Weekly Close

After another week of chop, Bitcoin closed its weekly candle just under our Range Low at $91k. Bitcoin has spent quite a bit of time in this tight range, so the next move will likely be a big one. It’s tempting to try and predict the move before it happens, but I prefer to wait for the market to decide. Big breakouts out of these tight ranges tend to set the new trend for awhile so there will be plenty of time to adjust once we see confirmation.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment remains in the Neutral region. This consolidation period has completely reset sentiment so the market is now primed for a big move. If we are in a bear market, this sentiment reset will provide the fuel for downside continuation. If we are in a bull market, we should expect Greed in the very near future. It will be interesting to see what direction Bitcoin chooses.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI is trying to head higher and start a new uptrend, but for now it is still within the same range it has been in for months. A new GLI uptrend would be a great tailwind for Bitcoin and could even reverse our downtrend, but for now that hasn’t happened yet. Bitcoin has been struggling ever since the GLI flatlined so we really want to see a new uptrend for the GLI soon.

Bitcoin and The Global Liquidity Index.

Inflation

We will be receiving an update to CPI tomorrow on Tuesday, January 13th. The market is expecting CPI to rise to 2.7%. We know that inflation is the main reason the FED is remaining stubborn with rate cuts and their rate of QE so I expect the market to watch this upcoming print very closely. A lower than expected print will pull rate cut odds forward and help The GLI. While a higher than expected print would push rate cuts even further back.

Core CPI.

The Bigger Picture

I still believe the lows are not in for 2026 yet. I’d love nothing more than to see Bitcoin head right back to new all time highs from here, but that’s not the base case as of right now. 2026 will likely be full of volatility and surprises so being prepared for multiple outcomes remains crucial. We should get more clarity on what path Bitcoin is going to take very soon.

Bitcoin Cycle Scenarios.

What I’m doing with my portfolio

No changes were made to my portfolio this week. A lot of pain has been avoided by remaining patient and not trying to trade this tight range. I do expect a big move soon so I look forward to taking some profits if it is a move to the upside or buying the dip if it is a move to the downside. In the meantime, I will wait for this week’s close and confirmation of a breakout before jumping to any conclusions.

Portfolio snapshot as of January 12th, 2026.

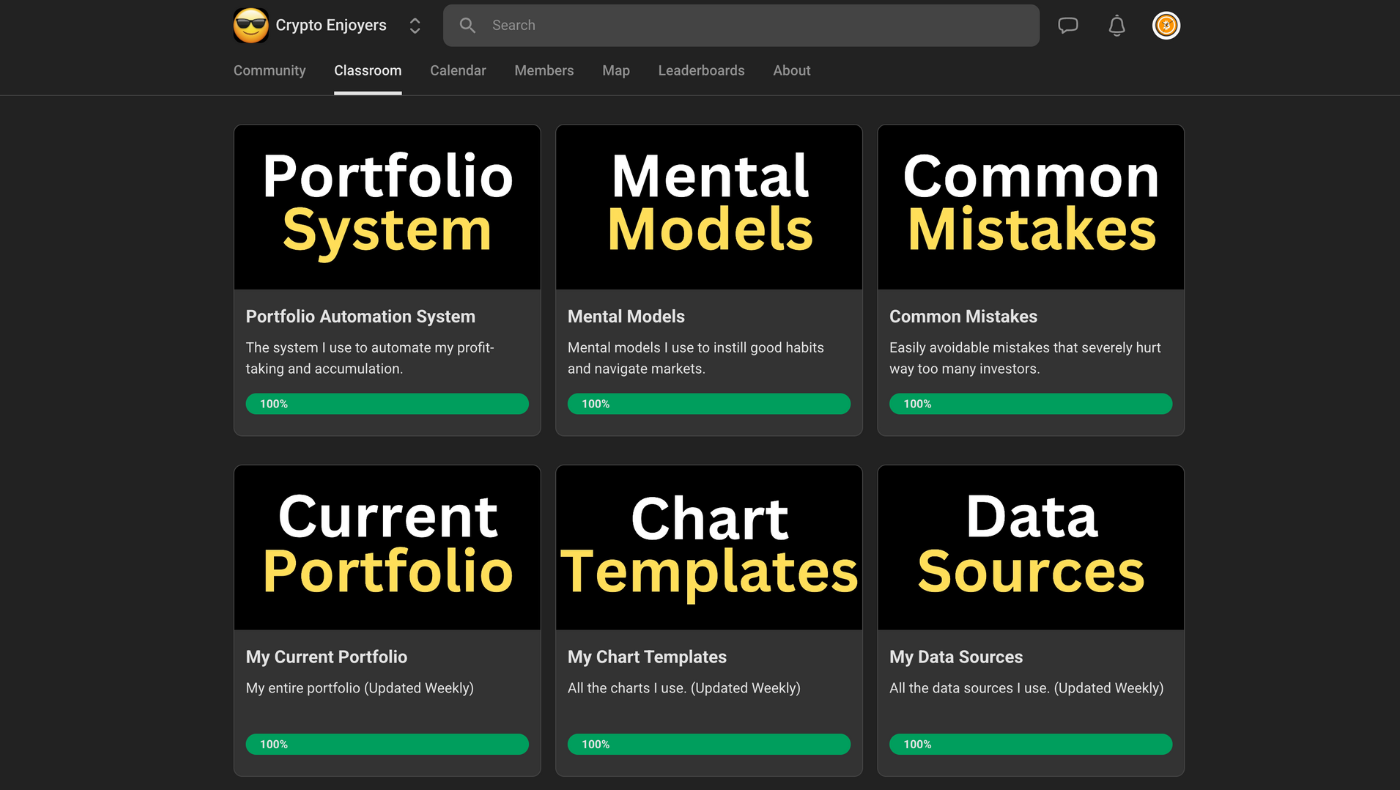

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to view my entire portfolio or would like to learn more about my Portfolio Automation System, checkout the Crypto Enjoyers program and community. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝