The Weekly Close

After a chop-filled week, Bitcoin closed its weekly candle back above $110k. It continues to close above its Range High at $109k for now. Therefore, our macro structure remains intact. I am still keeping a close eye on the 50-week moving average. Which has now reached $103k. As long as we continue closing weekly candles above it, my base case remains that we have higher to go.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment remains fearful. Investors are very worried that the cycle is over and that we have already entered a bear market. Maybe they are right, but I would rather wait for the market to prove it rather than try to guess and predict what will happen each and every time the market rallies or sells off. If the cycle isn’t over, these fearful periods tend to be the best opportunities.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI is beginning to roll over here thanks to the recent strength of the US Dollar. The recent hawkishness from the FED combined with the ongoing US Government shutdown is putting downward pressure on liquidity. This will likely negatively impact Bitcoin in the short-term, but doesn’t really impact our medium to long-term thesis. We will likely have to sit through quite a bit of volatility over the next few months, but the rewards on the other side should be worth the wait.

Bitcoin and The Global Liquidity Index.

The FED Balance Sheet

The FED has announced that they will be ending Quantitative Tightening on December 1st. QT has been a large liquidity drain over the past few years and its end is a solid tailwind for risk assets. It’s hard to predict when QE will restart, but we know that the FED has no choice but to restart QE and help the US Government navigate its large fiscal deficit problem.

The FED Balance Sheet.

The Bigger Picture

Bitcoin is back in the “Fair Value” region. This doesn’t mean it’s time to throw our entire cash position into the market, but it can be seen as a buying opportunity for investors that are underexposed to the market and want to increase their exposure. If we have entered a bear market, there will likely be much better buying opportunities, but if the bull market remains intact, this is likely the lowest price should go before recovering.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

Deployed some cash across my positions this morning. I really didn’t want to, but following my system has yet to fail me this cycle. The hardest times to sell have always been the best times to do so and the hardest times to buy have always been the best times to do so. I still feel well prepared for multiple outcomes and my long-term thesis for BTC, ETH and SOL remain unchanged.

Portfolio snapshot as of November 3rd, 2025.

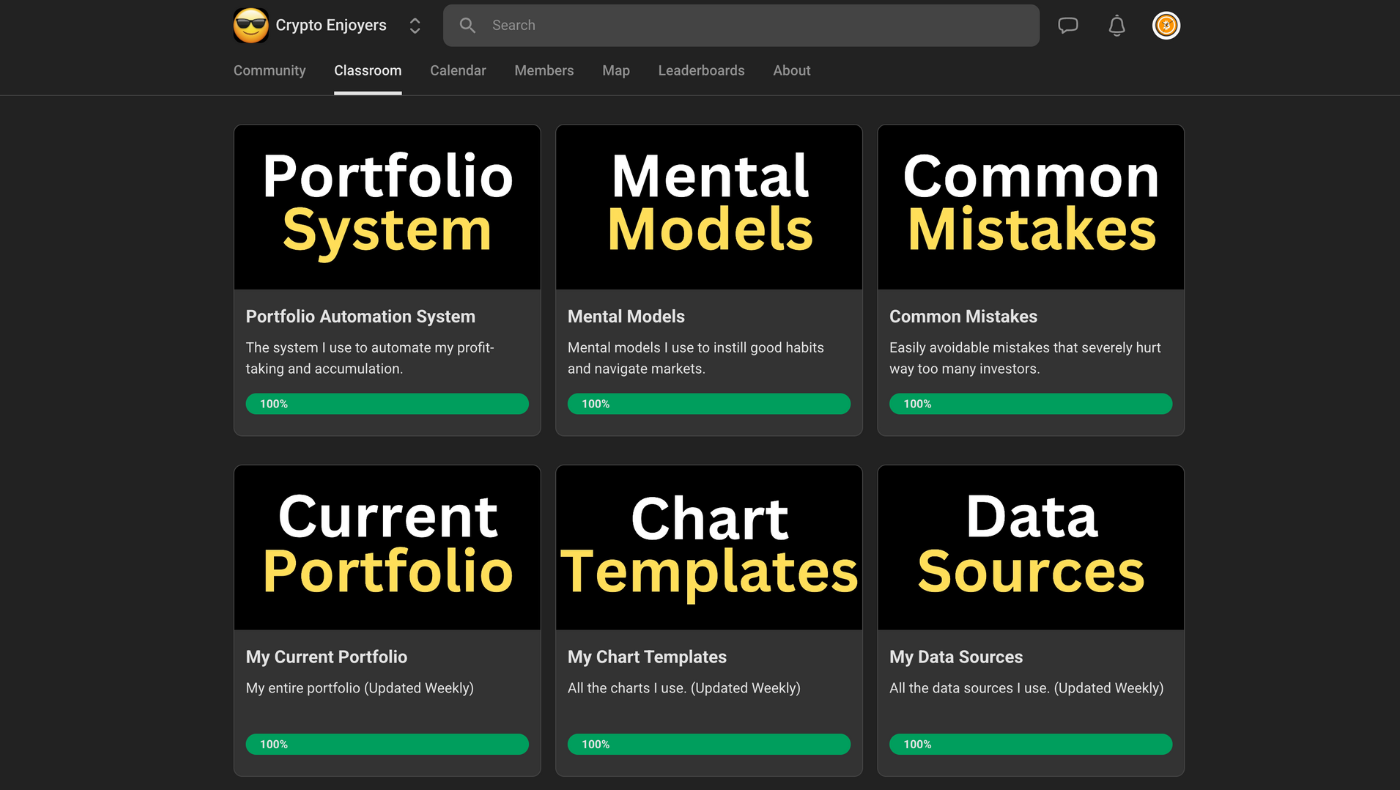

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. The lifetime access offer will be ending today and community access will become a monthly subscription. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝