The Weekly Close

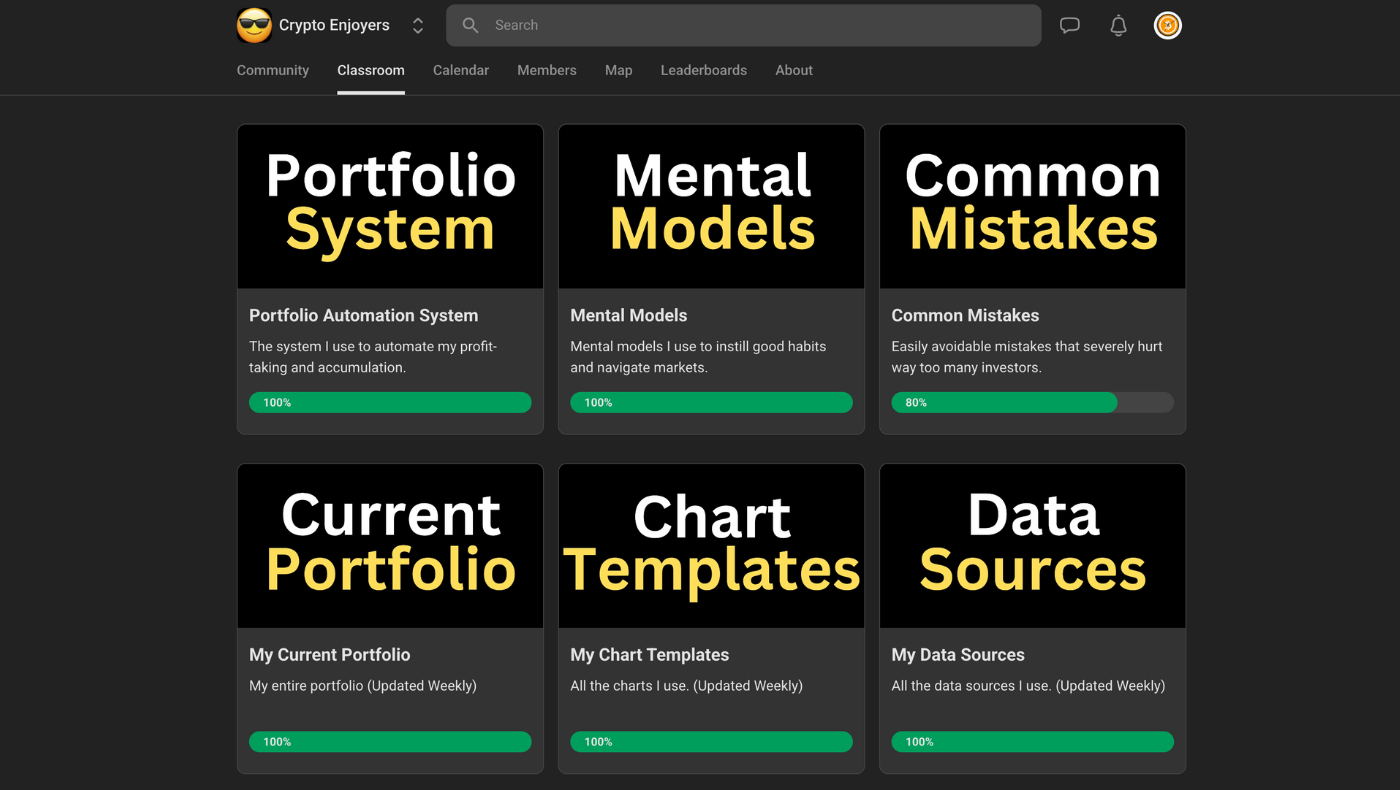

After an impressive rally last week and briefly making a new all time high over the weekend, Bitcoin closed its weekly candle just below $124k. We are knocking on the door of price discovery and I don’t see any major warning signs in the price action quite yet. This is when many investors start trying to predict the exact top and fight the trend. It is much easier to remain calm and patient and wait for the market to show us signs of weakness. Until then our base case should be that we are heading higher.

The Bitcoin Weekly Chart.

Market Sentiment

Market sentiment is at the top of our Neutral region. One more push higher and we will see Greed return to this market. It’s crazy to think that just 2 weeks ago the market was fearful and people were saying that the top was in. No matter how many times I watch this pattern play out, it still amazes me how quickly price action can change investor sentiment. Now it is our job to remain calm during the Greed the same way we remained patient during the Fear.

The CoinMarketCap Crypto Fear and Greed Index.

The Global Liquidity Index

The GLI continues to chop around near its recent highs. It is too early to assume that this is the beginning of a new downtrend, but we will have to monitor this closely over the next few weeks. As of right now the The GLI says Bitcoin should be in the clear until about late November. Once we get closer to that date, we should have more clarity as to what comes next. I will never follow this indicator blindly, but it continues to be a valuable tool in our toolkit.

Bitcoin and The Global Liquidity Index.

The US Dollar

Thanks to the US government shutdown delaying economic data releases, the DXY has been chopping sideways. A breakdown here would provide a strong tailwind for The GLI and risk assets as result, but there could be a mean reversion bounce to the upside before that happens. We’ll have to keep an eye on the price action and wait for the economic data releases to return.

The US Dollar Index.

The Bigger Picture

Bitcoin is now in the upper half of our “Expensive” region. This doesn’t mean it is time to sell everything and run for the hills, but it does mean I will hold off on any new purchases while we are in this range. I would love to take some profits in the “Very Expensive” region if this Q4 rally continues and will happily deploy some cash in the “Fair Value” region if we go that low. Otherwise, I will just sit on my positions and let the market handle the rest.

Bitcoin’s value based on how extended price is from its 200-week moving average.

What I’m doing with my portfolio

No changes were made to my portfolio this week. My allocations are all at or near their targets and I don’t see any major warning signs regarding Bitcoin’s price action as of right now. I will happily lock-in some more profits if we see continuation higher over the next few weeks, but I also feel quite calm knowing I am well protected if we get surprised by downside. For now, there isn’t much to do but sit on our hands and enjoy the ride.

Portfolio snapshot as of October 6th, 2025.

P.S. If you made it to the end of this report, thank you for reading and I hope you got some value from it. If you’d like to learn more, checkout the Crypto Enjoyers program and community. I am working on the final module for the “Common Mistakes” course and once that is completed, the program and community will be moving to a subscription. You can learn more about it here:

I hope you have an amazing week and the future looks bright. 🤝