The Weekly Close

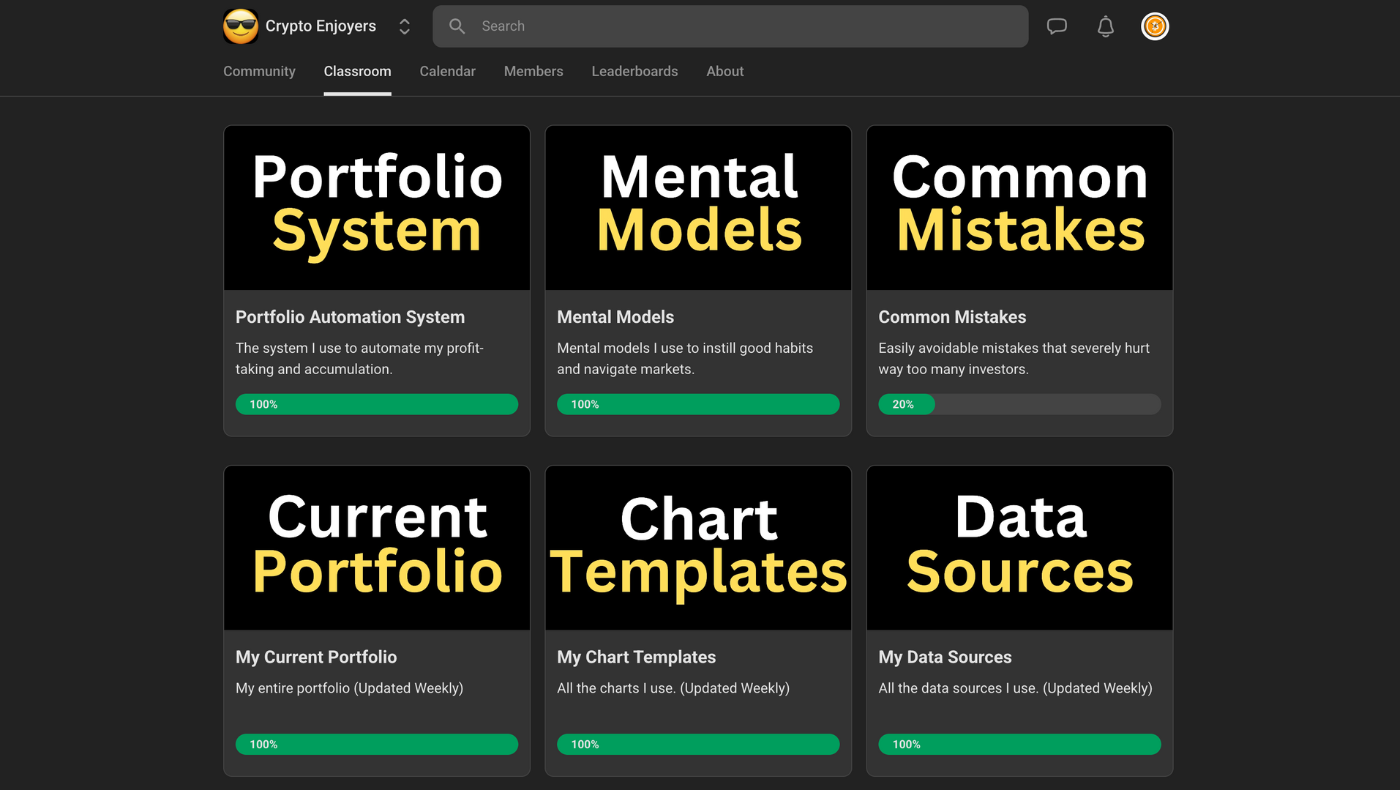

After a decent bounce back into our trading range last week, Bitcoin closed its weekly candle right above $115k. For now, this looks like a clean bounce off of support at our previous Range High and 20-week moving average. It’s too early to get overly excited because this could end up being a bounce into a lower high, but I believe that will come down to what we hear from Powell at this week’s FOMC meeting.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment is back near the exact center of Neutral at 51. It’s clear that market participants are very uncertain going into this week’s FOMC meeting. I would be much more concerned about a cycle top if we saw Greed or Extreme Greed going into the FED rate cut. So for now this looks like standard consolidation as market participants try to figure out what the next trend will be.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI just made a new high for the first time since July 1st. This gives me a lot of optimism that this cycle hasn’t topped yet. Although this is a great sign for risk assets, we have to remember that it is only one tool in our toolkit. Hopefully we can maintain this breakout going into the FOMC and afterwards.

Bitcoin and The Global Liquidity Index.

The Labor Market

Last week, Initial Jobless Claims, our proxy for layoffs, had a big surprise to the upside. One upside surprise isn’t enough to be considered a new trend, but this market will be watching this week’s print very closely. The market expectation is that Initial Jobless Claims will drop back to 243k in the print coming this Thursday, September 18th. Another upside surprise would spook markets into thinking this is the start of a concerning trend. So we really want to see this metric cool off and ease investor concerns.

Initial Jobless Claims.

The Bigger Picture

The new high by The GLI today is giving us more confluence that this cycle still has higher to go. Now we just need to see what the FED tells us at the FOMC meeting to confirm that thesis. It is still hard to tell whether we are entering the blowoff top phase right now or if it will still take more time, but I’m sure we will get the answer to that soon.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

I took some profits on my Solana position this morning. It has had quite the nice rally recently so it was difficult to do, but sticking to my Portfolio System has not failed me yet this cycle. I know Solana is the darling of the market right now with new treasuries being announced and spot ETFs around the corner, but I still have plenty of upside exposure to take advantage of that. I have found that taking small profits on the way up is a much easier way to navigate this market than trying to time everything perfectly.

Portfolio snapshot as of September 15th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝