next.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment has now slightly dipped into the Fear region. There is a ton of Fear out there right now surrounding recent price action and the Fear that we are repeating the exact same pattern as the 2021 cycle top. This is exactly what you’d expect during a late bull market correction. It’s important to have a plan in place so we are not caught off guard reacting to these emotions. I still believe it is highly unlikely we’ll repeat the exact same topping pattern as last cycle.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI has been almost perfectly flat for nearly a month now. It is clear that the September 17th FOMC meeting will be the deciding factor as to whether we make new highs or breakdown to new lows. If the FED doesn’t project enough rate cuts, we will likely see the GLI roll over. If the FED does come out dovish enough, we will see the GLI make new highs. All we can do for now is monitor the GLI and the economic data between now and the FOMC meeting to get a better picture of what’s to come.

Bitcoin and The Global Liquidity Index.

The Labor Market

We will be receiving an update to the FED’s preferred measure of employment, the unemployment rate, on Friday, September 5th. This labor market data will have a big impact on the market’s expectations for the upcoming FOMC meeting and rate cuts. The market currently expects an uptick from 4.2% unemployment to 4.3%. A print of 4.3% would lock-in the September rate cut, but a print higher than that would likely cause panic. These prints do tend to cause a lot of market volatility so it should be an interesting week.

The Unemployment Rate.

The Bigger Picture

It’s always helpful to zoom out and look at the bigger picture during these corrections. Bitcoin is still comfortably holding our first major support level at the Range High and 20-week moving average. If that were to break we still have our 50-week moving average at $96k which has acted as our last line of defense this entire cycle. As long as that level holds, my base case is that the cycle top is not in yet and Bitcoin still has higher to go.

Bitcoin Support Zones.

What I’m doing with my portfolio

No changes were made to my portfolio this week. I feel well positioned for all possible outcomes so it is easy for me to remain calm and collected during these corrections. We take profits during the rallies so that we can be patient and accumulate during the selloffs. I’m happy to deploy cash if we go lower while remaining above our 50-week moving average. I’m also happy to take more profits if we make new highs. 2025 has been a great year so far and I believe the best is still ahead.

Portfolio snapshot as of September 2nd, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝