Weekly Close

After a relatively quiet week of price action, Bitcoin closed its weekly candle ever so slightly below our $69k support level. Ideally we would have closed above it, but $200 below it doesn’t really give us a clear signal of a breakdown. We’ll have to see how this week’s price action develops to see if Bitcoin will maintain above $69k or spend more time chopping around in this area.

The Bitcoin Weekly Chart.

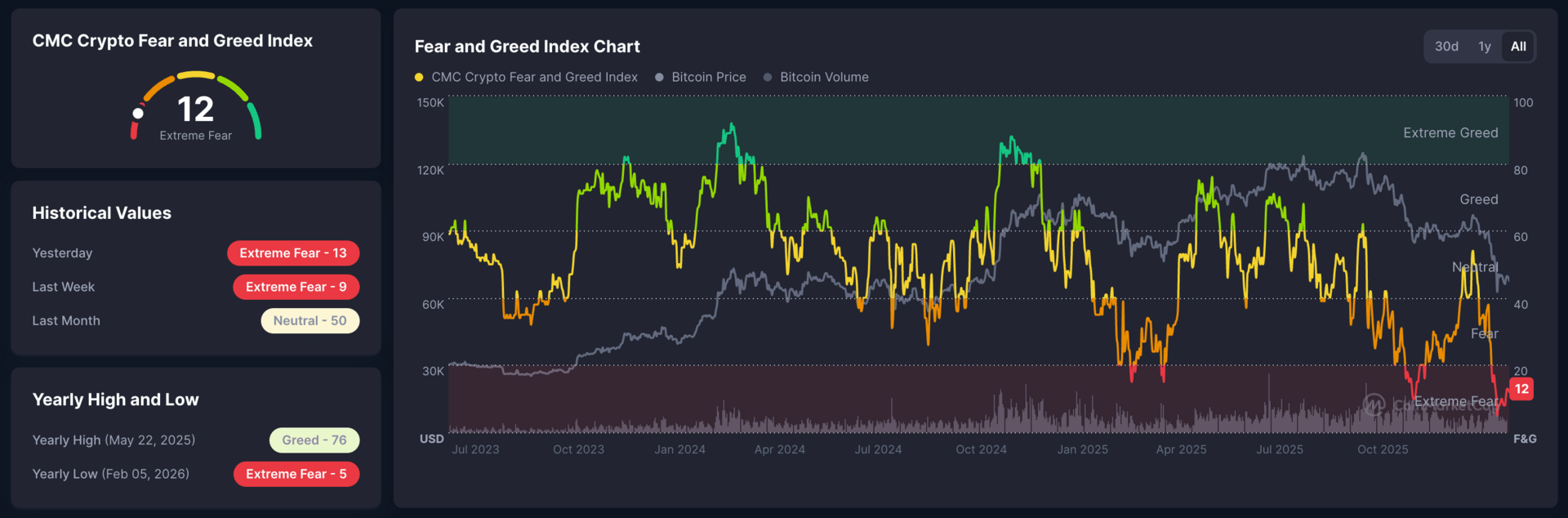

Market Sentiment

Market sentiment remains extremely fearful. There has been minimal relief so far and this is keeping investors quite concerned that Bitcoin is going to go lower. This is the exact sentiment we want to see when we are slowly accumulating an asset. Extremes in sentiment make investors do things they wouldn’t otherwise do in a calmer environment and that’s why it provides such great opportunities to go against the herd.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to head higher. We are within the time window where Bitcoin usually begins to follow. In 2022, The GLI had already started rolling over by this time in the year. Showing clear signs of tightening liquidity thanks to the FED rate hikes and balance sheet reduction. However, this time we have The GLI rising rapidly and a FED that plans to cut rates and increase their balance sheet in 2026. We will find out soon whether or not the main driver of Bitcoin is liquidity or the 4-year cycle.

Bitcoin and The Global Liquidity Index.

Inflation

We will be receiving an update to the FED’s preferred measure of inflation, Core PCE, on Friday, February 20th. CPI came in cooler than expected last week and that resulted in the market pricing in an additional rate cut for 2026. We now want to see that trend of slowing inflation continue. This will give the FED more room to cut rates and send The GLI higher.

Core PCE.

The Bigger Picture

Bitcoin is still comfortably within the lower half of our “Cheap” region. An asset being cheap does not mean that its value with skyrocket immediately or that it can’t get cheaper, but it does mean that investors with a long time horizon will likely be happy they accumulated at these prices years from now. We will of course make sure to save some dry powder incase we are granted the opportunity to accumulate in the “Very Cheap” region later in the year.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

I purchased more Bitcoin this morning. Not because I believe the low has to be in, but because I can’t help, but buy an asset I want to hold long-term when it is this oversold while everyone is extremely fearful. I look forward to accumulating in the “Very Cheap” region if we get the opportunity, but I am not convinced that we have to there given the liquidity backdrop. So I am taking advantage of the “Cheap” region while we have it.

Portfolio snapshot as of February 16th, 2026.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to view my entire portfolio and would like to learn more about my Portfolio Automation System, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝