The Weekly Close

After another wild week full of volatility for both Bitcoin and traditional markets, Bitcoin closed it’s weekly candle well below our $91k range low. We really don’t want to spend much time here because that would confirm the breakdown and lead to a much longer consolidation period. The good news is that we are also very close to the 50-week MA which tends to be reliable support for Bitcoin in bull markets. It wouldn’t surprise me if we tested the 50-week MA this week to fill the remainder of our CME gap and sweep our $78k low from 2 weeks ago.

The Bitcoin Weekly chart.

Temperature Check

For the first time ever, the CMC Crypto Fear and Greed Index reached “Extreme Fear”. The market is more fearful today than our August 2024 capitulation bottom at $49k during the Japanese Yen Carry Trade drama and lower than our September 2023 capitulation bottom at $25k after the SEC sued Binance and Coinbase. These market extremes do not last for long. For weeks we said Extreme Greed would come to an end as we took profits. Now we have to remember that Extreme Fear will come to an end as well.

The CoinMarketCap Crypto Fear and Greed Index.

Global Liquidity

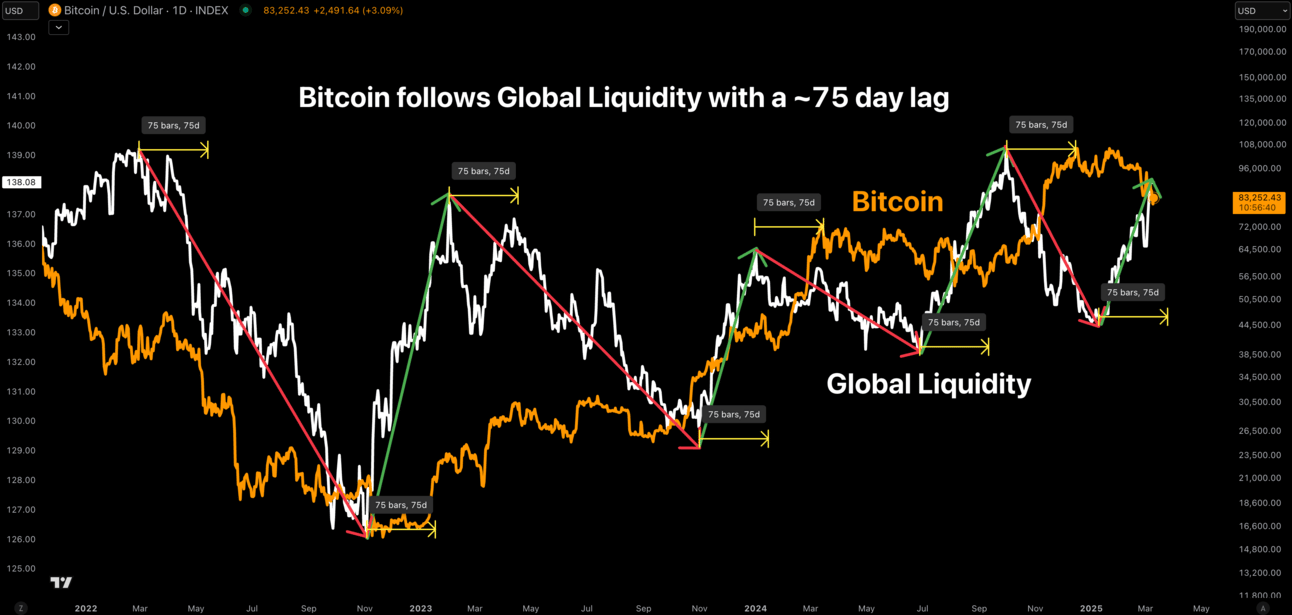

Global Liquidity continues to aggressively trend higher thanks to the drop we have seen in the DXY. It’s amazing how the previous downtrend in Global Liquidity encouraged us to take profits during Extreme Greed when everyone was bullish and now it’s giving a very clear signal that Bitcoin should follow within the next 1-2 weeks while everyone is giving up hope and turning bearish. It would be incredible if we saw the same pattern play out again. If Global Liquidity continues to lead Bitcoin by ~75 days, we should see Bitcoin start rising by the end of March.

Bitcoin and The Global Liquidity Index.

The DXY

The drop we saw in the DXY last week was truly extraordinary. It’s the largest single week drop since November of 2022 when Bitcoin found it’s bear market bottom and we have only seen 2 other drops like it in the past 10 years. The dollar’s reserve currency status means that a weaker dollar makes US debt easier to pay globally and that results in the increasing Global Liquidity wee keep discussing. I have a hard time being bearish Bitcoin here after the DXY put in this type of move.

The DXY.

Big Picture

The Bitcoin bull market is at a pivotal inflection point. We are now right above the 50-week MA which coincides with our March 2024 high. Weekly closes below that level would invalidate my thesis and let me know that this cycle is likely over. So this is the best risk-reward area on the chart for Bitcoin. If the cycle isn’t over, we should bottom around these prices, if it is, we will have to adjust accordingly. There are many factors lining up for a bottom in Bitcoin and traditional markets by late March. We just have to weather the storm until then.

Bitcoin cycle scenarios and their probabilities.

What I’m doing with my portfolio

I deployed some more cash this morning, not because I think the bottom has to be in, but because I believe we should bottom around these prices if the cycle isn’t over. My system tells me to DCA out during Extreme Greed when my cash percentage becomes too low and it tells me to DCA in during Extreme Fear when my cash percentage becomes too large. This is the exact opposite of what my emotions and the current narratives are telling me to do, but I have found this to be the best way to navigate markets and make the correct decisions when the time comes.

Portfolio snapshot as of March 10th, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. I know these time periods in the market are tough for many because prices are going down, but it’s important to remember that this is the natural cyclicality of markets and human emotions. I’m currently building out a program to teach my portfolio management system and everything else I use to navigate markets. This is something that’s been requested for years now and I finally have the time to make it happen. You can check it out here if you’d like:

I’m optimistic that the best is still ahead although it may not feel like it right now. I hope you have an amazing week. 🤝