The Weekly Close

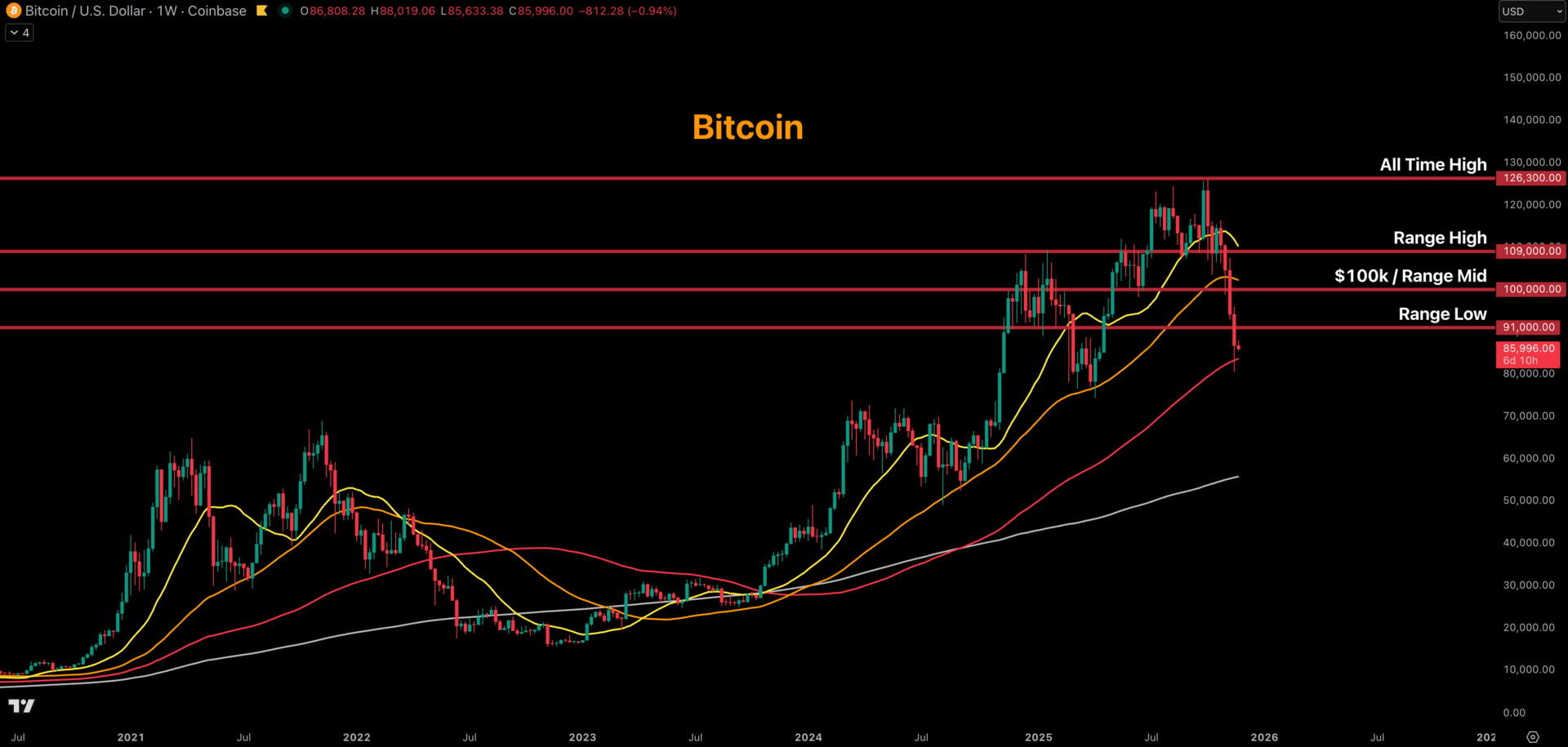

After another volatile week, Bitcoin closed its weekly candle just under $87k. It seems to have finally found some support at the 100W MA combined with our April 2025 accumulation region. We saw a lot of capitulation last week from investors who sold due to the close below the 50W MA. It’s too early to know for certain whether the local low is in, but it’s great to see buyers stepping in here. We now want to see Bitcoin hold support and start showing some follow through to the upside.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment remains in Extreme Fear. Many bearish narratives are starting to circulate and investors are throwing in the towel expecting Bitcoin to head much lower. My base case is that we are in a bear market, but that doesn’t mean it will be a straight path down. I am open-minded to Bitcoin proving me wrong and bottoming sooner than I currently expect, but we haven’t seen signs of that quite yet.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to head lower. The FED still hasn’t abandoned its hawkish tone and that is causing investors to push back rate cut expectations which strengthens the US Dollar and tightens liquidity. We know the FED will have to pivot eventually. Our job is to manage risk and survive until that time comes. The investors that are too optimistic on the timeline end up capitulating when price goes down for too long. While the investors that are too pessimistic end up sidelined when the pivot eventually happens. We have to remain patient and open-minded to succeed in the long-term.

Bitcoin and The Global Liquidity Index.

The DXY

The US Dollar continues to slowly grind higher putting downward pressure on global liquidity and risk assets as a result. The labor market is weakening and that is putting pressure on the FED to be less hawkish, but stubborn inflation is forcing them to ignore the labor market weakness for now. We need inflation to start heading in the right direction so that the FED can be more dovish and the market can become more optimistic on rate cut expectations. Until then, we will likely have to be patient and navigate quite a bit of volatility.

The US Dollar.

The Bigger Picture

Bitcoin dipped into the “Cheap” region for the first time in quite a while last week. It’s interesting that we saw quite a bit of selling from long-term holders and whales in the “Expensive” region. They clearly wanted to take some profits before mean reversion kicked in. We saw minimal buying in the “Fair Value” region and it wasn’t until we hit the “Cheap” region that serious money started to buy back in and create support. I plan to slowly accumulate in the “Cheap” region and accumulate aggressively in the “Very Cheap” region, if we get an opportunity to do so.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

I bought some BTC, ETH and SOL this morning. I can’t help but buy when I see this much fear and uncertainty among market participants. I have a long time horizon and I believe these purchases will look quite good in retrospect. I am taking my time and preserving cash as I accumulate so that I have plenty left over if and when we do see lower prices. Bear markets are a patience and survival game. They are very hard to navigate if you get caught up in the short-term volatility and don’t have a long-term plan and thesis.

Portfolio snapshot as of November 24th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

Crypto Enjoyers

Reduce Stress. Save Time. Make Money. Enjoy The Process.

www.skool.com/cryptocurrently

I hope you have an amazing week and the future looks bright. 🤝