The Weekly Close

After a relatively quiet week, Bitcoin closed it’s weekly candle just under $88k. We are slowly approaching our old range low at $91k, but it’s still too early to know whether this is just a bounce into a lower high before Bitcoin rolls over again or if this is the start of a new rally towards a new all time high. I am leaning towards a rally to new highs, but we need to wait for a reclaim of $91k before jumping to conclusions.

The Bitcoin weekly chart.

Temperature Check

Market sentiment has been slowly rising alongside Bitcoin’s price over the past few weeks. It’s normal for sentiment to reset after reaching such extreme levels of fear. We tried our best to be greedy while others were fearful at the low, now we just have to wait and see how price develops and how that will impact Bitcoin over the next few weeks.

The CoinMarketCap Crypto Fear and Greed Index.

Global Liquidity

The most promising piece of evidence that this is the start of a new Bitcoin rally and not just a bounce into a lower high is the continued increase in Global Liquidity. It has been in an uptrend for almost 70 days now and I believe it’s only a matter of time before Bitcoin follows it. I know there is disagreement over the correct lag amount, but the important thing to remember is that whether it’s a 75 day lag or a 105 day lag or anything in between, Bitcoin should see higher prices over the next few weeks as a result of this Global Liquidity uptrend.

Bitcoin and The Global Liquidity Index.

Macro

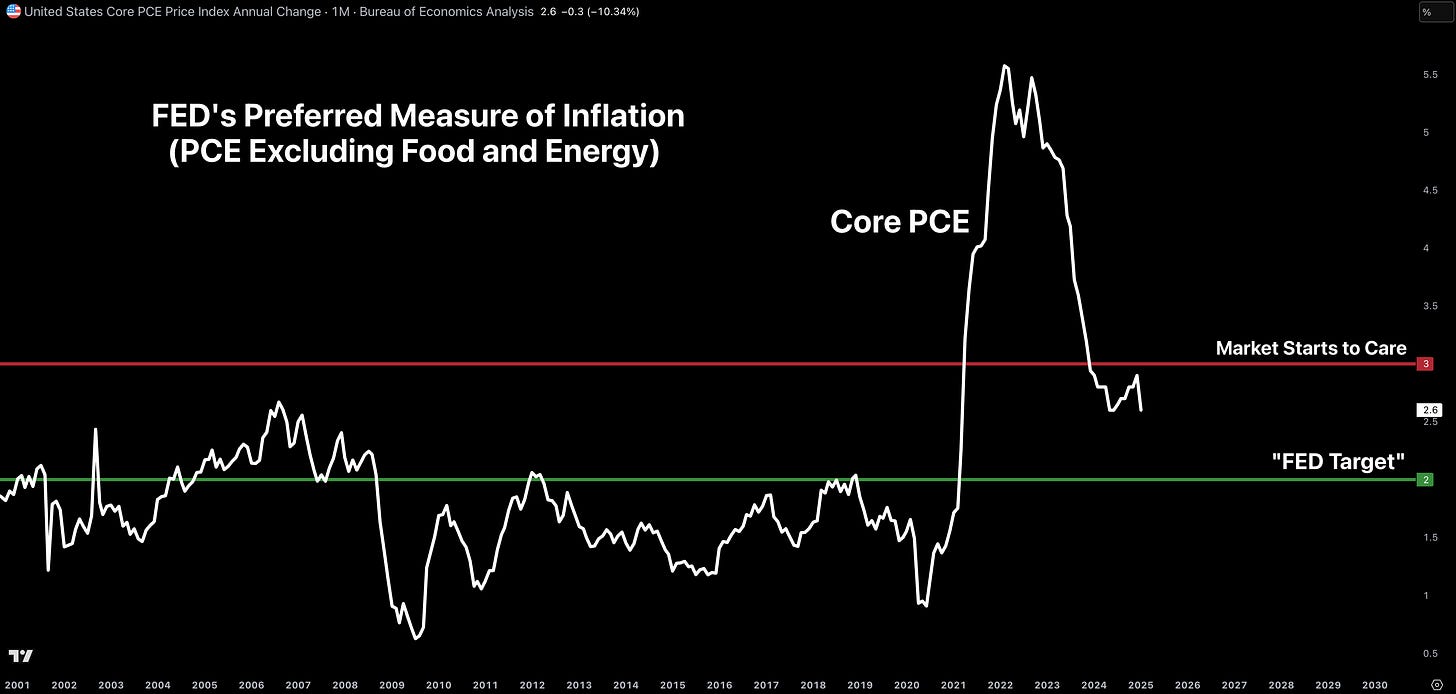

We have an important inflation print happening this Friday. Core PCE is the FED’s preferred measure of inflation so PCE data tends to have a strong impact on rate cut expectations and the DXY as a result. We really want the numbers to come in-line with market estimates or below them. The last thing we want to see here is a hot inflation print because that would likely spook markets.

Core PCE

Bigger Picture

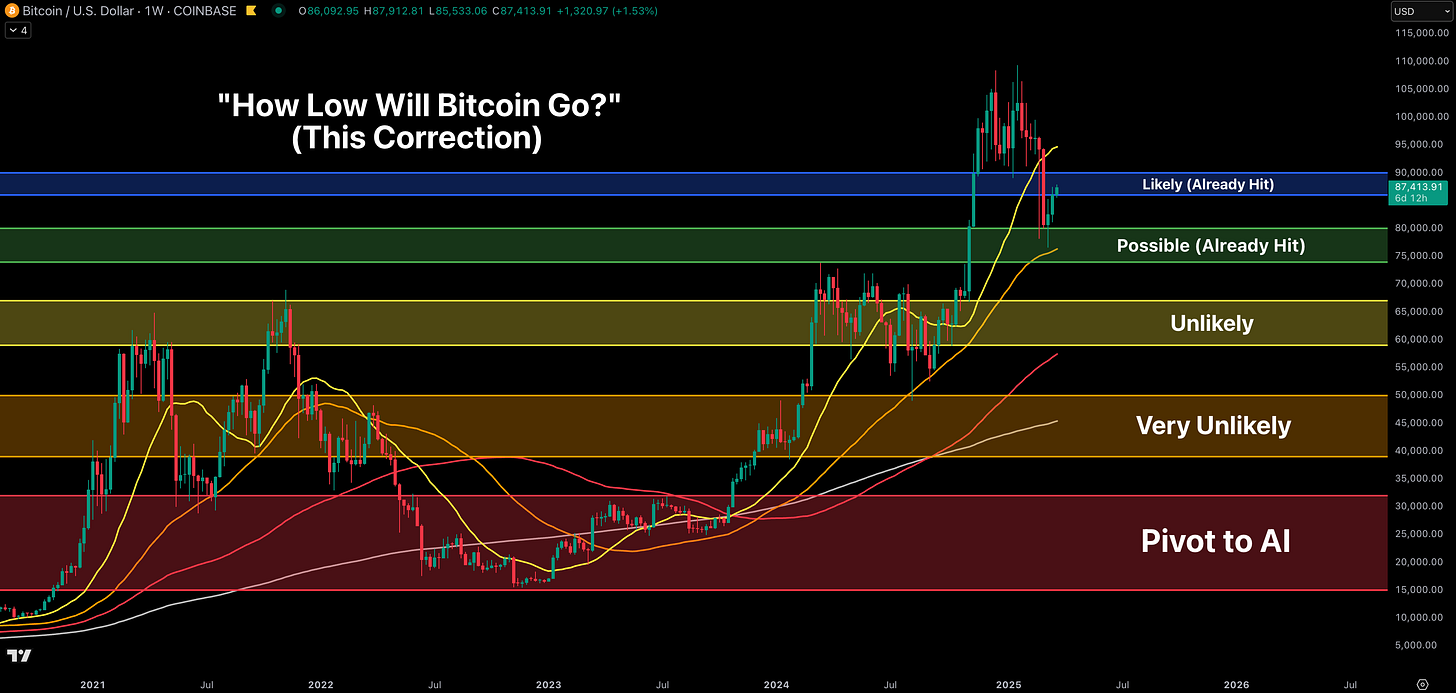

Bitcoin can still chop around between $80k and $90k, but I have been consistent with my base case that it is unlikely that Bitcoin would trade below $74k as part of this correction. I’m open to other outcomes, but as of right now the market seems to be supporting that view. Many investors lower their price targets as price goes down and raise them as soon as the market bounces. I have found having a plan with a set invalidation and sticking to it to be a way more profitable approach.

Bitcoin support regions and the probability of reaching them.

What I’m doing with my portfolio

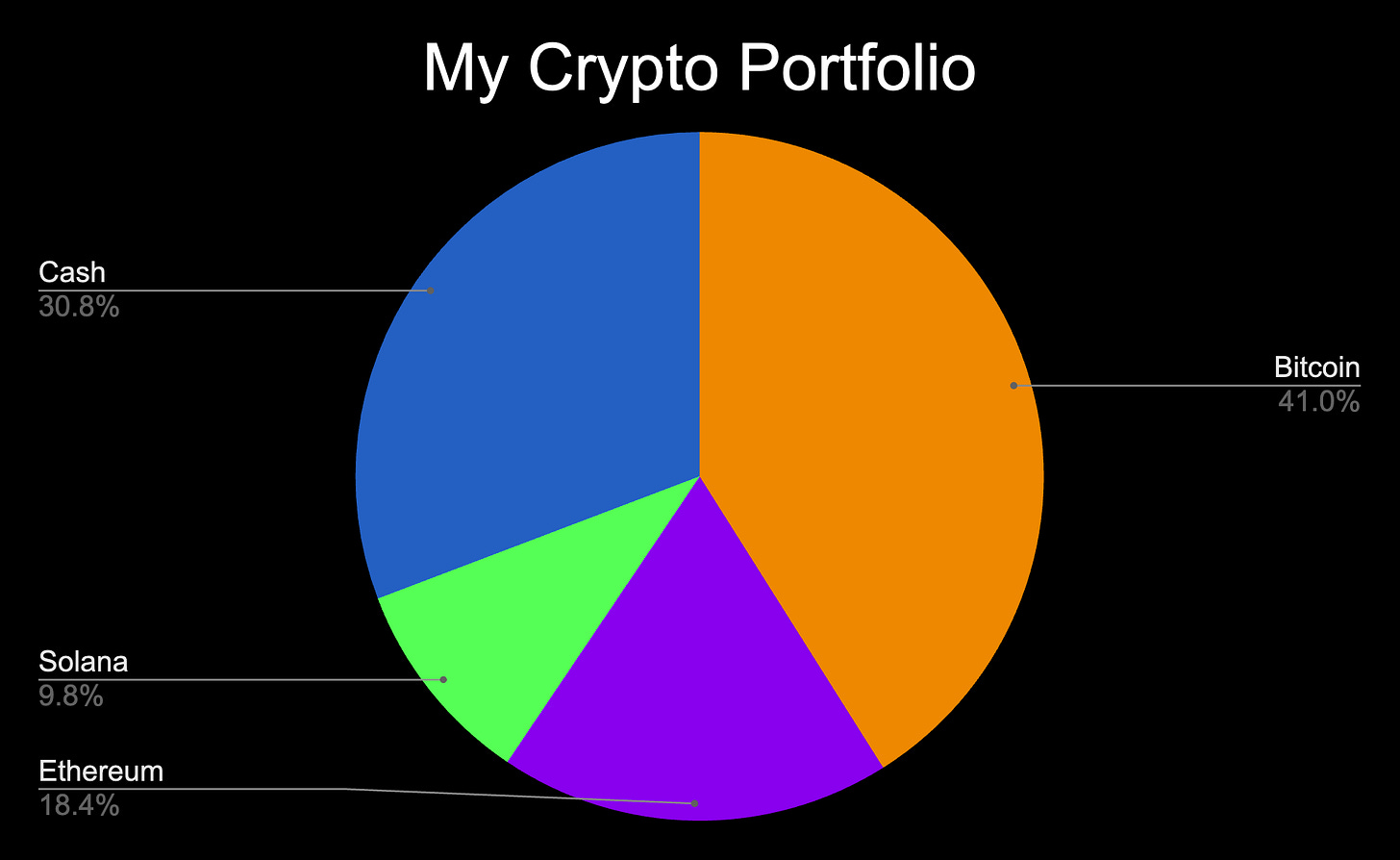

No changes were made to my portfolio this week. We took advantage of the discount markets gave us a few weeks ago and prices aren’t high enough to tempt me into any profit-taking yet so all we can do for now is sit on our hands and wait. I’m optimistic prices still have higher to go this cycle and that we will be able to lock in some profits in Q2, but we’ll wait and see how price action develops in the meantime.

Portfolio snapshot as of March 24th, 2025.

P.S. If you made it to the end of this report thank you for reading and I hope you got some value from it. If you’d like to learn more about my portfolio management system and approach to markets, early bird pricing is still available on the Crypto and Macro Enjoyers program I am building. You can learn more about it here:

I know many investors have thrown in the towel during this choppy price action we have seen over the past few weeks, but I’m optimistic that the best is still ahead for this asset class. We just need to survive long enough to see it play out. I hope you have an amazing week. 🤝